Polymarket Gets Regulatory Greenlight for US Launch

Polymarket, the cryptocurrency-based prediction market, received the necessary regulatory approvals to launch in the United States

Quick overview

- Polymarket has received regulatory approvals to launch in the United States, including a no-action letter from the CFTC.

- The no-action letter allows Polymarket to bypass costly swaps data reporting and record-keeping requirements.

- The exchange recently acquired QCX, which was approved by the CFTC, positioning it to compete with other regulated exchanges.

- Investigations by the DOJ and CFTC into Polymarket's operations have concluded, clearing the way for its US market entry.

Polymarket, the crypto-based prediction market, received the necessary regulatory approvals to launch in the United States after obtaining another crucial component from a top regulator, according to its CEO, Shayne Coplan.

The exchange, which recently acquired QCX—whose application was approved by the CFTC in July—was granted a no-action letter by the Commodities Futures Trading Commission today, allowing Polymarket to bypass swaps data reporting and record-keeping requirements. Coplan stated that the action gives Polymarket “the green light to go live in the USA.”

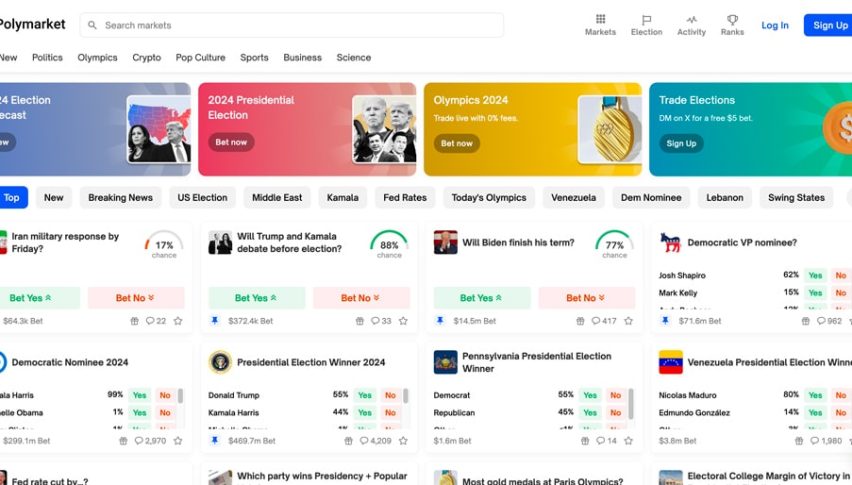

These letters are common in prediction markets, which trade swaps based on the outcomes of specific events, such as changes in interest rates, elections, or sports teams’ wins

According to the letter, the agency’s employees will not suggest that the exchange face enforcement action for failing to execute the reporting. Operating a prediction market without such a letter can quickly become expensive because swap transaction reports can be costly.

The Department of Justice and the CFTC both concluded their investigations into whether Polymarket allowed US-based traders to use its platform despite a consent decree with the markets regulator from 2022.

Polymarket will enter the US market as a competitor to CFTC-regulated exchanges like Kalshi and Crypto.com with the acquisition of QCX and the additional agency approvals. Democratic CFTC Commissioner Kristin Johnson emphasized that the agency has an “urgent need” to act.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM