Daily Crypto Signals: Bitcoin Tests $113K, Solana Struggles to Hold $200 as Market Stabilizes

Bitcoin has stabilized above the $105,000 support level following a major liquidation event with the US government preparing to seize $14.4B

Quick overview

- Bitcoin has stabilized above the $105,000 support level after a major liquidation event, with over 90% of its circulating supply still profitable.

- The US government is preparing to seize $14.4 billion in Bitcoin linked to a fraud case, marking a significant potential addition to its strategic reserves.

- Solana is experiencing institutional accumulation below the $200 mark, despite mixed signals from retail traders and recent bearish momentum.

- Analysts suggest that Bitcoin's current price action may indicate a mid-cycle reset rather than a deeper market collapse, with key resistance at $117,500.

Bitcoin BTC/USD has stabilized above the $105,000 support level following a major liquidation event, with the US government preparing to seize $14.4 billion in cryptocurrency, while Solana SOL/USD faces persistent network weakness despite institutional accumulation pushing the token toward a critical $200 resistance point.

Crypto Market Developments

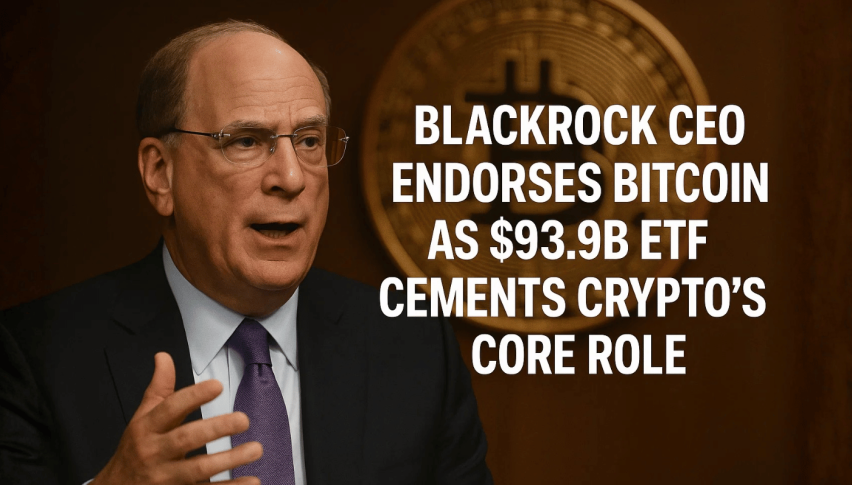

The crypto market is going through an important period of stability after a weekend of record-breaking liquidations. On Monday, US spot Bitcoin and Ether ETFs saw a total of more than $755 million leave the market. Bitcoin ETFs alone saw $326.52 million leave the market. But the bigger picture implies that this is a controlled deleveraging event rather than widespread panic. Over 90% of Bitcoin’s circulating supply is still profitable, which means that most of the losses came from highly leveraged holdings rather than a general loss of faith.

The US Justice Department filed a forfeiture action for 127,271 Bitcoin worth about $14.4 billion. This was connected to a fraud case involving Chen Zhi and schemes located in Cambodia. If this is authorized after a conviction, it would be one of the biggest additions to the US strategic reserve since President Trump’s March executive order set up national Bitcoin and crypto reserves.

Bhutan’s national ID system was linked to Ethereum ETH/USD from Polygon, which is a big step forward for blockchain usage. Now, about 800,000 people may verify their identities and use government services. This move is the first of its kind for blockchain-based sovereign identification systems, and it shows that institutions are becoming more confident in using crypto infrastructure for real-world governance.

Bitcoin Gearing Up for a Leg Higher?

Analysts say that Bitcoin is entering a “cleanup phase,” with a lot of deep buy orders piling up around the $105,000 to $100,000 mark after the deleveraging event. Material Indicators’ trading research shows that there is still considerable selling pressure around $107,000, but there are now more institutional buy offers at lower levels. Blockchain statistics from Glassnode show that Bitcoin’s price has stabilized. Bitcoin has stayed above its 135-day moving average, and the Young Supply MVRV measure has reset toward 1.0, which means that the market has cooled down from its speculative highs.

As the market stabilizes, Bitcoin bulls are looking to $117,500 as the key resistance level for the bullish trend to continue. If the market closes strongly and stays above this level, the recent pullback might quickly turn into a new rise in the next week. As the market finds a new bottom, it looks like it will trade sideways between $110,000 and $100,000. The Friday low of about $101,500 could be challenged again before a more solid range bottom arises.

Bitcoin is currently testing the multi-year uptrend that has been in place since 2022 on higher time frames. This has traditionally acted as a springboard throughout each correction of the current bull cycle. Crypto traders say that if this trendline holds again, it would mean that the overall bull market structure is still in place and that the current drop is only a mid-cycle reset, not the start of a deeper collapse. If Bitcoin drops below $105,000, technical support around the yearly open of $93,500 could become a longer-term price magnet.

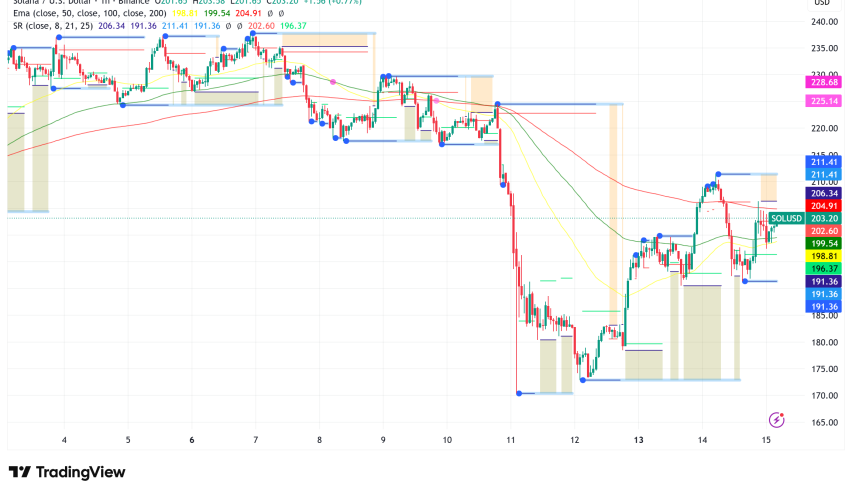

Solana Enjoys Institutional Accumulation Under $200

Despite mixed indications from ordinary traders regarding the token’s chances of recovery, Solana is seeing a lot of institutional buying at prices below $200. According to data from the analytics platform Hyblock, about 76% of retail traders currently have net long positions on Solana. This is a historically bullish sign because backtests show that when retail long percentages go above 75%, Solana’s seven-day forward returns go up from about 2.25% to over 5%, and the average drawdowns go down a lot. Corporate digital asset treasuries are taking advantage of present prices. For example, Solmate bought $50 million worth of SOL at a 15% discount from the Solana Foundation, while SOL Strategies bought another 88,433 SOL at an average price of $193.93.

Whale activity on Solana has started to rise again, which has happened before rallies of 40–70%. Analysts say that positioning seems to be happening before the October 16 spot SOL ETF decision. But when SOL dropped below $190 recently, it was the first time since February 2025 that the structure broke down in a bearish way. This could mean that momentum is changing on longer time periods. The coin is currently trading between the 50-day and 100-day exponential moving averages. This shows that there is indecision because short-term momentum is slowing down while medium-term support is holding. This is a pattern that often comes before bigger directional changes.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account