Google Becomes TeraWulf’s Largest Shareholder with 14% Stake in Strategic AI Infrastructure Deal

Google is now the biggest shareholder in TeraWulf (WULF), a bitcoin mining startup that is changing into AI infrastructure. This happened

Quick overview

- Google has become the largest shareholder in TeraWulf, increasing its stake to 14% through a strategic partnership focused on AI infrastructure.

- The collaboration includes a $3.2 billion financial backstop for TeraWulf's lease with Fluidstack, aimed at developing a major data center in New York.

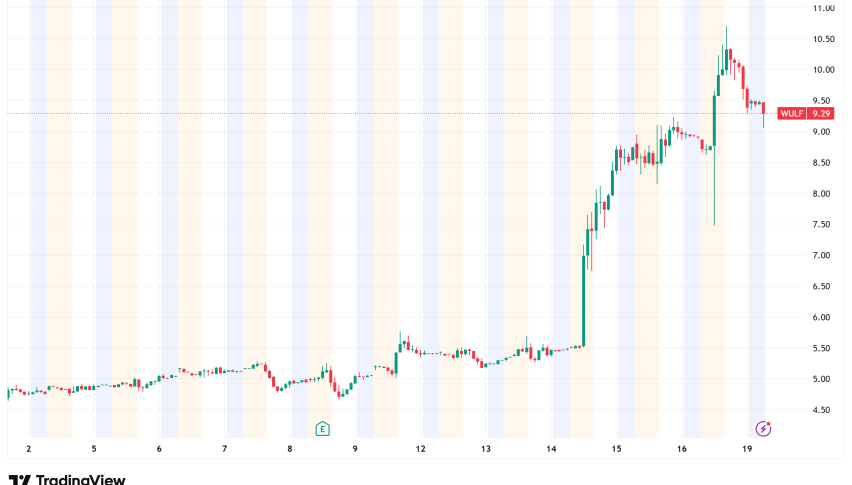

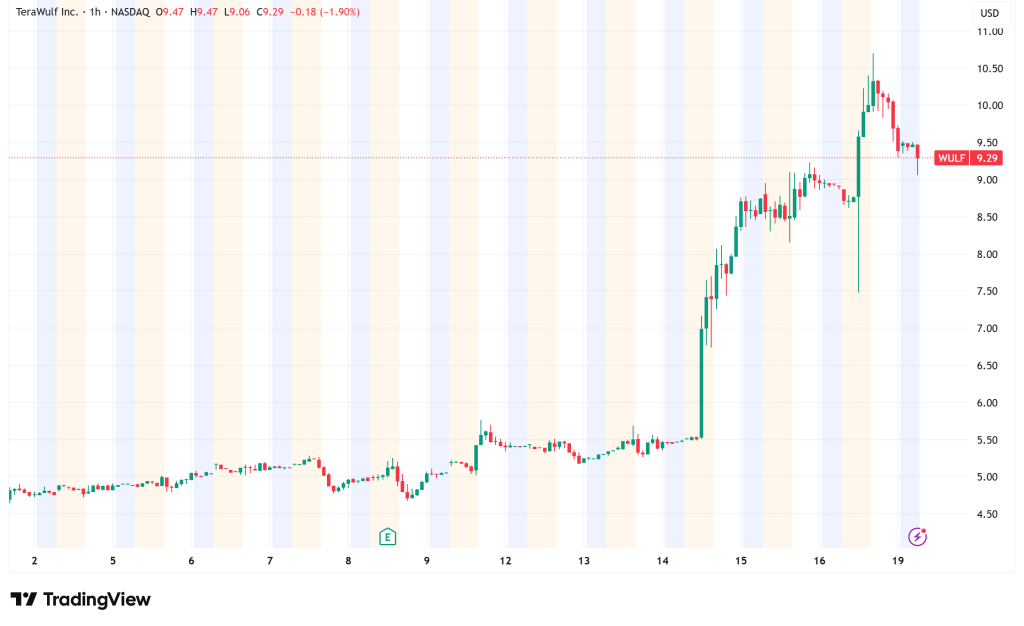

- TeraWulf's stock has surged over 86% following the announcement, reflecting strong market enthusiasm for its pivot from bitcoin mining to AI.

