Google Unveils Blockchain Platform to Challenge Financial Institution Networks

The Google Cloud Universal Ledger (GCUL) is a new layer-1 blockchain that Google Cloud has officially entered the competitive blockchain

Quick overview

- Google Cloud has launched the Universal Ledger (GCUL), a new layer-1 blockchain designed specifically for banks and payment systems.

- The platform aims to provide a 'credibly neutral' alternative to proprietary blockchain solutions, targeting financial institution adoption.

- GCUL will support Python-based smart contracts and is built as a private, permissioned system, raising questions about its decentralization.

- Google's partnership with the CME Group enhances the credibility of GCUL, with trials for tokenized asset settlement expected to begin in 2026.

The Google Cloud Universal Ledger (GCUL) is a new layer-1 blockchain that Google Cloud has officially entered the competitive blockchain infrastructure industry with. It was made just for banks and payment systems. Rich Widmann, Google Cloud’s Web3 Head of Strategy, talked about the announcement, which offers the platform as a “credibly neutral” alternative to proprietary blockchain solutions being made by financial competitors.

Google’s announcement in blockchain comes at a time when big tech and finance companies are racing to build the best institutional blockchain infrastructure. Circle just released Arc, an open network that is great for stablecoin finance. At the same time, Stripe is working with crypto investment company Paradigm on a secret blockchain project called Tempo.

Targeting Financial Institution Adoption

Google’s strategy is based on being neutral as a way to get ahead of the competition. Widmann said in his LinkedIn announcement, “Tether won’t use Circle’s blockchain, and Adyen probably won’t use Stripe’s blockchain.” This suggests that Google’s independent position could lead to other institutions using the technology.

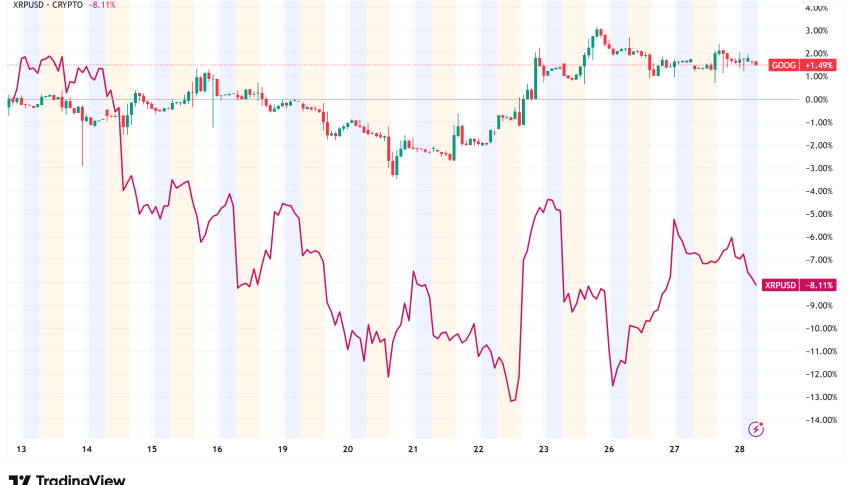

The Universal Ledger will be able to handle Python-based smart contracts and will work as what Google calls “planet-scale” infrastructure, with billions of possible users and bank-level features. This puts GCUL in a position to compete directly with other blockchain systems, namely Ripple’s XRP Ledger, which is also aimed at banks and cross-border payments.

But Google’s method is very different from how public blockchains work. GCUL will be a private, permissioned system that can only be accessed through one API. It will be built with compliance needs in mind. Some people in the community have criticized this architecture, and blockchain purists are unsure if a private, permissioned system could be called a real decentralized blockchain.

Google’s Strategic Partnership with CME Group

Google’s cooperation with the Chicago Mercantile Exchange (CME) Group, the largest options and futures exchange in the world, has given its blockchain plan a lot of credibility. CME is now testing GCUL for tokenized asset settlement and wholesale payment systems. Full market participant trials are anticipated to start in 2026.

The partnership is a big win for Google because CME made $1.7 billion in the second quarter of 2025, which is a record amount, with an average of 30.2 million contracts traded per day. Terry Duffy, the chairman and CEO of CME, has said that the Universal Ledger might “deliver significant efficiencies for collateral, margin, settlement, and fee payments as the world moves toward 24/7 trading.”

Google Cloud’s Years of Blockchain Investment Paying Off

The blockchain project from Google Cloud is the result of years of work on Web3 infrastructure. In 2018, the company started looking into blockchain technology by adding Bitcoin data to its Big Query warehouse. Later, it added support for Ethereum and more than a dozen more networks.

In 2022, the drive picked up speed a lot when a separate Web3 section was created. Since then, this division has formed relationships with big crypto companies like Coinbase, Polygon, and Solana. This foundation has put Google in a good position to use its huge cloud infrastructure and global presence in the blockchain area.

Competitive Landscape of Institutional Blockchains Intensifies

Google’s move into institutional blockchain infrastructure is part of a larger trend of established tech corporations creating their own blockchain solutions. In February, Plasma, a firm funded by investors tied to Tether, secured $24 million to construct a layer-1 settlement for USDt. Robinhood also introduced tokenized US equities and ETFs for European consumers on Arbitrum. They want to move to their own native layer-2 blockchain.

The Universal Ledger has many of the same features as Ripple’s XRP Ledger, such as being able to operate 24/7, having minimal latency, allowing for programmable asset tokenization, and working with third-party wallets. However, Google’s $2.5 trillion market valuation and current ties to banks might make it much easier for businesses to use the technology.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account