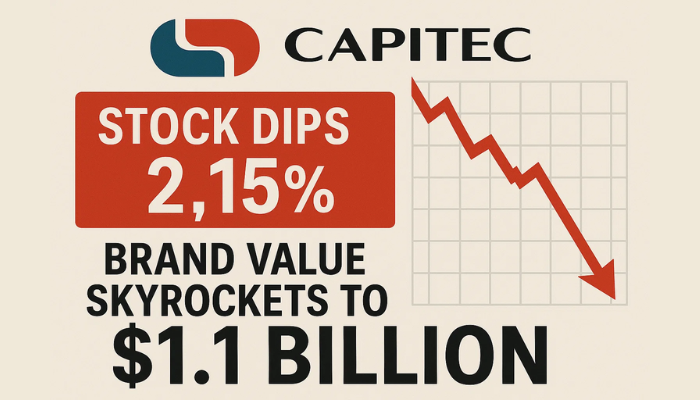

Capitec Dips 2.15% After $1.1B Brand Surge—Is a Rebound Setup in Place?

Capitec Bank Holdings Ltd. (JSE: CPI) fell 2.15% on Wednesday to 348,536 ZAC as its brand value almost doubled to $1.1 billion.

Quick overview

- Capitec Bank's stock fell 2.15% to 348,536 ZAC despite its brand value nearly doubling to $1.1 billion.

- The bank improved its brand ranking from 28th to 14th in Brand Finance's 2025 Africa 200 report, achieving an AAA+ rating.

- Key growth drivers include a 21% increase in app users and strong profitability across loan products.

- Technically, Capitec is at a pivot zone, with potential bullish and bearish scenarios depending on price movements.

Capitec Bank Holdings Ltd. (JSE: CPI) fell 2.15% on Wednesday to 348,536 ZAC as its brand value almost doubled to $1.1 billion. The decline followed a rejection at ZAR 359,209, a level that’s been acting as resistance since mid-June. Despite the pullback, sentiment remains positive as Capitec consolidates its position as one of Africa’s fastest growing financial brands.

According to Brand Finance’s 2025 Africa 200 report, Capitec moved from 28th to 14th in the brand value rankings, with an AAA+ brand rating and a 94.6/100 BSI score – the highest in Africa’s banking sector. Key drivers of growth include:

- +21% increase in app users (Aug 2023–Aug 2024)

- New business banking and insurance offerings

- Strong profitability across loan products

- Top scores in customer loyalty and brand engagement

The market is cautious but long term fundamentals are strong not weak.

Rand Firm as Ceasefire Calms Markets

The South African rand was 0.2% stronger at 17.7675/USD as the Israel-Iran ceasefire calmed markets. The dollar was flat against peers but the rand’s gain should support local stocks and ease pressure on CPI’s balance sheet in the short term.

South Africa’s 2035 bond yield rose just 0.5 basis points to 9.955%, a sign of cautious optimism from fixed income investors. Now traders focus on Thursday’s data:

- PPI Report – Inflation insights

- SARB Bulletin – FDI trends and monetary policy tone

With the macro backdrop calmer, attention is back to price action.

Technical Levels: Watch the 50-EMA Pivot

Technically Capitec is at a pivot zone after the failed breakout at ZAR 359,209. The price is above the 50-EMA at ZAR 347,884 and a bounce here could get momentum going again. But a break down is risk.

Bullish Setup:

- Entry: Rebound from ZAR 339,745–347,700 zone* Targets: ZAR 359,209, then ZAR 366,288

- Stop-loss: Below ZAR 339,000

Bearish Scenario:

- Close below ZAR 339,745 may go to ZAR 331,364 or ZAR 323,119

- Watch MACD for momentum confirmation (signal > MACD = bearish shift)

MACD is showing a weakening histogram and a bearish crossover soon – a key decision point for traders.

Final:

Capitec’s brand and digital growth is long term bullish. Short term the chart is a reversal zone. Watch for confirmation at trendline support or get ready for a move down.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account