XRP Price Prediction: XRP ETF Launch Boosts Institutional Access as Price Eyes $2.12 Support

Canadian asset manager 3iQ has launched the first XRP ETF in North America, listed on the Toronto Stock Exchange under XRPQ

Quick overview

- 3iQ has launched North America's first XRP ETF, listed on the Toronto Stock Exchange as XRPQ and XRPQ.U, providing direct access to XRP for investors.

- The ETF is a long-only product that tracks XRP's price, with Ripple as a founding partner, though their investment size remains undisclosed.

- In the US, the SEC is reviewing a proposal for an XRP Spot ETF, which could significantly impact XRP's market presence if approved.

- XRP's price is currently at $2.15, facing resistance levels, with mixed signals from on-chain data and technical indicators suggesting a potential breakout.

Canadian asset manager 3iQ has launched the first XRP ETF in North America, listed on the Toronto Stock Exchange under XRPQ and XRPQ.U. This gives both retail and institutional investors direct access to XRP through traditional financial infrastructure. Since January 2015 XRP has gone up over 10,800% and is now one of the top 5 digital assets by market cap.

The new ETF is a long only ETF that tracks the price of XRP. Ripple the company behind XRP is a founding partner of the ETF but the size of their investment is not disclosed. To celebrate the launch 3iQ is ringing the closing bell on the TSX.

US Spot ETF Still Under Review

Meanwhile in the US regulatory environment is still in flux. The SEC has reopened the comment period for CBOE’s proposal to list Franklin Templeton’s XRP Spot ETF.

Comments are due by the end of July after delays earlier this year. If approved it will be a big deal for XRP in the US markets especially if it follows the path of the Bitcoin and Ethereum ETFs.

On chain signals are looking good. Santiment data shows a big increase in daily active XRP addresses – now over 295,000 compared to a 3 month average of 35,000-40,000. Over 2,700 wallets now hold at least 1 million XRP.

XRP Technical Outlook: Price Squeeze

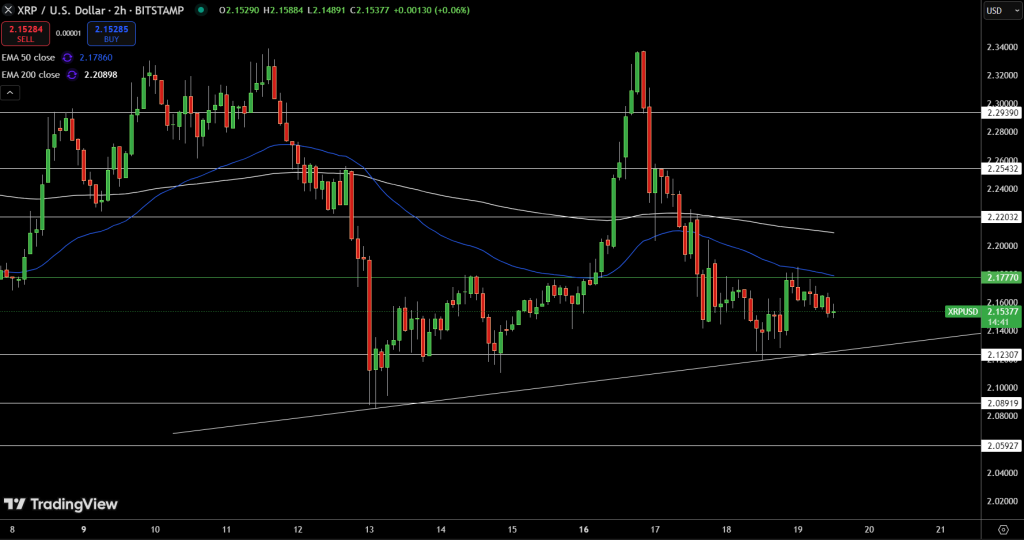

XRP/USD is trading at $2.15 stuck in a tight range below $2.1777. The 2 hour chart shows a bearish setup with the 50 period EMA ($2.1786) and 200 period EMA ($2.2089) acting as resistance. Price structure has turned bearish after the failed breakout at $2.25.

The MACD is below zero and the histogram is flattening – showing no momentum. The ascending trendline from early June is support at $2.1230. A break below this could see XRP drop to $2.0891 or even $2.0592.

Trade Setup

Bullish

- Close above $2.18 with MACD crossover.

- Targets: $2.22 and $2.25.

- Stop: $2.12

Bearish

- Break below $2.1230 for short.

- Target: $2.0891.

- Stop: $2.18

XRP is at a breakout point. ETF and on chain momentum is mixed. Watch price action closely.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account