Bitfarms Is Down after Topping Performance Charts. Is It Time to Buy?

Bitfarms Ltd. stock is down for now but could be positioned for investors to take advantage of a stock that may be ready to climb soon.

Quick overview

- Bitfarms Ltd. (BITF) experienced a 6.4% decline recently, despite being one of the top-performing stocks in recent months.

- Analysts from ATB Capital Markets have given Bitfarms an 'outperform' rating, indicating strong long-term investment potential.

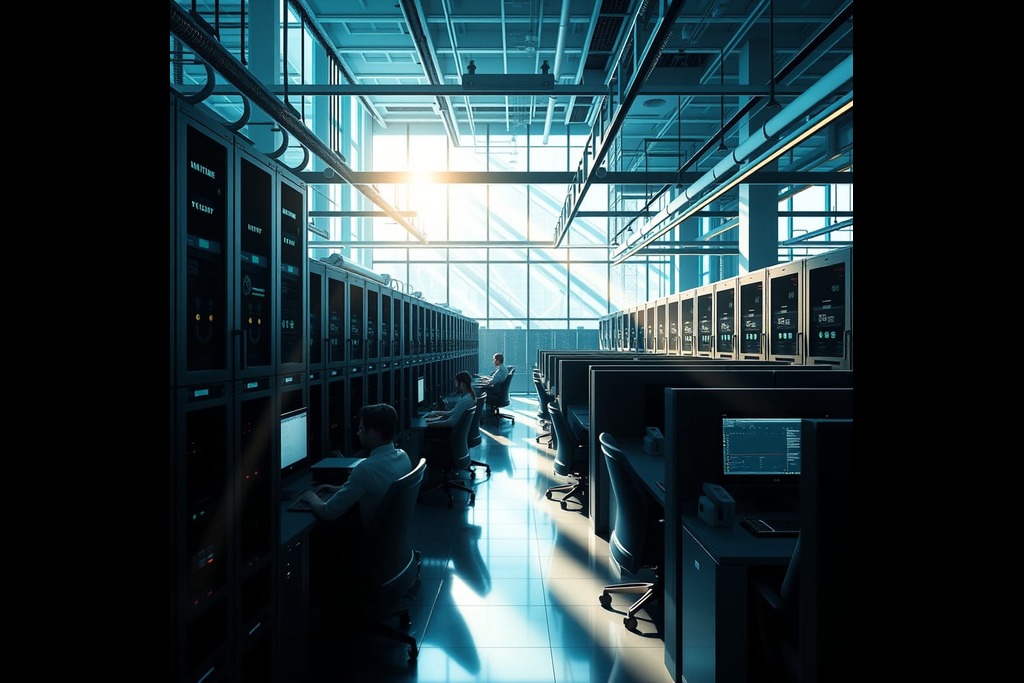

- The company's transition from bitcoin mining to cloud computing services has generated initial interest, although some has waned.

- With a projected revenue increase of 73% to around $81 million, Bitfarms is expected to benefit from its new business model.

Bitfarms Ltd. (BITF) has been ranked as one of the top-performing stocks of the last few months, but it fell 6.4% on Thursday as consumer sentiment toward this stock shifted.

Investors may want to take another look at Bitfarms since the stock dived this week and could be undervalued. The stock has performed well for much of the last few months but has recently been on a downward trend.

Bitfarms was assessed by ATB capital Markets and given an “outperform” rating. The firm’s analyst, Martin Toner, believes that this stock is an excellent long-term investment. There was initially strong interest in Bitfarms when it transitioned over to cloud computing services from bitcoin mining, but some of that interest has dissipated.

How Has Bitfarms Performed in the New Niche?

BITF stock climbed through much of September and October this year as the company worked to shift over to its new business operations. The stock price peaked at $6.47 per share in late October, an all-time high for the stock. However, the stock price fell drastically from that high but still maintained much of its gains from the last couple months.

As Bitfarms makes the move into this new business model, they expect to see much better revenue and profit performance, as they were mostly breaking even or losing money in the previous market. Analysts expect similar performance from them, which is why many galactical firms are optimistic on this stock.

The forecast for now for the company’s revenue is around $81 million, which would be an increase of 73% from the previous year. If they can manage numbers even close to that, they will have proved that the shift to the new business was a smart one.

It looks like Bitfarms may have pulled out of the Bitcoin business in time too, since BTC’s price is down to a five-month low right now and will struggle to hit some of the predicted 2025 highs. Cloud computing is definitely a bigger business at the element, since Google and Alphabet have seen tremendous growth in those areas, and most of Microsoft’s profits from their last quarter came from that niche.

Our recommendation is to buy the dip on Bitfarms for now, since the stock has tremendous potential and is positioned in a growing market. Despite the recent decline, they have retained much of their gains from the past few months and appear to be on an upward trajectory for profits, revenue, and stock value.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account