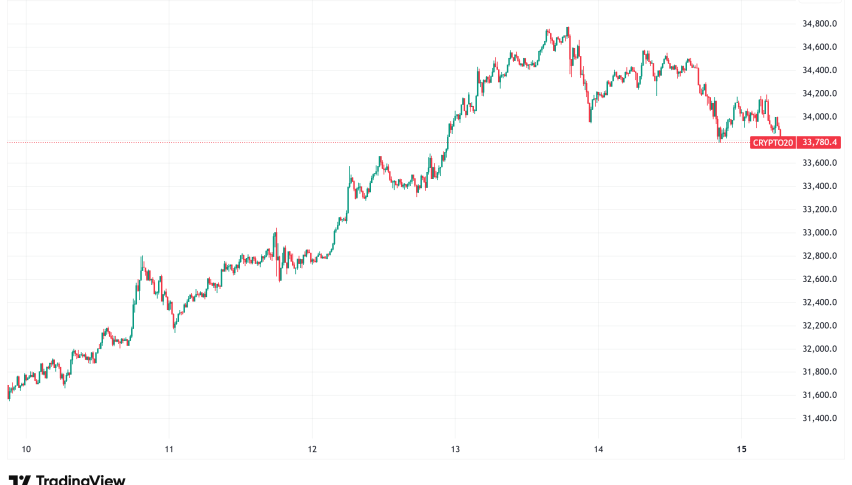

Daily Crypto Signals: Bitcoin Eyes $115K Support, Ethereum Shows Strength with 56,000 Daily Exchange Outflows

Bitcoin hovers near critical $115,000 support levels ahead of the Federal Reserve's anticipated rate cut decision, while institutional

Quick overview

- Bitcoin is currently trading near the critical support level of $115,000, with expectations of increased institutional investment by year-end.

- Ethereum shows strong underlying demand with significant daily outflows, although its ETH/BTC ratio remains below the 0.05 threshold.

- Pakistan is embracing cryptocurrency by allowing major exchanges to apply for operating licenses, reflecting growing adoption in emerging markets.

- The cryptocurrency market is closely watching the Federal Reserve's upcoming interest rate decision, which could influence Bitcoin's appeal to institutional investors.

Bitcoin BTC/USD hovers near critical $115,000 support levels ahead of the Federal Reserve’s anticipated rate cut decision, while institutional allocation predictions suggest traditional finance firms will increase Bitcoin exposure by year-end. Meanwhile, Ethereum ETH/USD demonstrates underlying strength with consistent exchange outflows of 56,000 ETH daily over 30 days, though the ETH/BTC ratio remains below the 0.05 threshold despite recent all-time highs.

Crypto Market Developments

The cryptocurrency market is at a turning point right now because rules are becoming clearer around the world and more businesses are using them. Pakistan has welcomed multinational crypto businesses by allowing big exchanges and virtual asset service providers to apply for operating licenses under the Pakistan Virtual Asset Regulatory Authority (PVARA). This news comes as the country ranks third in the world for crypto adoption, which shows that more people are accepting it in emerging economies.

Native Markets won the right to issue Hyperliquid’s USDH stablecoin in a competitive bidding procedure in the decentralized finance space. The team wants to roll out the project in stages, starting with a small number of transactions worth up to $800. After that, they will publish a USDH ERC-20 token and open the market completely. This news shows how the stablecoin ecosystem is still changing and how it is being used on more than one blockchain network.

Bitcoin Needs to Stay Above $115,000 Support for More Gains

Bitcoin is now trading at about $114,939, which is close to the weekend lows. It is getting close to a very important weekly close before some big macroeconomic events. The cryptocurrency has held up well since it surpassed $116,800 during the last Wall Street session of the week. This was its highest level since August 23. However, traders are seeing controlled negative pressure as the market starts a fresh week of trading.

Technical analysis says that Bitcoin needs to stay above $114,000 at the end of each week to keep its upward momentum. Rekt Capital, a market expert, says that the main goal right now isn’t to breach $117,000, but to get back to $114,000 as support so that people can buy the premium needed to raise prices. The exchange order book data reveals that there is a lot of bid depth and liquidity below $115,000, which might help if the price drops any more.

Jordi Visser, a macro analyst and veteran of Wall Street, says that traditional banks will greatly boost their holdings of Bitcoin before the end of the year. Since January, Bitcoin exchange reserves have dropped from 3.05 million BTC to 2.47 million BTC, a 23% reduction. This institutional interest comes at a time when reserves are low. Analysts say that the combination of better economic data, permissive financial conditions, and expected Federal Reserve rate decreases makes for an attractive trading climate that will last into next year.

The market’s major emphasis is still on the Federal Reserve’s imminent interest rate announcement, and everyone expects at least a 0.25% cut. This change in monetary policy, along with positive macroeconomic statistics, makes Bitcoin a good choice for institutional investors looking for other assets when interest rates change. Mosaic Asset Company, a trading firm, is still positive about risk assets in the fourth quarter. They point to strengthening leading indicators and a robust market breadth that includes cyclical industry participation.

Ethereum Trades Sideways Around $4,600

Ethereum is showing a lot of power under the surface, even though it is trading sideways at $4,660. On-chain data shows that investors are acting very differently now. For example, over the past 30 days, almost 56,000 ETH have been taken out of exchanges per day. This steady negative netflow is at levels not seen since the depths of the last weak market, which shows that holders are becoming more confident in the long run.

The withdrawal pattern started after Ethereum’s price dropped from $4,000 to $1,500. Instead of giving up, investors have steadily shifted their holdings to non-custodial wallets for long-term safekeeping. There have been more than 400,000 ETH withdrawals on some days, and exchange netflows haven’t been positive since July. This trend shows that investors are becoming more hopeful about Ethereum’s long-term prospects, even though the market was skeptical at first.

Over the previous four months, Ethereum exchange reserves have dropped by 20%, from 20.6 million ETH to 17.1 million ETH. This drop really started in May, as ETH fell below $1,500 and the trend changed. The steady outflow pattern suggests that investors are accumulating, which might be a bullish sign for future price movements.

The ETH/BTC ratio, on the other hand, is still a worry. It is at 0.039 and has not been able to get back to 0.05 since July 2024. The ratio reached its highest point of 0.14 in June 2017, even though institutions were using it, ETF inflows were coming in, and Ethereum hit an all-time high of $4,957 in August.

Since it launched in 2015, Ethereum has only outperformed Bitcoin 15% of the time. Most of the time it has done better was during the ICO bubble from 2015 to 2017. After the hot rally in August, market observers say Ethereum may need weeks or even months to reach new all-time highs. The $5,000 mark is still a major psychological milestone, just $43 away from its previous peak.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account