Gold Muted as Jackson Hole in Spotlight

Gold remained stable on Thursday as the metal awaited clues regarding the Federal Reserve's policy outlook

Quick overview

- Gold prices remained stable at $3,380 per ounce as traders awaited insights on the Federal Reserve's policy during the upcoming Jackson Hole symposium.

- The market's risk sentiment improved following discussions among US and European leaders regarding a potential diplomatic resolution to the Russia-Ukraine conflict.

- Traders are looking forward to the release of the FOMC's July meeting minutes, which may provide clarity on internal policy debates and potential shifts in interest rates.

- Despite improved perceptions of risk, ongoing geopolitical uncertainties continue to support gold as a safe-haven asset.

Gold remained stable on Thursday as the metal awaited clues regarding the Federal Reserve’s policy outlook ahead of the annual economic symposium at Jackson Hole in Wyoming.

The precious metal traded at $3,380 per ounce at the spot market. The bullion asset eased following Tuesday’s sharp drop as demand for immediate safe havens decreased due to improving risk sentiment.

There are now increased expectations for a diplomatic solution to the Russia-Ukraine conflict after US President Donald Trump, Ukrainian President Volodymyr Zelenskyy, and leading European leaders met in Washington.

Trump suggested that a trilateral summit between him, Russian President Vladimir Putin, and Zelenskyy could be in the works, and the market is now focused on that possibility. Moscow has not yet committed to these discussions. According to Russian Foreign Minister Sergey Lavrov, any potential meeting must be “prepared gradually,” starting with experts and progressing through official diplomatic channels.

Although no specific timeframe has been established, the renewed involvement has improved the overall perception of risk. Still, with some safe-haven positioning remaining, ongoing geopolitical uncertainty continues to give Gold a slight buffer

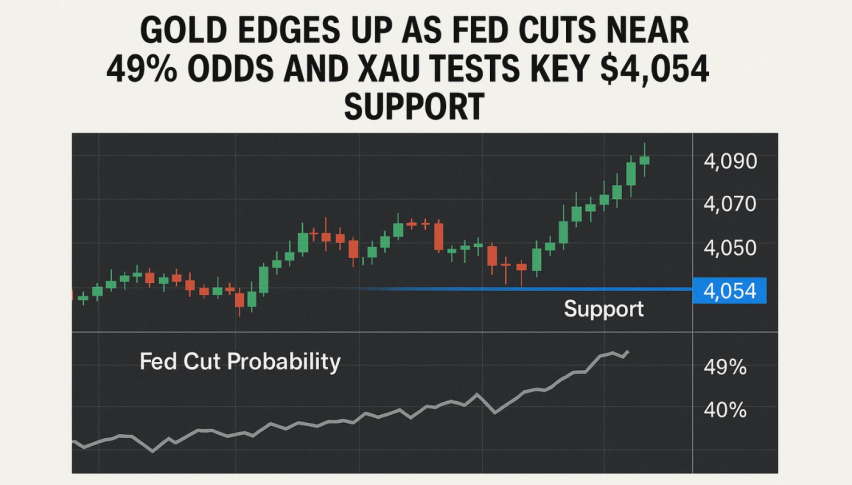

Traders are also awaiting the release of the minutes from the FOMC’s July meeting, which could shed light on internal policy debates. Christopher Waller and Michelle Bowman, who preferred a 25-basis point (bps) rate cut over keeping rates steady, made the meeting notable as the first since 1993 with two dissenting votes from the Board of Governors. The minutes may reveal whether internal divisions at the Fed and a shift toward easing are gaining momentum.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account