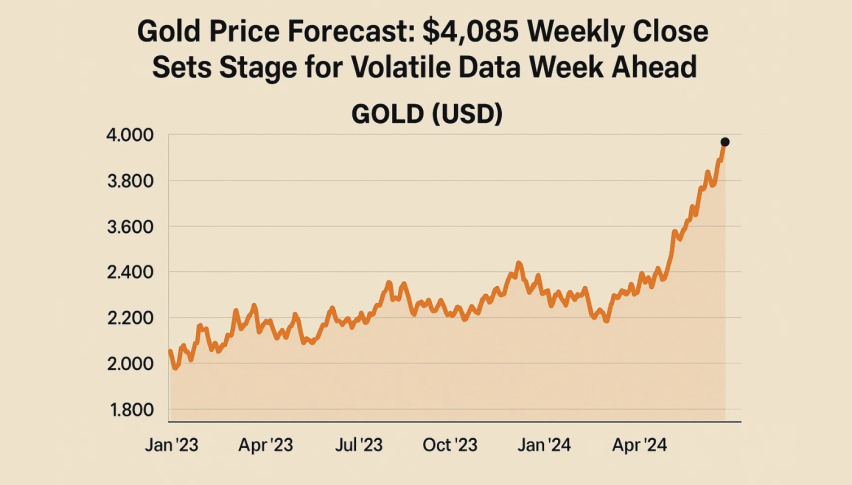

Best Gold Year Since ’79: Rally Roars On, Overbought Warnings Flash

The bullion asset is on track to record its best annual performance since 1979 as its record-breaking year continues.

Quick overview

- Gold is on track for its best annual performance since 1979, rising 56% year-to-date and nearing its all-time high.

- Silver has increased by 80% this year, approaching its record price of $54.47 per ounce.

- Despite expectations for a US government shutdown resolution, gold prices rose due to ongoing labor market weakness and hopes for interest rate cuts.

- A recent market sell-off, driven by hawkish comments from the Federal Reserve, caused gold prices to drop, dampening rate cut expectations.

The bullion asset is on track to record its best annual performance since 1979 as its record-breaking year continues.

The yellow metal had risen an astounding 56% year-to-date. This week, the yellow metal broke above $4,200 per ounce once more, getting closer to its all-time high of $4,379.13, which was reached on October 17. Silver is on track to have its best year ever, increasing by 80% so far this year.

Silver increased to a few cents short of its record price of $54.47 per ounce. Silver futures reached a new all-time high of $54.415 per ounce.

Despite the news that the longest US government shutdown in history was about to end, which is typically a development that would reduce demand for safe-haven assets, gold prices increased this week. However, the US labor market’s ongoing weakness is raising hopes for additional interest rate cuts by the Federal Reserve in December.

A wider market sell-off on Friday caused global spot gold prices to fall 2.9 percent to $4,080.70 per ounce, dampening expectations for a December interest rate cut. Hawkish comments from US Federal Reserve officials sparked the sell-off. The idea that we might see a lesser likelihood of a Fed rate cut in December is taking some of the wind out of the sails of the gold and silver market.

Following the worldwide selloff brought on by hawkish Fed signals, equity markets plummeted.

The Fed and traders were left in the dark ahead of next month’s policy meeting due to a significant data gap caused by the longest US government shutdown, which ended on Thursday. Investors anticipated that new data would indicate a slowing economy, allowing the Fed to lower interest rates in December and increasing the allure of non-yielding gold. Those hopes faded as more Fed officials took a cautious approach to further monetary easing.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account