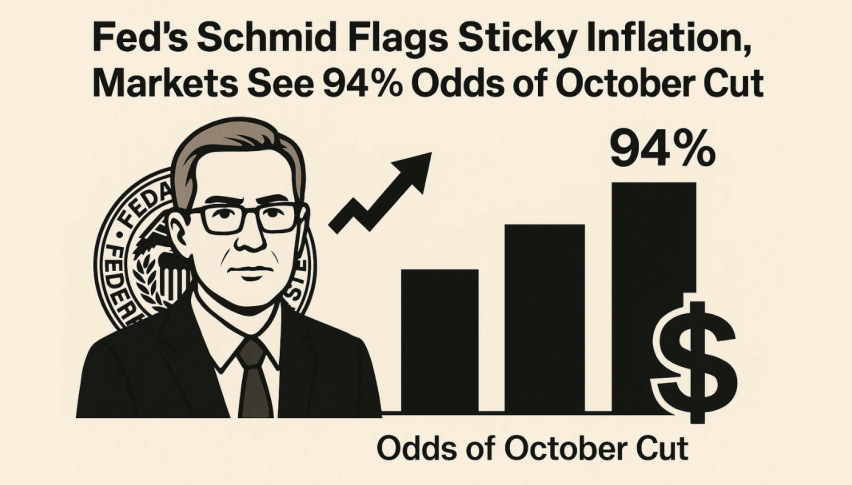

Fed’s Schmid Flags Sticky Inflation, Markets See 94% Odds of October Cut

Kansas City Fed President Jeffrey Schmid is opposed to further rate cuts, saying inflation is too high for aggressive easing.

Quick overview

- Kansas City Fed President Jeffrey Schmid opposes further rate cuts due to high inflation, advocating for a slightly restrictive policy.

- He believes that maintaining current rates is essential to control inflation and allow supply to catch up with demand.

- Schmid's comments align with a broader Fed sentiment prioritizing inflation control over immediate labor market concerns.

- Looking ahead, he emphasizes a data-dependent approach for future policy decisions amid uncertainties from a government shutdown.

Kansas City Fed President Jeffrey Schmid is opposed to further rate cuts, saying inflation is too high for aggressive easing. His comments to CFA Kansas City suggest the current policy is slightly restrictive, which he thinks is the right balance between inflation control and economic stability.

Schmid said policy should continue to “lean against demand growth” to give supply time to catch up — a key to reducing price pressures. He warned that cutting rates too soon could reignite inflation and undo the progress of the past year.

Schmid expects limited inflation impact from Trump-era tariffs but said that would be based on measured policy moves, not aggressive easing.

Key Points:

- Current policy: “Slightly restrictive but okay”

- Inflation above target

- Schmid voted for one rate cut in September as a risk-management strategy

Inflation First

Schmid’s comments are part of a growing chorus within the Fed — that inflation control must come before short-term labor market concerns. At the September FOMC meeting, Schmid supported a 25-basis-point rate cut, saying with labor market cooling, it was a cautious move to balance inflation and employment risks.

But his latest comments suggest further cuts could undermine the Fed’s inflation credibility. Schmid acknowledged the challenge of pursuing both mandates at once, noting that measures that stimulate job growth often fuel higher prices.

He’s in line with Dallas Fed President Lorie Logan who also warned against rapid rate cuts citing the same inflation risks. Both officials see the current policy as modestly restrictive — the right level to keep downward pressure on prices without stalling growth.

Data Dependence Ahead of October Meeting

Looking ahead, Schmid said the Fed will remain data-dependent for future policy decisions. But the U.S. government shutdown has delayed key economic data releases and the October 28-29 FOMC meeting is uncertain.

According to the CME FedWatch Tool, markets still have a 94.1% chance of a 25-basis-point rate cut in October despite Schmid’s reluctance. Until labor and price data resume, Schmid will monitor alternative indicators to guide his decisions.

In short, Schmid’s cautious tone is a policy pivot point: with inflation persistent, the Fed’s credibility may depend on restraint, not stimulus.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM