Bitcoin Holds Above $111K as Corporate Holdings Reach Historic 1 Million BTC Milestone

Bitcoin (BTC) is still holding strong above the $111,000 barrier. Its price has stayed rather consistent over the previous 24 hours, even

Quick overview

- Bitcoin remains strong above the $111,000 mark, with public corporations now owning over 1 million BTC, representing 5.1% of the total supply.

- MicroStrategy leads corporate Bitcoin holdings with 636,505 BTC, influencing 184 other publicly traded companies to adopt similar strategies.

- Emerging companies are aggressively accumulating Bitcoin, creating supply pressure with only 5.2% of the total supply mined so far.

- Technical analysis suggests Bitcoin may remain range-bound between $109,000 and $113,000, with potential for a breakout if it can establish $112,000 as a support level.

Bitcoin BTC/USD is still holding strong above the $111,000 barrier. Its price has stayed rather consistent over the previous 24 hours, even though the rest of the market is uncertain. The cryptocurrency community is celebrating a big milestone: public corporations have already bought more than 1 million Bitcoin, which represents 5.1% of the total supply.

MicroStrategy Leads Corporate Bitcoin Revolution

BitcoinTreasuries.NET says that public corporations now own 1,000,698 BTC worth more than $111 billion. This is the highest level of the corporate Bitcoin treasury movement ever. Michael Saylor’s MicroStrategy is still the leader in this area, with an astonishing 636,505 BTC, which is about two-thirds of all corporate Bitcoin holdings.

MicroStrategy’s groundbreaking Bitcoin strategy, which started in August 2020, has led 184 publicly traded companies to do the same. During the 2022 bear market, when Bitcoin dropped to $15,740, the company stuck to its guns, and now critics who had branded it a “wild experiment” see that the idea worked.

Emerging Corporate Players Drive Supply Shock

Mining firms like MARA Holdings (52,477 BTC) are still doing well, but new corporations are quickly increasing their holdings. Jack Mallers’ XXI owns 43,514 BTC, and the Bitcoin Standard Treasury Company has 30,021 BTC. Metaplanet, a Japanese investment firm, and Bullish, a crypto exchange, round out the top tier with 20,000 and 24,000 BTC, respectively.

The supply dynamics are particularly attractive given Bitcoin’s fixed supply cap. Companies like Metaplanet (which wants to collect 210,000 BTC by 2027) and Semler Scientific (which wants to achieve 105,000 BTC) are using aggressive accumulation tactics to put a lot of pressure on the supply side. Only 5.2% of Bitcoin’s total supply has been mined so far.

