Ripple (XRP) Ready to Explode? $3.14 is the Gatekeeper!

Quick overview

- Ripple (XRP) has reached significant trading levels around $2.94, surpassing previous breakout targets.

- The price is currently testing a critical resistance level at $3.1418, which could trigger a major upside breakout if breached.

- Ripple Labs is expanding its On-Demand Liquidity corridors and has upgraded its XRP Ledger, enhancing its ecosystem.

- Market participants should closely monitor price movements around the $3.1418 resistance and ongoing regulatory developments.

Since our last bullish forecast on Ripple (XRP), the market has delivered precisely on our anticipated breakout targets at $2.4237 and $2.6656, even extending to current trading levels around $2.94.

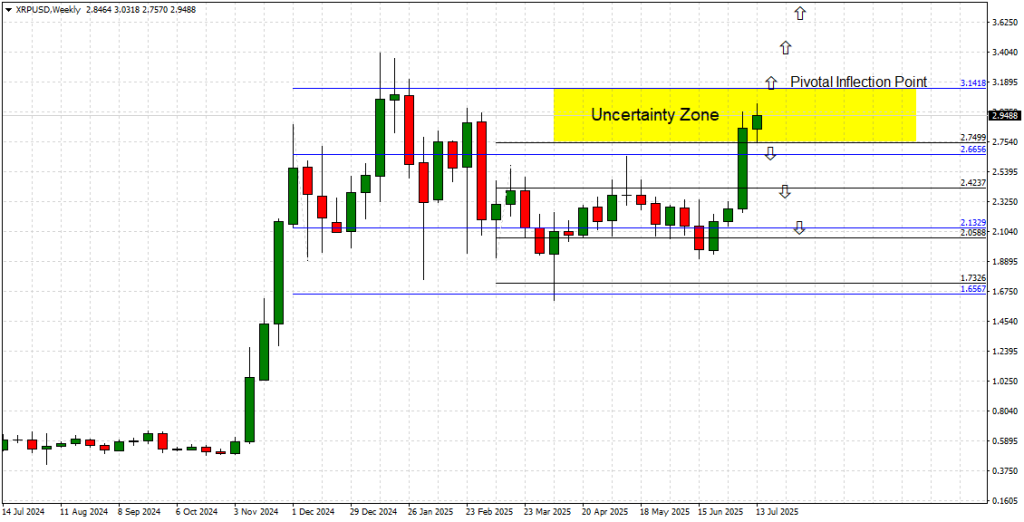

This impressive rally now brings XRP into a decisive technical juncture, as price action pushes into what we’ve labeled the ‘Uncertainty Zone’ on the attached weekly chart — an area historically marked by volatile, indecisive market behavior.

Technical Overview

The chart reveals that XRP has spent the better part of 2025 consolidating between $2 and $3 (for the most part), following a sharp rally in Q4 2024. After several failed breakout attempts earlier this year, last week’s bullish push decisively cleared our upper target at $2.6656, now testing resistance within a range that extends up to $3.1418, identified as the ‘Pivotal Inflection Point’.

At present, price action sits just beneath this critical level. A clean break and weekly close above $3.1418 would likely trigger a significant upside breakout, potentially doubling XRP’s value within a short window. This expectation is supported by the structural compression XRP has endured throughout its multi-month consolidation, with trapped liquidity and accumulated positions potentially fueling a violent squeeze.

Conversely, failure to decisively breach the $3.1418 resistance zone would likely trigger a sharp downside retracement. Key support levels are mapped at $2.6656, followed by $2.4237, and the major support floor between $2.0588 and $2.1329. A move back toward these lower ranges would preserve the broader consolidation structure but invalidate near-term bullish momentum.

Key Technical Levels to Watch:

-

Resistance: $3.1418 (pivotal breakout level)

-

Support: $2.7499 / $2.6656 / $2.0588 – $2.1329

-

Uncertainty Zone: $2.7499 to $3.1418

A decisive close outside this zone will dictate Ripple’s next major directional move.

Technology & Ecosystem Update

From a fundamentals and ecosystem perspective, Ripple Labs continues to navigate regulatory landscapes while expanding its institutional payment infrastructure. The most significant recent development is the integration of Ripple’s ODL (On-Demand Liquidity) corridors into new regions in Asia and Latin America, accelerating real-time cross-border transactions using XRP as a bridging asset.

Additionally, Ripple’s legal positioning against the SEC remains cautiously optimistic for market participants. While final rulings on XRP’s security status are pending, legal analysts suggest the most restrictive enforcement risks have largely been priced into the market.

On the technical front, Ripple has also upgraded its XRP Ledger (XRPL) network in June 2025, implementing enhancements for decentralized token issuance and NFT minting capabilities, improving transaction throughput and reducing settlement times. The XRPL’s ecosystem now supports over 350+ tokenized assets and digital collectibles, positioning Ripple as a strong Layer-1 contender for enterprise-grade asset transfers.

Key Ecosystem Highlights:

-

Expansion of ODL corridors into Brazil, India, and the Philippines.

-

XRPL network upgrade completed in June 2025.

-

Over 350 tokenized assets and NFTs live on XRPL.

-

Legal risk perception stabilizing as SEC litigation enters final phases.

Conclusion

Ripple (XRP) stands at a pivotal market inflection point. The recent rally has brought prices into a historically volatile range, with the potential for either a significant breakout or sharp retracement. A sustained move above $3.1418 could open the floodgates for a rapid bull cycle, potentially doubling XRP’s valuation as trapped liquidity is released.

Conversely, failure to maintain these higher levels risks a corrective move back to the $2.0588 – $2.1329 support zone, keeping price action trapped within its multi-month consolidation structure.

We advise traders to monitor price behavior around the $3.1418 resistance closely, alongside updates from Ripple Labs regarding regulatory progress and further XRPL integrations. Position sizing should remain disciplined within this ‘Uncertainty Zone’.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM