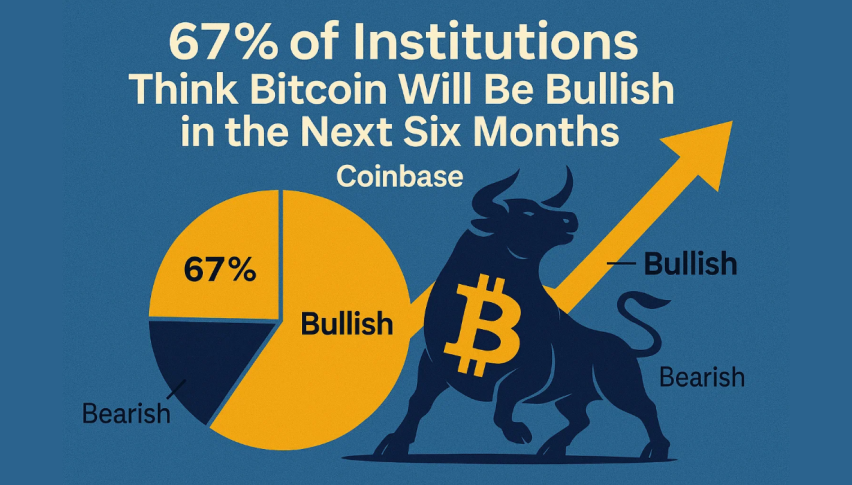

67% of Institutions Think Bitcoin Will Be Bullish in the Next Six Months: Coinbase

A recent report from Coinbase Institutional shows that almost two-thirds of institutional investors predict that Bitcoin will see robust...

Quick overview

- A recent Coinbase Institutional report reveals that 67% of institutional investors are bullish on Bitcoin's performance through 2026.

- Despite differing views on the market cycle, professional investors show greater confidence in the continuation of the bull market compared to non-institutional investors.

- Coinbase highlights that digital asset treasuries are maintaining their cryptocurrency holdings, indicating long-term conviction in the market's potential.

- The report suggests that Bitcoin is positioned for growth, supported by strong institutional interest and favorable economic trends.

A recent report from Coinbase Institutional shows that almost two-thirds of institutional investors predict that Bitcoin will see robust performance over the next six months. In response to the survey, “Navigating Uncertainty,” professional investors are becoming more optimistic as Bitcoin maintains its resiliency in 2025.

🚨INSTITUTIONS ARE TURNING BULLISH!

As per Coinbase, 67% of institutional investors expect Bitcoin to rise in the next 3–6 months — signaling growing confidence in a strong Q4 for crypto. pic.twitter.com/dUcJQUDODq

— Coin Bureau (@coinbureau) October 20, 2025

According to Coinbase’s study of 124 institutional investors, 67% of them have a bullish outlook for Bitcoin (BTC) until 2026. Despite differing views on the market’s current cycle, David Duong, Head of Research at Coinbase Institutional, stated that “the majority of respondents are bullish on Bitcoin.”

In contrast to 27% of non-institutional investors, 45% of institutions think that cryptocurrency markets are nearing the end of a bull run, based to the study. It shows a greater level of confidence among professional investors on the bull cycle’s continuation.

Keep Purchasing Crypto Treasuries During the Dip

This year’s market stability has been greatly impacted by digital asset treasuries, according to Coinbase. It’s difficult to overestimate the influence these businesses have had on supply and demand, according to Duong.

The market expert Tom Lee-led BitMine, for instance, recently bought over 379,000 Ether (ETH) for over $1.5 billion after Ether prices fell below $4,000. Strong faith in the long-term worth of cryptocurrencies is shown by this big accumulation.

Strategy founder Michael Saylor, meanwhile, made a suggestion that the business might purchase further Bitcoin. Currently holding about $69 billion in Bitcoin, Strategy’s steady purchases indicate that institutions strongly believe in the cryptocurrency as a long-term store of value.

Coinbase stated that digital asset treasuries (DAT) are holding onto their cryptocurrency holdings despite slight stock pullbacks in October, indicating “long-term conviction” in the market’s development potential.

The bull market is still expanding.

The present bull market “has room to run,” based on Coinbase. The overall climate for cryptocurrencies is still positive, according to Duong, even though recent market developments have prompted a somewhat cautious approach.

He identified three main causes for optimism: robust liquidity, a solid macroeconomic environment, and encouraging regulatory tendencies. In the fourth quarter Coinbase added additional investors would reenter the cryptocurrency market as a result of anticipated rate reduction by the Federal Reserve and possible monetary stimulus from China.

According to the research, “More investors may decide to exit the market if the Fed cuts interest rates further and China’s fiscal and monetary stimulus increases.”

Bitcoin Positioned for Growth

Coinbase is more cautious about altcoins, but it thinks the market is especially favorable for Bitcoin. According to the research, institutional capital and positive worldwide economic trends may be able to support Bitcoin’s growth through the beginning of 2026.

Bitcoin rose beyond $109,000 over the weekend, regaining a crucial technical mark at $108,000, while Ether briefly crossed $4,000. The market is still cautious, but institutional participation and better liquidity show that trust is growing again.

Coinbase says that Bitcoin is on track for a bullish six months ahead, showing sustained success in the largest cryptocurrency in the world due to robust treasury demand anticipated interest rate decreases and institutional optimism.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account