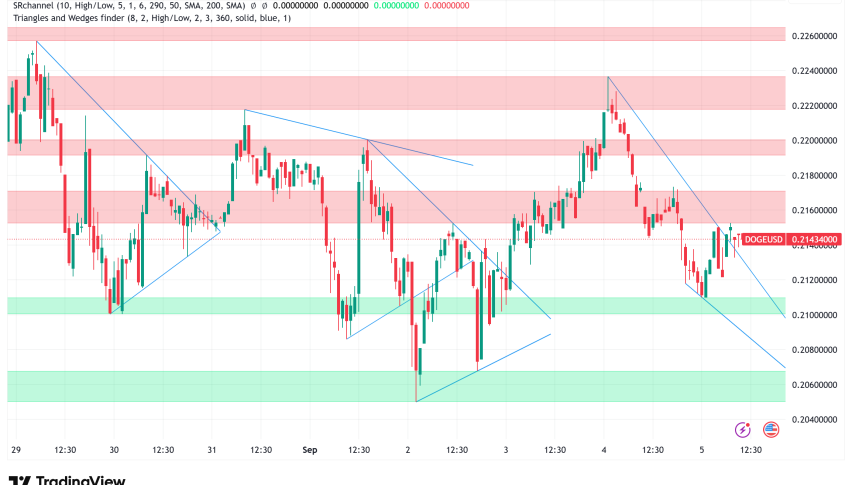

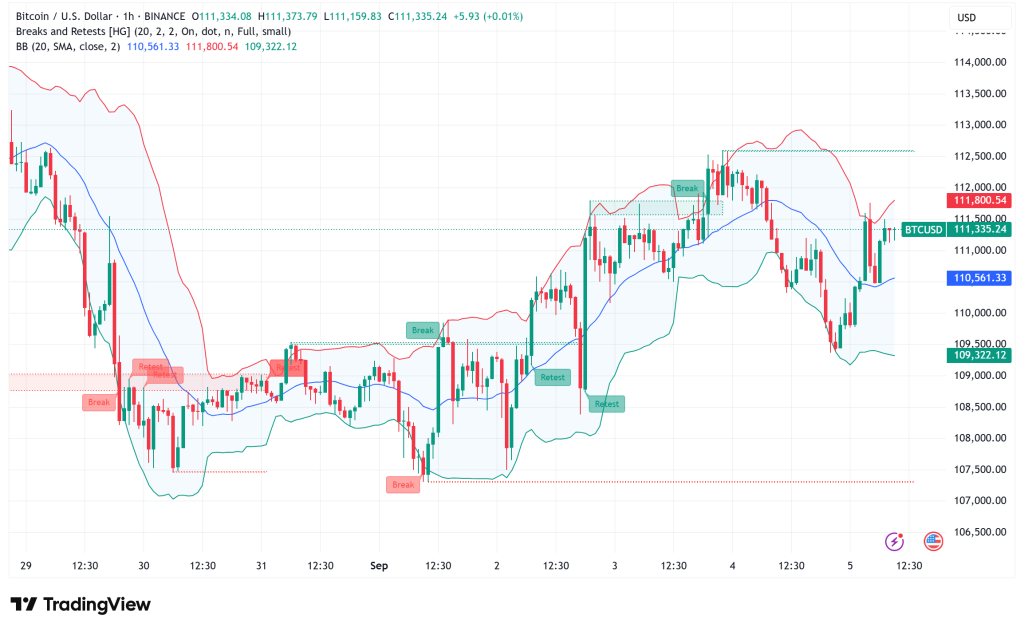

BTC/USD Technical Analysis Points to Critical Resistance Level

Bitcoin is hitting a key point of resistance at $112,000 from a technical point of view. Asian trade immediately rejected Wednesday’s rise above $112,600, which led to a drop toward $109,329 on Thursday. The BTC/USDT liquidation heatmap shows that prices are moving closely between $109,000 and $111,200, and short-term profit-taking is putting pressure on the range highs.

Even if the market has pulled back recently, people are still cautiously optimistic. Hyblock data shows that both retail and institutional traders are still buying in spot markets, which suggests that demand is still strong. The fact that the cryptocurrency has stayed above $111,000 throughout this consolidation period shows how strong the present support level is.

Federal Reserve Policy Creates Bullish Catalyst

The US jobs data coming out on Friday is a key factor that will determine the next path of Bitcoin. The weak ADP private hiring report, which showed that only 54,000 jobs were added in August (less than the 75,000 estimate), has made people more sure that the Federal Reserve will lower rates. The CME Group’s FedWatch tool says there is a 97.6% chance of a 25 basis point rate drop in September. This might provide Bitcoin the monetary boost it needs to break through the current resistance level.

Bitcoin Price Prediction: Range-Bound Action Before Breakout

Bitcoin looks like it will stay in the $109,000-$113,000 range for the time being, based on current technical signs and fundamental forces. But if the daily close is over $112,000 and the jobs data is good, which supports the Fed’s dovishness, it might lead to a move above the previous all-time high of $124,450.

The combination of businesses adopting treasuries, possible Fed rate cuts, and limited supply dynamics makes for a positive medium-term picture. If Bitcoin can make $112,000 a support level instead of a resistance level, it is more likely that it will test $120,000 in the next 4 to 6 weeks.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account