XRP Price Forecast: Ripple’s $1B Treasury Plan Sparks Bullish Rebound Hopes

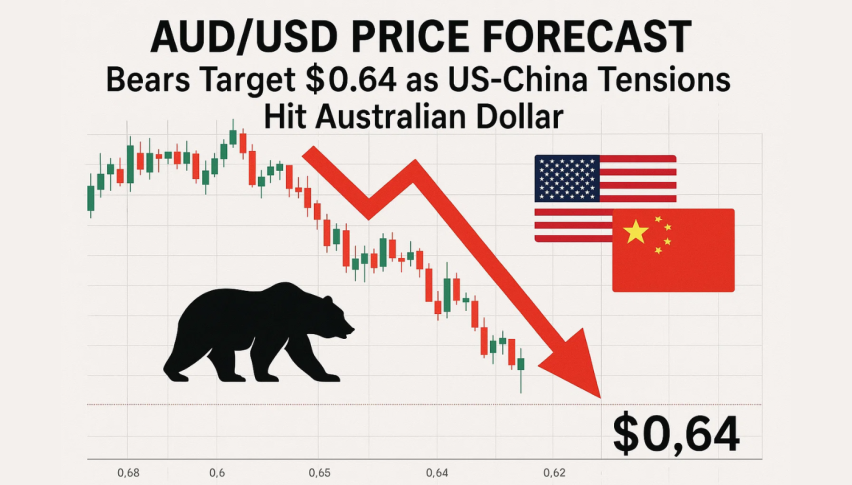

XRP is still having difficulties in gaining momentum, with the currency at around 2.29 following a 3.8% decline over the last 24 hours.

Quick overview

- XRP is currently facing challenges, trading at approximately $2.29 after a 3.8% decline in the last 24 hours.

- The cryptocurrency is in a downward channel, with key accumulation levels between $2.00 and $2.20, while resistance targets are set at $2.72, $3.32, and $3.67.

- Ripple's announcement of a $1 billion treasury fund aims to enhance liquidity and market stability, potentially boosting confidence in XRP.

- Analysts suggest that if Ripple successfully implements its treasury plan, XRP could see a recovery towards the $3.30 - $3.60 range.

XRP is still having difficulties in gaining momentum, with the currency at around 2.29 following a 3.8% decline over the last 24 hours. The greater crypto industry is risk averse and traders are monitoring the new Ripple treasury plan of 1 billion dollars to give indications of future price movement.

On the day-to-day chart, XRP has been trading in a downward channel that resembles the formation that saw it climb by 81 percent the day before. The technical traders tend to see the price action to indicate a consolidation between 2.00 and 2.20- a price that will be considered by them as the accumulation region.

In the event that buyers protect this level, XRP may seek to revert to $2.72 and then test $3.32. Breaking out of the estimation at a level of over 3.32 would mean a revived bullish momentum and might lead the token to 3.67, the next level of resistance.

But a continued decline below $2.00 can be a welcome to proceed with additional selling and this would push the price to a level it had not reached since its last recovery. This arrangement is regarded as a turning point among short term inconsistency to long term faith by traders.

Key Technical Observations:

- XRP is trading within a downward trend line.

- Accumulation zone: $2.00-$2.20.

- Resistance targets: $2.72 – $3.32 – $3.67.

- Support floor: failure to accumulate will incur a cost of 1.90.

The Treasury Move Ripple Makes $1B Makes People More Confident

The move by Ripple to announce a 1 billion XRP treasury fund is significant in terms of creating a strong liquidity and market stability. The company will finance the acquisition of shares in a special purpose acquisition vehicle, some of which will be supported by the company using its XRP.

This action is in the wake of the recent acquisition by Ripple of GTreasury, which will create a wider range of institutional liquidity and cash-management solutions. The new treasury will be a dedicated liquidity reserve, which will assist enterprises to access XRP in order to make cross-border payments and in the DeFi integrations.

Ripple will enhance the depth of liquidity and thereby mitigate price volatility as it tries to show long-term commitment to the XRP ecosystem. According to the analysts, this initiative can be considered a stabilizing mechanism in times of increased uncertainty in the market.

XRP Prognosis: High Caution on Bounceback

XRP is technically sound, even though it continues to be volatile. The stability of the asset in the area around the accumulation zone coincides with the increased institutional efforts by Ripple – providing an opportunity to trigger the revived upward momentum.

The trade range between two and three dollars has become the mark of consolidation and recovery to traders. Should Ripple be able to implement its treasury plan, it has the potential to rebuild market confidence, strengthen liquidity, and cement the status of XRP as one of the most popular utility assets in the world of finance.

With this further momentum, XRP may revisit the $3.30 -3.60 zone in the next few sessions- a significant milestone in a prolonged period of recovery.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account