WLFI Hits All-Time Low After Justin Sun Wallet Freeze Sparks Market Panic

Trump-supported DeFi project World Liberty Financial has banned an address associated with Justin Sun, blocking 540...

Quick overview

- World Liberty Financial has banned an address linked to Justin Sun, blocking over 3 billion tokens amid accusations of selling.

- The WLFI token experienced significant price volatility, dropping to an all-time low of $0.1616 before recovering slightly.

- Sun criticized the ban as a violation of investor rights and urged the team to unlock his tokens to maintain confidence in the project.

- The controversy surrounding the token's management has raised concerns about the project's centralization and credibility.

Trump-supported DeFi project World Liberty Financial has banned an address associated with Justin Sun, blocking 540 million unlocked tokens and 2.48 billion locked tokens. On the price charts, WLFI dropped to a new all-time low of $0.1616 before recovering to $0.1898.

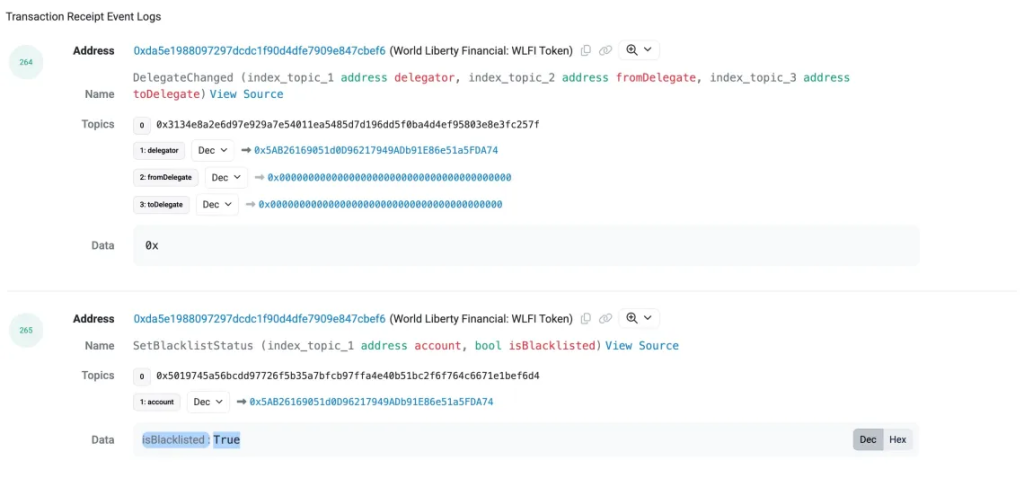

On Thursday, World Liberty Financial purportedly blocked the Tron founder’s Ethereum wallet address in response to recent fluctuations in his WLFI holdings and many internet accusations that he was selling.

The coin merely began trading on exchanges earlier this week. Exchange volumes indicate that the token has been particularly popular among South Korean dealers on Upbit and Bybit.

Based on Arkham data, Sun seized 600 million WLFI tokens at the Token Generation Event (TGE), which were valued at $200 million at the time and represented 20% of the 100 billion tokens unlocked.

The Tron founder was one of the first investors in World Liberty Financial in 2024 and was named the top holder of US President Donald Trump’s official memecoin, TRUMP, earlier this year.

Sun has responded in an X post, encouraging the World Liberty Financial team to release the tokens that support his investment as an early investor.

Sun said that World Liberty’s action to restrict his tokens violates investor rights and risks “damaging broader confidence in World Liberty Financial,” adding: I urge the team to uphold these principles, unlock my tokens, and work together to ensure the success of World Liberty Financials.

The founder of Tron (TRX) also stated that as an early investor, I joined forces with everyone else; we all bought in the same way and deserve the same rights.

To the World Liberty Financials team and the global community,

As one of the early major investors in World Liberty Financials, I have contributed not only capital but also my trust and support for the future of this project. My goal has always been to grow alongside the team…

— H.E. Justin Sun 👨🚀 (Astronaut Version) (@justinsuntron) September 5, 2025

In a subsequent post, the founder expounded on the events that caused the panic, including a few generic test deposits followed by the 50 million token transfer. Sun refers to the final transfer as an address dispersal rather than a sale, which may have affected the market price.

Our address only carried out a few general exchange deposit tests with very small amounts, followed by an address dispersion. No buying or selling was involved, so it could not possibly have any impact on the market.

— H.E. Justin Sun 👨🚀 (Astronaut Version) (@justinsuntron) September 4, 2025

WLFI Price Experiences Sharp Decline

WLFI trade echoed the instability, with prices plummeting within a week of the freeze. After debuting on Binance at $0.32, the coin hit an all-time low (ATL) of $0.16 before rebounding to the $0.18 mark, wiping billions off its market capitalization. Market participants pointed to the controversy as a primary cause of the drop.

Furthermore, as reported by Coinalyze, WLFI had a negative Buy-Sell Delta for three days in a row.

On August 5, WLFI had 184.23 million in sell volumes, down from 1.66 billion the previous day. This is in compared to 177.4 million in purchase volumes.

As a result, the altcoin had a negative Buy Sell Delta of -6.82 million, indicating aggressive spot selling.

The Trump family, who are identified as co-founders of World Liberty Financial, is currently under examination for its token management practices. Critics claimed that restricting wallets in response to rumors highlighted the project’s centralization dangers. The incident has tested WLFI’s credibility in an already uncertain market.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM