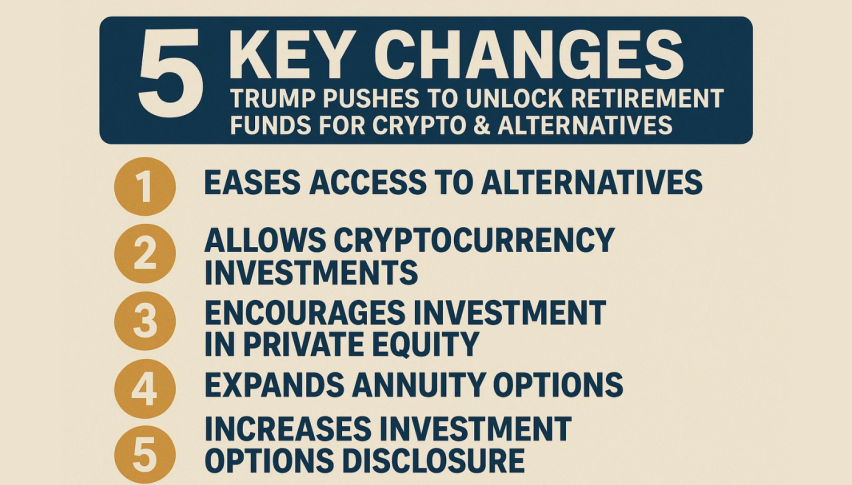

5 Key Changes Trump Pushes to Unlock Retirement Funds for Crypto & Alternatives

President Trump has told U.S. regulators to loosen up on retirement accounts so Americans can invest in things like cryptocurrencies.

Quick overview

- President Trump has directed U.S. regulators to allow more investment options in retirement accounts, including cryptocurrencies and private equity.

- The administration aims to democratize investment opportunities that were previously limited to wealthy individuals and institutions.

- Employers have been reluctant to offer these options due to high fees and complex regulations, but the Department of Labor will review these barriers.

- While this could lead to greater diversification and potential higher returns, critics warn of increased risks and volatility for retirement savers.

President Trump has told U.S. regulators to loosen up on retirement accounts so Americans can invest in things like cryptocurrencies, private equity, real estate and gold. This will allow more investment options in 401(k) plans which are currently limited to stocks, bonds and mutual funds.

By encouraging employers to add non-traditional assets, the administration wants to democratize investment opportunities that were previously reserved for the wealthy and institutions.

Employers have been hesitant to offer these options because of high fees, complex regulations and liquidity issues. Trump’s order tells the Department of Labor to review the rules within 180 days and identify and remove barriers that might prevent employers from adding 401(k) options.

Benefits and Industry Reaction

If this happens, it will open up new funding channels for alternative asset managers and grow retirement accounts. Big investment firms like State Street and Vanguard have already partnered with private equity giants Apollo Global and Blackstone to create retirement funds focused on alternative assets.

Key benefits will be:

- More diversification for retirement portfolios

- Access to asset classes previously only available to high net worth individuals

- Potential for higher returns beyond stocks and bonds

But these come with trade-offs as some alternative investments are riskier and less transparent and not suitable for all investors.

Concerns and Regulatory Background

Critics say adding high risk assets to retirement plans will expose savers to volatility and potential losses and put their financial security at risk. Historically the Department of Labor has prioritized protecting retirement funds from excessive risk and high fees.

In 2022 the Labor Department issued guidance cautioning against crypto investments in retirement plans and then rescinded it in May 2024. Trump’s administration previously encouraged private equity but adoption was limited due to litigation and regulatory uncertainty. Biden later reversed some of those policies citing investor protection issues.

This latest directive is an effort to modernize retirement savings by adapting to the changing investment landscape but significant regulatory reviews and safeguards will be required before any changes take effect.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account