- Analysts have raised their ratings for TeraWulf, highlighting its potential to capitalize on the growing demand for AI and high-performance computing.

Google is now the biggest shareholder in TeraWulf (WULF), a bitcoin mining startup that is changing into AI infrastructure. This happened after Google raised its stake to 14% through a strategic collaboration that might change the way data centers work.

The Alphabet subsidiary now has warrants to buy more than 73 million shares in TeraWulf. This is a $3.2 billion financial backstop for the company’s 10-year colocation lease arrangement with AI infrastructure provider Fluidstack. This new pledge comes after Google’s first $1.8 billion investment, which gave it an 8% share in the company just last week.

Kerri Langlais, TeraWulf’s chief strategy officer, stated, “This is powerful validation from one of the world’s leading technology companies.” This shows that the company can build zero-carbon infrastructure and flourish.

Terawulf’s Massive Data Center Expansion at Lake Mariner

The cooperation is based on TeraWulf’s Lake Mariner data center property in Western New York. Fluidstack has chosen to grow there with a new facility built for that purpose, which will open in the second half of 2026. Lake Mariner is expected to be one of the biggest data centers in the US when it is finished.

Fluidstack’s long-term lease contracts are backed by Google’s financial guarantee. If the AI startup can’t pay its bills, Google would step in with the full $3.2 billion. TeraWulf makes it clear that this backstop is just for AI and high-performance computing lease revenues, not the company’s bitcoin mining operations or corporate debt.

Strategic Pivot Drives Investor Enthusiasm

TeraWulf’s revelation has shocked the market, with the company’s shares rising more than 86% in only five trading days. During Monday’s trading session, shares rose 17% to $10.57 before ending at $9.38. This is a big gain since the alliance was first announced.

The excitement in the market is in line with developments in the industry as a whole. After the April 2024 halving, which cut mining incentives to 3.125 Bitcoin, bitcoin miners are moving toward AI infrastructure, which is putting pressure on traditional mining profitability. VanEck, an asset management company, says that if publicly traded bitcoin mining companies moved just 20% of their energy capacity to AI and high-performance computers by 2027, they could make an extra $13.9 billion in earnings over 13 years.

Long-term Revenue Potential

TeraWulf thinks that its Fluidstack deal will bring in $6.7 billion in revenue, and that it may bring in $16 billion if the leases are extended. This is a big change for the company, which started off as a bitcoin mining company. However, Langlais stressed that TeraWulf will keep its existing mining infrastructure at Lake Mariner and focus on AI and computing workloads for future growth.

Langlais said, “In the short term, mining makes money and helps keep the grid stable.” “However, we think it would be more valuable to move those megawatts to AI and HPC workloads with long-term contracts for revenue over the medium to long term.”

Terawulf (WULF) Stock: Analyst Confidence and Market Position

Analysts on Wall Street have raised their ratings after the Google deal. B. Riley kept its buy rating but raised its price target from $8 to $14. Needham’s John Todaro boosted his target from $6 to $11, saying that TeraWulf is “one of the best suited miners to convert data center capacity” for AI computing applications.

TeraWulf launched a $400 million convertible senior notes offering to help with its growth objectives. This will provide the company more money to build data centers. The AI revolution and huge computing needs are predicted to make the data center market grow to over $585 billion by 2032, which is twice its current size.

TeraWulf was started in 2021 with money from famous people like Gwyneth Paltrow and Mindy Kaling. The company is now at the crossroads of sustainable energy and high-performance computing. Google’s large investment backs this plan and gives TeraWulf the money it needs to grow quickly and become a major player in the fast-changing AI infrastructure market.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM