Week 2 of US Government Shutdown: Crypto Industry Faces Regulatory Uncertainty

The US government shutdown reached its seventh day on Monday, and there was still no sign of a quick settlement. This left crypto markets

Quick overview

- The US government shutdown has entered its seventh day, causing significant disruptions to federal agencies, including the SEC and CFTC, which are crucial for crypto regulation.

- Senate attempts to resolve the deadlock have failed, with both parties unable to agree on a temporary funding plan, primarily due to disagreements over healthcare policy.

- The shutdown is expected to hinder innovation in the crypto industry, as regulatory bodies operate with limited staff, affecting their ability to process applications and enforce regulations.

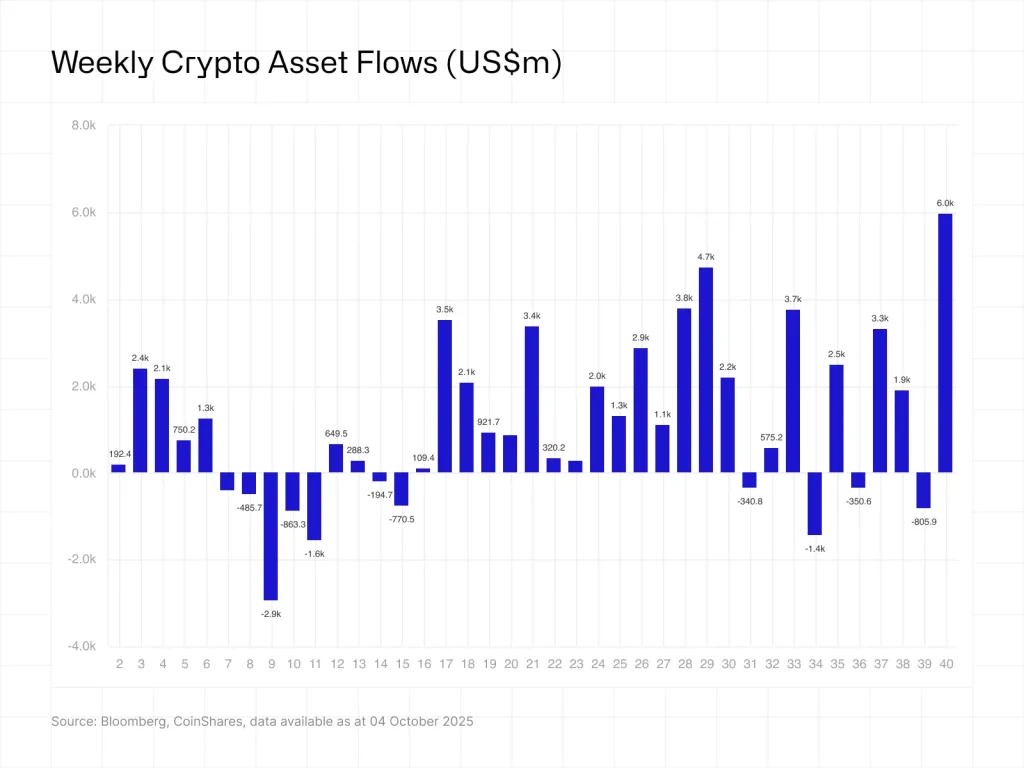

- Despite the political uncertainty, cryptocurrency markets have seen a surge in inflows, with a record $5.95 billion invested in digital asset products last week.

The US government shutdown reached its seventh day on Monday, and there was still no sign of a quick settlement. This left crypto markets and digital asset regulation in limbo as important federal agencies worked with only a few staff members.

The shutdown started at midnight on October 1 because Congress couldn’t agree on a temporary funding plan. About 800,000 federal workers, or over 40% of the federal workforce, were sent home without pay, while another 700,000 continued to work without pay. The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are two important regulators for the crypto industry. They are both working with very few people and under very tight rules.

Senate Deadlock Continues

On Monday, the Senate tried to break the deadlock by voting on continuing resolutions from both parties that were in conflict with one other. But neither plan was able to get the 60 votes needed to move forward. The bill supported by Republicans failed by a vote of 52 to 42, while the bill supported by Democrats failed by a vote of 45 to 50. This pushed the shutdown even further into unknown terrain.

The main point of disagreement is healthcare policy, with Democrats saying that any spending plan should undo cuts made by a budget measure in July. After the votes failed, President Donald Trump attacked the Democrats in a social media post. Both parties are still blaming each other as negotiations are still stuck.

Regulatory Paralysis Threatens Crypto Innovation

The closure might have a big effect on digital asset markets. The SEC said it would work “under modified conditions” with “an extremely limited number of staff.” This makes it very hard for the agency to look at crypto exchange-traded fund applications and other regulatory issues. The CFTC is in a similar situation, with only one commissioner acting as chair.

“The US government shutdown can hurt the crypto industry by making it harder for the SEC and CFTC to do their jobs, which are very important to global digital asset markets,” said Przemysław Kral, CEO of the crypto exchange Zondacrypto. “While the immediate effects may seem limited, their lower operational capacity could slow down innovation and lower investor confidence, especially in an area that is already behind in crypto regulation.”

Because of the regulatory freeze, the Senate can’t look at bills to set up a full digital asset market structure, and President Trump can’t choose new CFTC commissioners to fill open slots. Last Monday, the White House pulled Brian Quintenz’s nomination for CFTC head because certain well-known crypto advocates were against it.

Prediction Markets Bet on Extended Shutdown

Traders in prediction markets think the conflict will last a long time. On Kalshi, betting markets say there is a 69% chance that the shutdown would last more than 15 days and a 41% chance that it will stay more than 25 days. Polymarket users think there is a 72% possibility that the shutdown will last longer than October 15, but only 24% think it will last longer than Trump’s record 35-day shutdown during his first term.

Cryptocurrency markets have risen sharply, even if the political situation is unclear—or maybe because of it. Last week, digital asset investment products saw a record $5.95 billion in inflows. This was partially because people were worried about the stability of the government and the dollar’s decline. Bitcoin had the most money coming in this week, with $3.55 billion, and it broke past $125,000 for the first time. Ethereum had $1.48 billion, while Solana saw record inflows of $706.5 million.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM