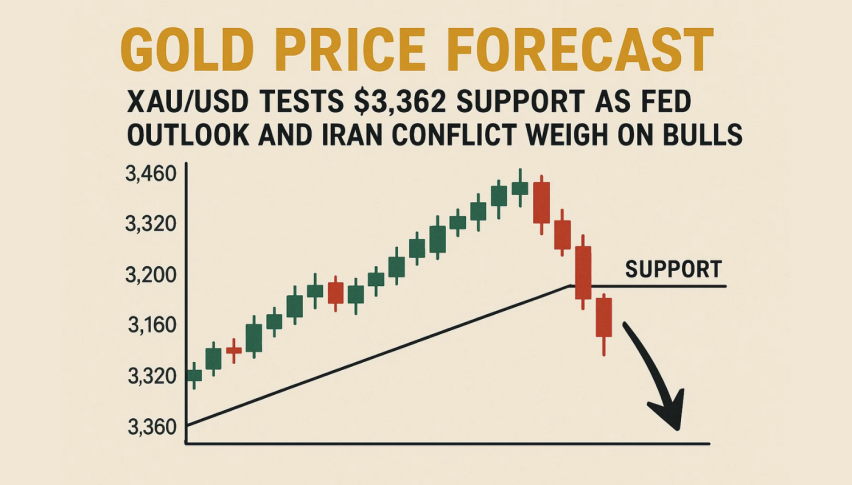

Gold Price Forecast: XAU/USD Tests $3,362 Support as Fed Outlook and Iran Conflict Weigh on Bulls

Gold edges higher as Iran-Israel conflict enters 7th day, but gains capped by Fed’s cautious tone. Gold briefly pops on headlines...

Quick overview

- Gold prices are experiencing slight gains amid the ongoing Iran-Israel conflict, but these are limited by the Federal Reserve's cautious stance.

- The Fed's decision to keep interest rates unchanged and warnings about inflation risks have contributed to a stronger dollar, which is pressuring gold prices.

- Gold is currently testing a critical support level near $3,362, with potential downside targets if this level is breached.

- The upcoming price action will be pivotal in determining whether gold will break down further or see a rebound.

Gold edges higher as Iran-Israel conflict enters 7th day, but gains capped by Fed’s cautious tone. Gold briefly pops on headlines but can’t sustain momentum as traders weigh geopolitical risk vs monetary headwinds.

KCM Trade’s Tim Waterer says “Gold has made a small bounce as we wait for next steps in the Israel-Iran conflict. If the US gets involved the stakes could rise quickly”. US President Donald Trump has so far not confirmed US involvement in the strikes on Iranian nuclear and missile sites. Meanwhile reports of Tehran residents fleeing amid air strikes and US military moving aircraft and ships from regional bases have added to the unease.

Despite the geopolitical boost, gold faces headwinds from a stronger dollar and Fed policy restraint – two factors keeping prices in check.

Fed holds back, dollar stays strong

The Fed left interest rates unchanged on Wednesday but was less dovish than expected. While the median forecast still implies two rate cuts in 2025, Fed Chair Jerome Powell warned of “meaningful” inflation risks from looming import tariffs.

“The Fed was not as dovish as some had hoped” says City Index’s Matt Simpson. “Powell’s comments will have capped gold’s upside especially with the dollar sitting at oversold levels”.

Key bearish pressures:

- Fed holds rates steady; cuts may be slower than expected

- Powell signals caution on inflation, slows gold’s momentum

- Stronger US dollar continues to pressure metal markets

Gold price near $3,362: make or break

Technically gold (XAU/USD) is testing a key support zone near $3,362. Price is below the 50 period EMA ($3,385) which has been resistance since early June. After failing to break above $3,430 gold has printed a series of small bodied candles and lower highs, indicating buyer fatigue.

The MACD histogram is in negative territory, both lines are sloping down. No bullish reversal pattern (hammer or engulfing candle) has formed. Instead price action looks like distribution not accumulation.

Trade Outlook:

- A break below $3,362 could open downside targets at $3,344 and $3,319

- If bulls defend this level, watch for a bounce toward $3,411 or $3,430

- Short-term bias remains bearish unless strong bullish confirmation appears

The next few candles will be crucial in shaping gold’s next leg—either a breakdown or a tactical rebound.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM