Stocks Flip-Flop as Nasdaq Falls 1.9%

Tech stocks are falling the hardest and bringing the Nasdaq index down with them today as the tech rally ends.

Quick overview

- The stock market experienced significant fluctuations, with the Nasdaq Composite dropping 1.9% on Thursday after a brief rally.

- Concerns over rising tariffs and a potential slowdown in the AI market are contributing to the decline in tech stocks.

- The Supreme Court is questioning the legality of President Trump's tariff plans, adding to market uncertainty.

- Analysts warn that the AI investment bubble may burst, jeopardizing profits for many tech companies.

The stock market has had a wild week of ups and downs, and after Wednesday’s upswing, Thursday ended on a sour note with the Nasdaq Composite falling 1.9%.

The Dow Jones dropped 0.84% on Thursday, and the S&P 500 backtracked with a loss of 1.12%. The top three indices all wound down on Thursday, with the tech-heavy Nasdaq falling the most and losing nearly 2%. The tech rally has run out of steam before it even got going this week.

The decline on Thursday is attributed to rising tariff fears and concerns about the AI market tapering off. Because many tech stocks are reliant on AI investments, if the market there starts to dry up, many major tech companies will be left with massive outflows that they will not be able to make up in earnings.

Tariff Plans Might be in Trouble

U.S. President Donald Trump has big plans for his tariffs, but the Supreme Court is casting doubt on the legality of those far-reaching tariffs. The court is currently hearing arguments against the President’s tariffs, and justices from both political parties have been putting pressure on the court to call Trump’s tariff actions into question.

Trump used the International Emergency Economic Powers Act to put his tariff plans into action, declaring a national emergency over illegal immigration and drugs coming into the country. He has been trying to levy the power of tariffs to force the hand of trade partners so that they will crack down on illegal immigration and illegal drugs coming into the United States. In some instances, his efforts have worked, and the U.S. government has reached key agreements with Mexico, Canada, and the United Kingdom on these issues.

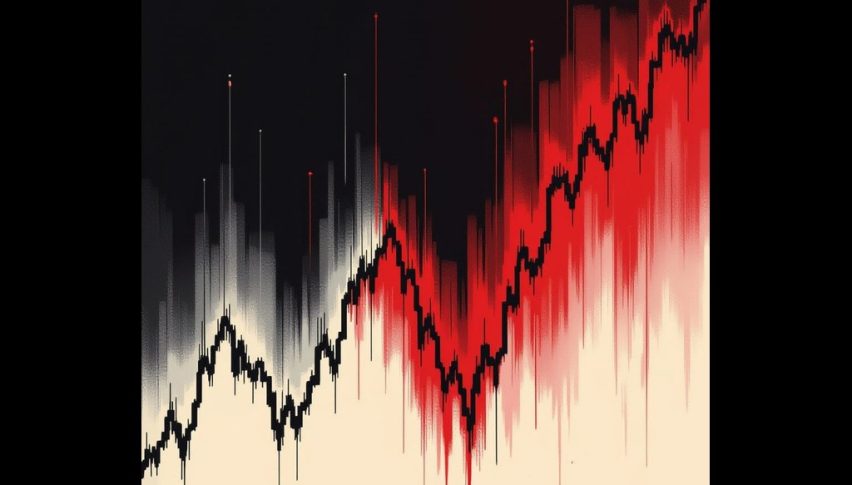

As a result of the trade war that ensued as countries pushed back against the tariffs, the stock market has fluctuated wildly this year. It has been relatively stable over the last few months, though, as a pattern has developed where Trump threatens new tariffs, countries comply with at least some of his demands, and the new tariffs are not as strict as originally proposed.

This week, however, the stock market is in fluctuation over tariff fears and other concerns, and we may start to see some slipping from the record highs posted by the major stock market indices as well as a number of tech stocks.

AI Fears Persist and Plague market

This week has also seen serious debate over the longevity of AI investments. There is fear that AI has peaked for now and may not be able to go much further, and there is also rising concern that companies may have reached a threshold as to how much profit they can squeeze out of AI technologies. Analysts have proposed that the AI bubble will burst, bringing many tech companies down as it implodes.

There was some positive news on that end as Advanced Micro devices posted positive earnings for the quarter, but investors are still worried that the billions of dollars that companies are pouring into AI investment may not prove profitable in the coming years.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM