Bitcoin Surges Past $118,000 Despite Government Shutdown: Bulls Eye $120,000 Breakout

Bitcoin has broken above the $118,000 barrier for the first time since mid-August and has gained more than 3.7% in the last 24 hours. The

Quick overview

- Bitcoin has surpassed the $118,000 mark for the first time since mid-August, gaining over 3.7% in the last 24 hours.

- Weak U.S. private-sector employment data has fueled optimism for Bitcoin, as it may lead to a decrease in interest rates by the Federal Reserve.

- Analysts highlight critical resistance at $117,500, with potential upward movement towards $120,000 if broken.

- Institutional support for Bitcoin remains strong, with significant inflows into U.S. spot Bitcoin ETFs in September.

Bitcoin BTC/USD has broken above the $118,000 barrier for the first time since mid-August and has gained more than 3.7% in the last 24 hours. The top cryptocurrency’s ability to hold up during the first U.S. government shutdown since 2018 has made people more optimistic, and analysts have called dips due to the closure “buy opportunities” instead than reasons to worry.

Labor Market Weakness Fuels Risk-Asset Rally

The poor U.S. private-sector employment data that came out on Wednesday was what caused Bitcoin’s current rise. In September, the job data turned negative, which was a huge disappointment because they had been expected to show a gain of 45,000 jobs. People think that this dismal job market is good for cryptocurrency markets because it makes it more likely that the Federal Reserve would decrease interest rates, which will bring more money into riskier assets.

The CME Group’s FedWatch Tool says that most people in the market are now betting on a 0.25% rate drop at the Fed’s meeting in October. The poor job numbers support the idea that monetary policy will stay loose, which is good news for Bitcoin’s rise.

Bitcoin’s connection to stocks stays strong even when it trades with other risky assets. After the jobs report, both the S&P 500 and Nasdaq Composite began slightly higher. Gold, on the other hand, was stable after reaching new all-time highs of $3,875–$3,895 per ounce earlier in the session.

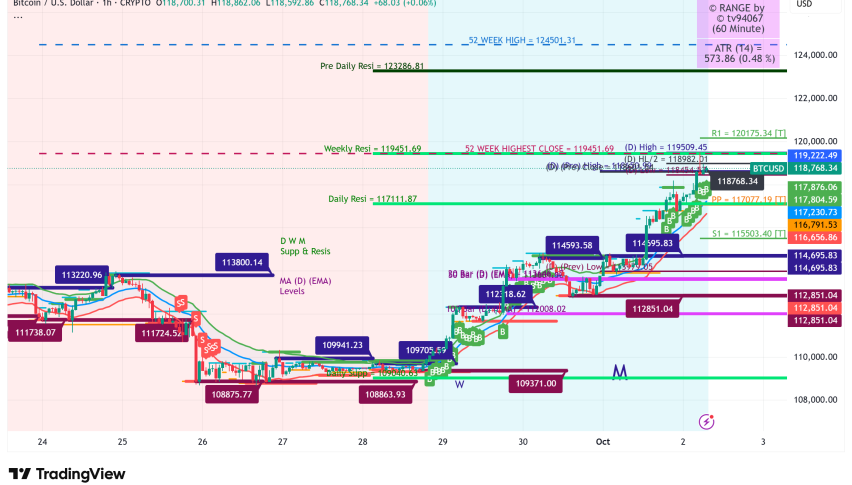

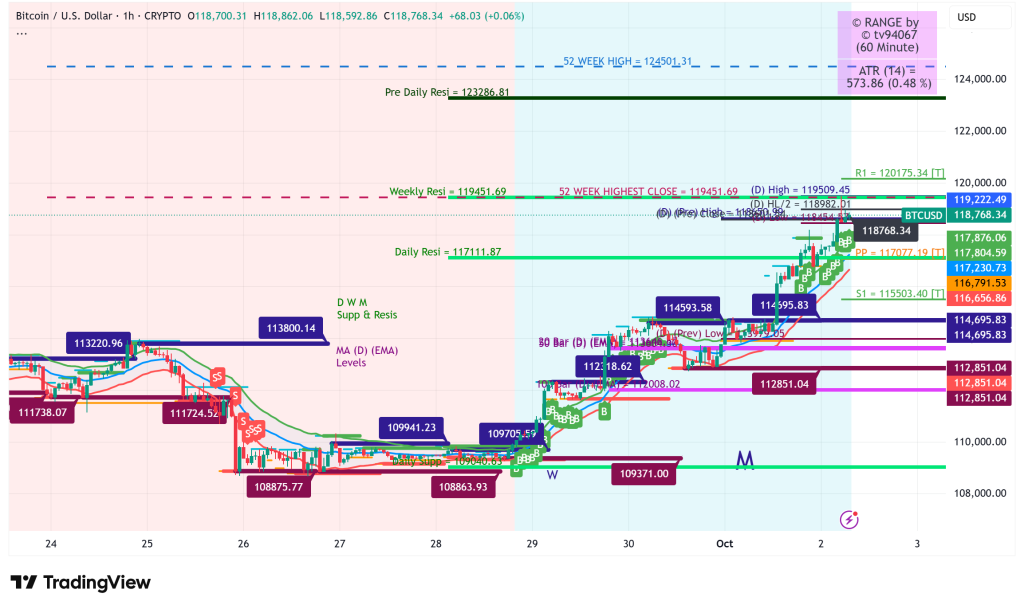

BTC/USD Technical Analysis Points to Critical Resistance Zone

Rekt Capital, a well-known analyst, said that Bitcoin is “trying to break out of its Monthly Range already on the first day of the new month of October.” The cryptocurrency was only $150 away from breaking its September high of $117,863, which would have been its highest level since August 17.

Trader Jelle said that Bitcoin was “pushing through the resistance like it isn’t even there.” He also said that if it broke through the September highs, bears would have “very little leg to stand on.” But there are still technological problems. Daan Crypto Trades said that $112,000 was “key short-term support” and that going back to this level could be bad news for the bullish structure.

Several analysts say that resistance around $117,500 is the next big problem. If the market closes above this level every day, it might move toward $119,300–$120,300, with the psychological level of $120,000 being the next big target. Order-book data shows that there is a lot of short liquidity between $118,000 and $119,000—about $7 billion worth—which could cause a short squeeze if it is broken.

CME Gap Presents Downside Risk

There is a warning indication on the CME Bitcoin futures chart, even though the price is going up. At the start of the week, there was a big gap between $110,000 and $111,300. Based on past trends, these gaps tend to fill in before the trend starts up again. Daan Crypto said that this gap shouldn’t be seen as “in play” until Bitcoin drops below $111,000. However, closing the gap would undo a lot of the recent recovery and might make the short-term price structure worse.

Institutional Support and Market Structure Strengthen

U.S. spot Bitcoin ETFs brought in a total of $3.53 billion in net inflows in September, with a huge $429.9 million coming in on September 30 alone. BlackRock, Ark, and Fidelity were the biggest investors. This institutional demand has enabled Bitcoin’s market share rise from 57% to 59%, which analysts say is a more stable structure than rallies powered by altcoins.

On-chain indicators and derivatives data show that things are looking good. Leverage is resetting after recent drops, financing rates are returning to normal, and open interest is staying the same. QCP Capital, a trading company, said that the government shutdown should not affect the market, pointing out that the S&P 500 rose 10% during the 2018 shutdown. Because Bitcoin has a higher beta than stocks, QCP thinks that “shutdown-related dips are buy opportunities rather than chasing gap-ups.”

Bitcoin Price Prediction: Critical Juncture for Q4 Rally

Top analysts, such MN van de Poppe, Ted Pillows, and Daan Crypto Trades, all agree on a clear plan: protect the $112,000 support level, break above $117,500 decisively, and allow momentum push prices to new all-time highs in the fourth quarter.

The first level of resistance is $117,500, and a breakthrough would aim for the $119,300–$120,300 area. On the other hand, bulls need to hold $114,800–$115,200 at first, and subsequently the important $112,000 pivot. Bitcoin might hit the $107,000–$108,000 range, where about $8 billion in long liquidations are waiting, if the correction goes worse.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account