TSMC Smashes Profit Record as AI Boom Explodes

Global AI investment is expected to reach US$1.5 trillion in 2025 and exceed US$2 trillion in 2026, equivalent to roughly 2% of global GDP.

Quick overview

- TSMC reported record third-quarter earnings, with a net profit of NT$452.3 billion, a 39.1% increase year-on-year.

- The surge in demand for microchips is driven by major clients like Apple and Nvidia, amid concerns of a potential semiconductor bubble.

- Global AI investment is projected to reach US$1.5 trillion by 2025, significantly contributing to TSMC's growth.

- TSMC's earnings announcement comes amid rising tensions between the U.S. and China, affecting the semiconductor industry.

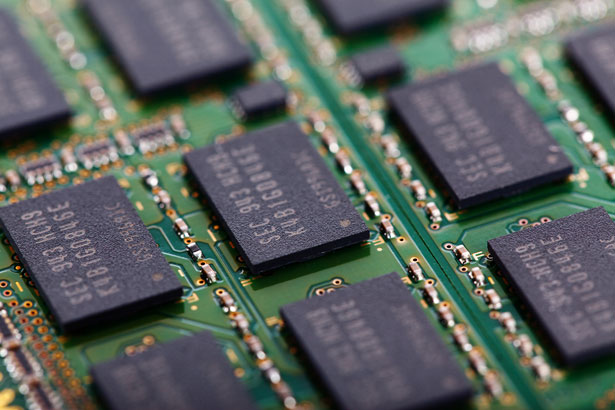

Taiwanese tech giant TSMC reported record-breaking third-quarter earnings on Thursday, driven by surging demand for microchips used in both Apple’s iPhones and artificial intelligence applications.

Taiwan Semiconductor Manufacturing Company (TSMC) — the world’s largest contract chipmaker — has attracted massive investments amid the global AI boom.

Major clients such as Nvidia and Apple are among those pouring billions of dollars into chips, servers, and data centers, sparking renewed concerns about a potential bubble in the semiconductor industry.

TSMC said its net profit for July through September jumped 39.1% year-on-year to NT$452.3 billion (around US$14.7 billion), a new quarterly record that beat Bloomberg’s analyst consensus of NT$406.7 billion. Total revenue rose 30%, also above expectations.

The announcement comes as tensions between Washington and Beijing intensify, with the U.S. imposing new export restrictions on China, potential tariffs on semiconductors, and Beijing responding with curbs on rare earth exports.

“AI growth will be very dramatic — and very positive,” said TSMC Chairman C.C. Wei, when asked about the impact of the U.S.-China dispute.

Spending related to artificial intelligence continues to surge globally. According to research firm Gartner, global AI investment is expected to reach US$1.5 trillion in 2025 and exceed US$2 trillion in 2026, equivalent to roughly 2% of global GDP.

“It’s not just Apple’s new iPhone driving sales,” Wei added. “AI clients like Nvidia and AMC have also ramped up their orders for high-end chips.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account