Bitcoin Cash (BCH) Bullish Breakout Accelerates — Primary Target Within Reach

Quick overview

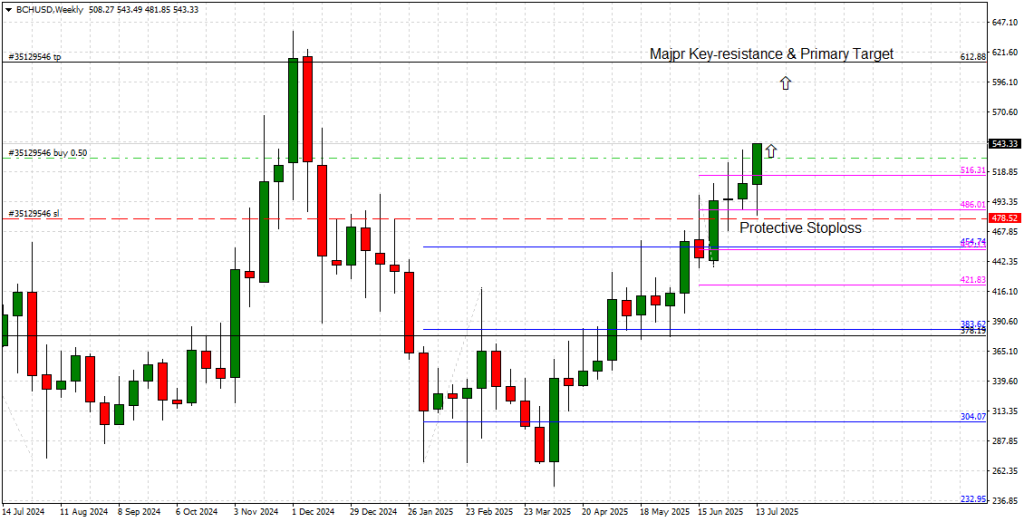

- Bitcoin Cash (BCH) has successfully broken through the key resistance level of $516.31, confirming bullish momentum.

- The price is currently around $543, with a strong likelihood of testing the next resistance at $612.88.

- BCH's ecosystem is evolving with the CashTokens upgrade and increasing merchant adoption, enhancing its real-world utility.

- Traders should monitor the $613–$717 zone for potential signs of exhaustion while maintaining protective stops below $486.

Bitcoin Cash (BCH) is delivering a textbook bullish breakout, fulfilling our previous forecast from June 25. As anticipated, BCH successfully broke through its short-term key resistance level at $516.31, confirming bullish momentum and accelerating towards our primary upside target and major key resistance at $612.88.

This week’s price action exhibits strong commitment from bulls, with BCH now trading around $543, following an impressive string of higher weekly closes. The breakout above $516.31 is particularly significant: this level previously served as a hard cap on BCH’s rally attempts. Its breach clears the path for price discovery toward the next pivotal level, and further supports the broader bullish structure in play.

Breakout Confirmation & Bullish Continuation

The current structure on the Weekly chart reveals a sustained upward trajectory. BCH has posted eight green candles out of the last ten, with increasingly higher lows — a hallmark of a mature bull run. The breakout above $516.31 activated a bullish continuation signal, and BCH is now targeting the $612.88 zone — a level that historically acted as both resistance (December 2024) and a supply wall from which BCH was violently rejected.

With price already advancing past $543 and demonstrating strength above the short-term ascending trendline, there’s a strong probability BCH will test — and potentially pierce — the $612.88 resistance. Above this level, the next cluster of interest would lie around $717, the previous major high from April 2024.

Protective Stop & Risk Management

From a tactical perspective, any long exposure should now be protected with a trailing stop or a fixed protective stop below the $486.00 level, which marks the last weekly swing low and former resistance. This zone now acts as support, and a drop below it could challenge the bullish structure — though at this stage, such a reversal seems unlikely without broader market weakness.

Momentum Drivers: Tech & Ecosystem Updates

Beyond technicals, Bitcoin Cash’s ecosystem continues to evolve, particularly in areas that align with its core mission: peer-to-peer digital cash with low fees and fast transaction times.

1. CashTokens Expansion:

The CashTokens upgrade, implemented in May 2023, is starting to show real-world applications in 2025. This protocol enables BCH to host smart contracts, DeFi protocols, and tokenized assets natively on the chain — similar to what Ethereum offers but with higher scalability and lower cost. Ecosystem development has grown since, with platforms like Cashonize and CashTokens DEX enabling trustless swaps and tokenized asset issuance.

2. Merchant Adoption:

BCH remains one of the top cryptocurrencies used for payments, with recent adoption reports from regions in South America and Asia highlighting increasing real-world usage. Platforms like BitPay and GoCrypto continue to onboard merchants, while Wallet of Satoshi and Paytaca improve the user experience, making BCH more accessible than ever.

3. Developer Funding & Governance:

Through its infrastructure funding proposal (IFP), Bitcoin Cash continues to allocate block rewards to ecosystem development. This decentralized funding model is strengthening core protocol upgrades and incentivizing developer retention — a major advantage in a space where long-term project health is often dependent on funding volatility.

Outlook: Bull Run in Motion

The technical picture for BCH remains decisively bullish. Momentum is backed by both structural and fundamental growth drivers. The break above $516.31 affirms the start of a new price leg, with $612.88 firmly in sight and likely to be tested in the short term.

As long as BCH holds above its former breakout zone and continues to print higher weekly closes, bulls remain in full control. Traders and investors should monitor the $613–$717 zone for signs of exhaustion or consolidation, but for now, Bitcoin Cash is very much in breakout mode.

Key Levels to Watch

-

Major Resistance / Target: $612.88

-

Current Price Zone: ~$543.00

-

Key Support (former breakout): $516.31

-

Protective Stop Area: $478.00

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account