Bitcoin Cash (BCH) Bullish Structure Intact, Eyes Set on Major Breakout

Quick overview

- Bitcoin Cash (BCH) is currently challenging the key-resistance level of $454.74, which is crucial for its bullish continuation.

- A successful breakout above this resistance could lead BCH towards a major target of $612.88, a level not seen since late 2024.

- The market sentiment has shifted positively due to reduced geopolitical tensions, benefiting high-beta assets like BCH.

- Technological advancements, including the CashTokens upgrade, position BCH to engage more actively in decentralized finance and enhance its utility.

Bitcoin Cash (BCH) continues to track precisely in line with our roadmap from the June 11 forecast, as the market respects technical levels with impressive precision.

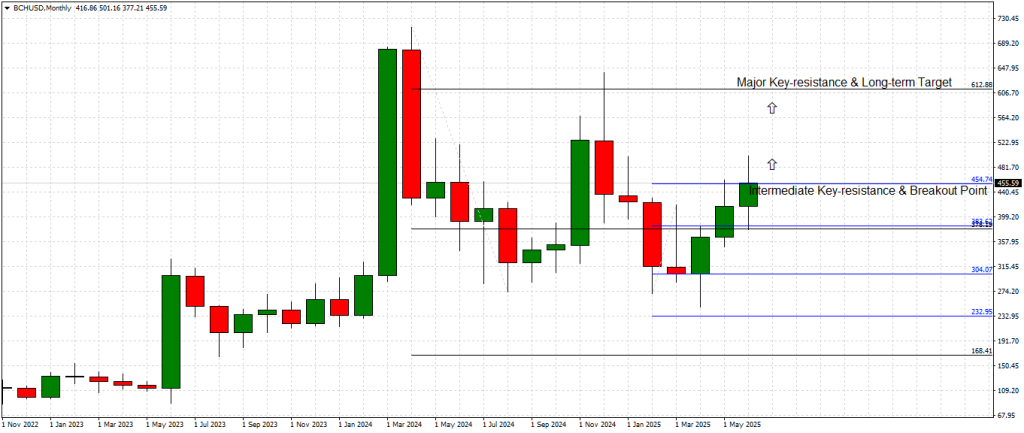

In our previous report, we identified the intermediate key-resistance at $454.74 as a pivotal breakout point for BCH. As of this writing, price action has rallied to directly challenge this barrier, with the Monthly chart highlighting this confrontation.

The current market dynamic reveals a sustained bullish structure since the March 2025 lows, with a series of higher lows and firm rejections of downside attempts. This pattern has fueled a steady upward grind, positioning BCH for a critical test at $454.74. A decisive close above this level on the higher timeframes, especially the Monthly, would validate the bullish continuation thesis.

Should this breakout materialize, it will pave the way toward the major key-resistance and long-term target at $612.88 — a level not visited since late 2024. This level is not only technically significant due to previous price memory but also psychologically impactful, as it represents the mid-range of BCH’s post-2021 retracement phase.

On the downside, the recent support area around $419.20 remains the first defensive line, with $378.20 acting as a deeper corrective threshold should temporary weakness surface.

Macro & Market Sentiment Outlook

Geopolitical tensions stemming from the Middle East conflict, which previously capped risk appetite across crypto markets, have notably subsided. With immediate threats of escalation diminishing — particularly amid signs of the Iranian regime’s limited operational capacity — global markets have collectively shifted back to a risk-on posture. This shift favors high-beta assets such as cryptocurrencies, and Bitcoin Cash is already benefiting from this sentiment pivot.

Furthermore, broader crypto market conditions remain constructive. Bitcoin (BTC) has reestablished itself above key inflection points, while Ethereum (ETH) eyes bullish reversals, both reinforcing positive spillover sentiment for mid-cap coins like BCH.

Technology & Vision Update

While Bitcoin Cash has historically positioned itself as the scalable, transaction-friendly alternative to Bitcoin, it continues to innovate quietly in the background. The CashTokens upgrade, successfully activated earlier this year, has equipped BCH with native token issuance capabilities, decentralized applications (dApps), and smart contract features, effectively closing a functional gap versus more flexible chains like Ethereum.

This development opens the door for Bitcoin Cash to participate more actively in DeFi ecosystems, peer-to-peer asset trading, and token-based services without abandoning its primary mission as a fast, low-fee payment network. Adoption growth in regions with volatile fiat environments — notably in South America and Africa — has further validated BCH’s utility-driven vision.

Looking ahead, the Bitcoin Cash ecosystem roadmap for late 2025 highlights efforts to enhance interoperability with Ethereum-compatible protocols, improve CashTokens functionality, and expand native dApp frameworks — positioning BCH to capture a meaningful share of decentralized financial services without the high transaction costs associated with Ethereum.

Conclusion

In summary, Bitcoin Cash maintains a firm bullish technical structure, closely following our strategic forecasts. The immediate focus lies on conquering the intermediate key-resistance at $454.74. A confirmed breakout above this line would likely accelerate upside momentum, unlocking the path toward $612.88 — the major long-term target.

With geopolitical risk premium retreating and a broader crypto market recovery underway, Bitcoin Cash is well-positioned to capitalize on renewed investor appetite for mid-cap assets. Coupled with its strategic technology upgrades and growing transaction utility, BCH’s bullish thesis for 2025 remains fully intact.

Key Levels to Watch

-

Immediate Key-Resistance: $454.74

-

Major Target: $612.88

-

Support Levels: $419.20 / $378.20

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM