Altcoin Season Gains Momentum as Markets Await XRP and Dogecoin ETFs Launch

This week is a turning point for the cryptocurrency market. Two revolutionary altcoin exchange-traded funds are about to launch in the US

Quick overview

- This week marks a pivotal moment for the cryptocurrency market with the launch of XRP and Dogecoin ETFs in the US.

- The approval of these ETFs signals growing institutional acceptance and could lead to a significant altcoin rally if global monetary policies are eased.

- Economic indicators from China and anticipated interest rate cuts by the Federal Reserve may influence the market direction in the coming days.

- A coordinated easing strategy among major global central banks could further enhance the performance of altcoins, particularly Ethereum.

This week is a turning point for the cryptocurrency market. Two revolutionary altcoin exchange-traded funds are about to launch in the US, and global economic conditions seem to be getting better and better for what analysts are calling a possible “mega altseason.”

Historic Crypto ETF Launches Signal Growing Institutional Acceptance

REX-Osprey has passed the Securities and Exchange Commission’s 75-day review period for both XRP and Dogecoin ETFs. The ETFs should open this week. The XRP ETF, which will trade under the ticker XRPR, will start trading on Friday. This will be the first US fund to give investors direct access to the third-largest cryptocurrency in the world by market cap.

The Dogecoin ETF (DOJE) is set to launch on Thursday, making it the first exchange-traded fund in the US that focuses on memecoins. The Investment Company Act of 1940 made it easier to get both products approved than the Securities Act of 1933, which is what Bitcoin ETFs employ.

“This will be another good test of demand for ’33 Act spot XRP ETFs,” said Nate Geraci, president of Nova Dius. He also pointed out that futures-based XRP ETFs are currently close to $1 billion in assets under management.

Expanding Altcoin ETF Pipeline

The debuts of XRP and Dogecoin are simply the first steps in a bigger growth of cryptocurrency ETFs. James Seyffart, an ETF analyst at Bloomberg, says that more than 90 crypto exchange-traded products are presently waiting for SEC approval. Recent submissions include changes to Canary Capital’s Litecoin ETF prospectus, which the SEC will make a final decision on in early October, and Bitwise’s new Avalanche ETF application.

But the rules and regulations are still hard to understand. The SEC has put off making decisions about Bitwise’s planned Dogecoin ETF and Grayscale’s Hedera ETF until November 12. This shows that these new financial products are still being closely watched.

The Solana staking ETF that REX-Osprey released in July, which was their last altcoin project, has only attracted a small amount of interest, with $274 million in assets under management. This suggests that investors may have quite different tastes when it comes to altcoin ETFs.

Critical Ten-Day Window Could Determine Market Direction

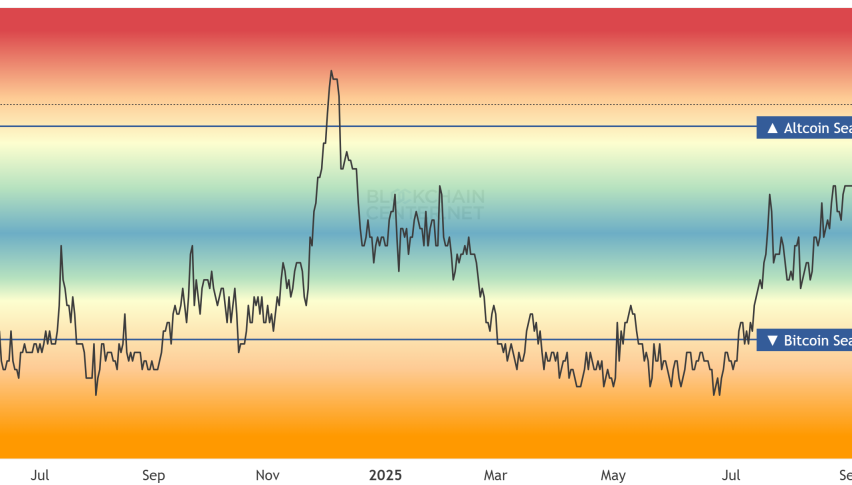

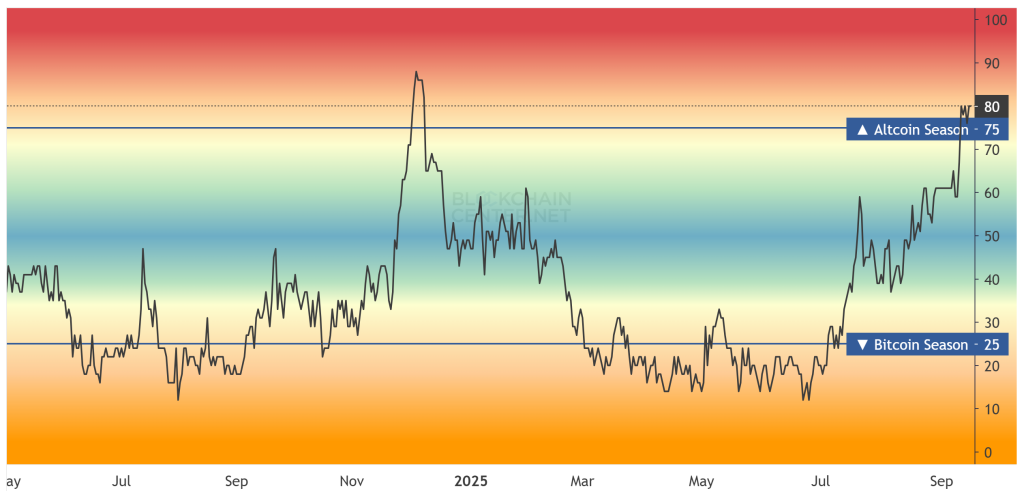

While changes in ETFs help altcoins in the long run, changes in the economy as a whole may be even more important. The Bull Theory says that the next ten days might be very important for starting a big cryptocurrency rally, but only if global monetary policy is eased in a coordinated way.

Recent economic data from China shows worrying patterns. For example, retail sales only grew by 3.4% year-on-year, which is less than the expected 3.9%, and industrial production grew by just 5.2%, which is the slowest rise in twelve months. These signs point to a slowing Chinese economy, which may require quantitative easing measures that might increase global liquidity.

The United States adds another important factor, as markets expect the Federal Reserve to lower interest rates by 25 basis points on September 17. If Fed Chair Jerome Powell not only confirms this cut but also hints at more easing, the accompanying spike in liquidity could cause crypto values to rise by 5% to 10% in a few of weeks, based on what has happened in the past.

Global Central Bank Coordination Key to Altcoin Success

The timing goes beyond US monetary policy. The Bank of England will have to make a decision about interest rates on September 18, and the Bank of Japan will meet on September 19. If these big central banks all took a dovish attitude at the same time, it could be the best time for risk assets, like altcoins.

The Bull Theory researchers say that “the best-case scenario would involve a coordinated global easing strategy.” They think that this kind of alignment may help Bitcoin break through the $120,000 mark and speed up the flow of Ethereum ETF funds, which would help altcoins do better overall.

Ethereum is presently trading about $2,400, down from previous highs. It is still the altcoin that would benefit the most from possible ETF inflows. The next decision by the Federal Reserve might decide whether ETH and other altcoins break over resistance levels or have to go through more corrections.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account