Gold stops Glowing ahead of U.S inflation data

Gold prices slightly declined, wiping out some of the gains made after the Federal Reserve's decision to loosen policy

Quick overview

- Gold prices slightly declined by 0.5 percent to around $3,623 an ounce, erasing some recent gains.

- The unexpected drop in US producer prices supports expectations for a potential interest rate cut by the Federal Reserve next week.

- Metal traders are anticipating a quarter-point decline at the Fed's September meeting, with two more cuts likely by year-end.

- Gold has increased nearly 40% this year, attracting more investor capital into gold-backed exchange-traded funds.

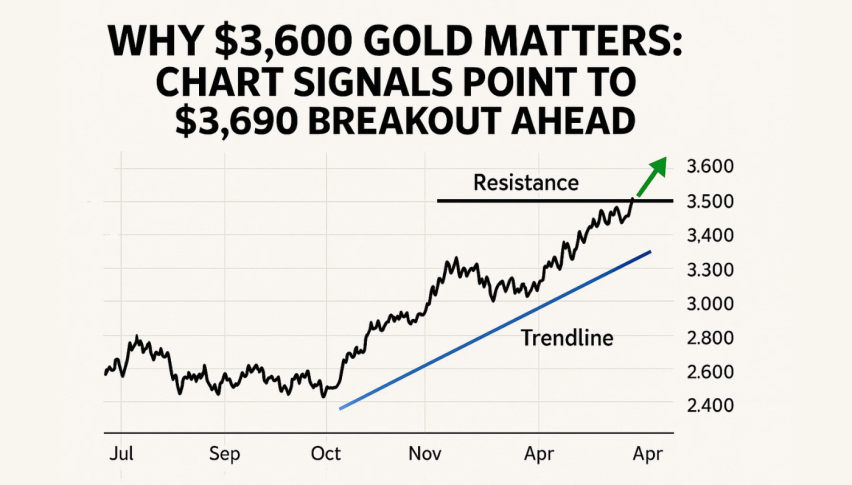

Gold prices slightly declined, wiping out some of the gains made after the Federal Reserve’s decision to loosen policy was bolstered by a surprise decline in US producer prices.

The yellow metal dropped as much as 0.5 percent to about $3,623 an ounce, about $50 less than the peak set earlier this week.

US producer prices unexpectedly declined for the first time in four months in support of traders’ wagers that US borrowing costs will be lowered next week. Later on Thursday, consumer price data will be the next key data point to watch.

The bullion asset was down 0.3 percent at $3,631.33 an ounce after closing 0.4 percent higher on Wednesday. Silver fell closer to $41 an ounce after rising more than 40% this year. Palladium and platinum dropped.

Metal traders now anticipate a quarter-point decline at the Fed’s September meeting. In an attempt to boost the economy after a string of poor labor market data, policymakers are likely to implement two more cuts by the end of the year. The 16–17 meeting is a lock. Since gold doesn’t generate interest, lower rates typically favor it. This year, the price of gold has increased by almost 40%, making it one of the most successful major commodities. Gold-backed exchange-traded funds have seen an increase in investor capital due to growing expectations of US rate cuts.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account