Solana (SOL) Bullish Forecast: Key Support Re-Test Fuels Fresh Breakout Prospects

Quick overview

- Solana (SOL) is showing signs of a bullish resurgence after finding support at $133.21.

- The price has successfully retested the $138.11 level, confirming it as new support.

- Key targets for SOL include an intermediate target of $166.73 and a primary bull target of $186.21.

- Easing geopolitical tensions are contributing to a favorable environment for crypto recovery.

After several weeks of bearish pressure and market uncertainty, Solana (SOL) is showing definitive signs of a bullish resurgence.

Precisely as anticipated in our June 17 forecast, we highlighted the potential for a decisive drop toward the Major Key Support at $133.21, warning that a failure at the $138.11 intermediate resistance could open the gates for a retest of this lower zone.

True to our projection, Solana’s price action followed our assessment to the letter, with the market finding a clear bottom at the $133.21 Major Support, validating its critical role as a defensive stronghold for bullish sentiment. Even more telling, the price has since rebounded, and just yesterday successfully retested the $138.11 intermediate key-level from above, confirming it as newfound support.

Key Technical Outlook

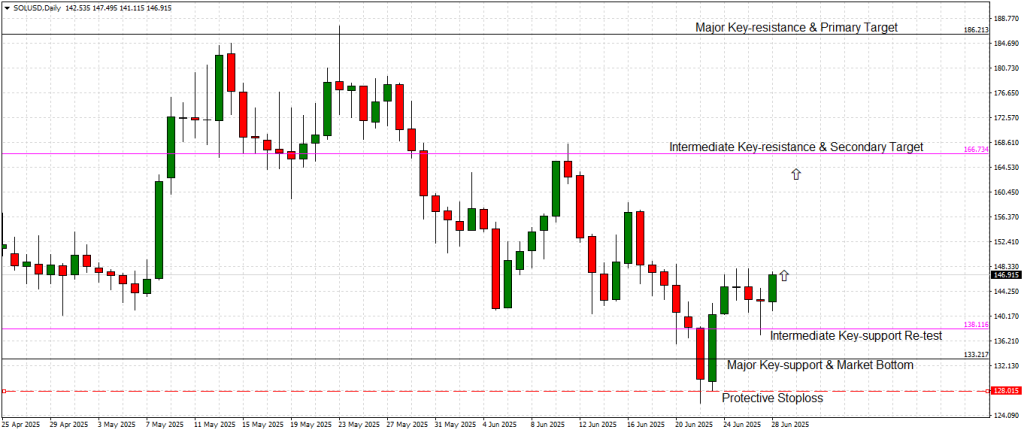

The daily chart (see attached) paints a clear picture of improving market structure for SOL:

-

Protective stop-losses can be established at the lower levels around $128.00, relying on the key support of 133.21 as last line of resort.

-

Price action established a bottom formation around $133.21, followed by a sharp rebound.

-

A successful retest of the $138.11 intermediate support confirmed new buying interest, with SOL now trading around $146.91 at the time of writing.

Our intermediate target sits at $166.73, a significant resistance zone identified in previous forecasts. This level has served as both support and resistance in recent months, and reclaiming it would be a strong confirmation of a broader bullish breakout.

Higher Timeframe Context

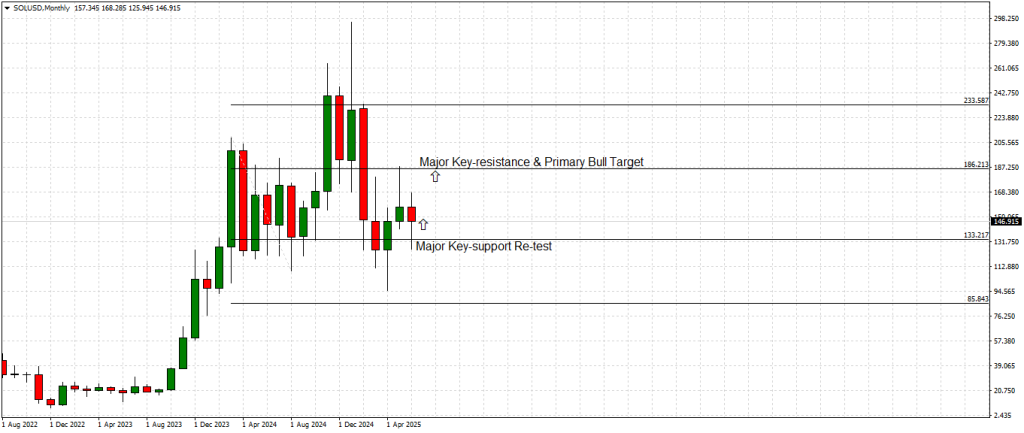

Zooming out to the Monthly chart reinforces this bullish scenario. After multiple months of corrective decline, Solana’s price has settled into a consolidation pattern between $133.21 and $166.73, with long-wick rejections of lower levels hinting at persistent demand.

Key levels on the monthly chart:

-

Major Key Support Re-Test: $133.21

-

Primary Bull Target: $186.21

-

Further breakout potential toward the long-term resistance zone at $233.58 — a level last approached in early 2025.

If SOL can decisively clear $166.73 in the coming sessions, momentum should carry it toward $186.21, a key multi-month resistance and our primary bull target for this wave.

Macro Drivers: Middle East Tensions Cooling

Aside from technical factors, macroeconomic conditions are also turning favorable for crypto markets. The easing of tensions in the Middle East has reduced market risk aversion, triggering a rotation back into risk assets, including major altcoins like Solana. This geopolitical shift is expected to support a more sustainable crypto recovery cycle over the next several weeks.

Conclusion & Strategy

Solana (SOL) has delivered a textbook technical move since our June 17 analysis — dropping to our forecasted bottom, establishing a reliable base at $133.21, and reclaiming $138.11 on a retest. With support firming and geopolitical risks easing, the stage is now set for a continuation of this bullish structure.

Trading Outlook:

-

Entry Zone: On minor dips toward $144.50 – $146.00

-

Intermediate Target: $166.73

-

Primary Bull Target: $186.21

-

Protective Stop: Below $133.21, ideally around $128.00

The longer price action remains above $138.11, the more likely it would add further confirmation to this bullish scenario, opening the door for a rapid test of $166.73.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account