Gold Charges Toward $4,100 Milestone: Safe-Haven Buying Heats Up Amid NFP Delay Drama

Gold attracts new sellers and continues to drop from the weekly high hit the previous day after rising to the $4,110 region during the Asian session on Thursday.

Quick overview

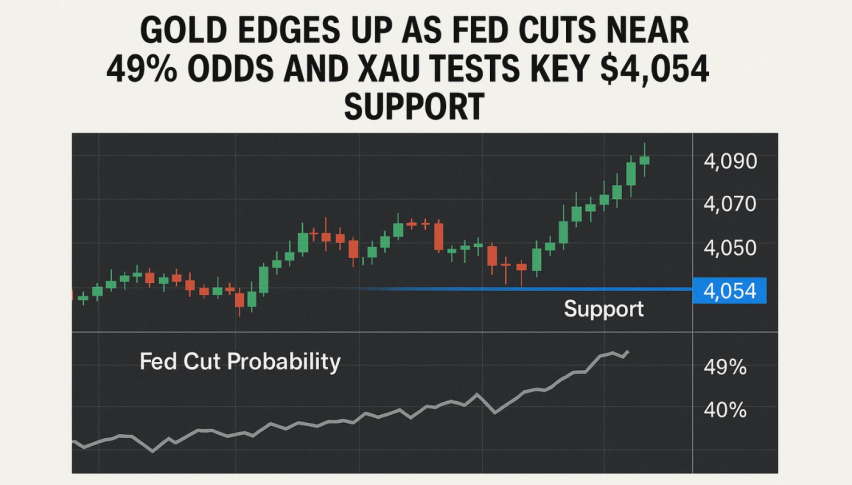

- Gold prices are declining after reaching a weekly high of $4,110, influenced by new sellers entering the market.

- The US dollar has strengthened due to less dovish Federal Reserve expectations, despite concerns over economic slowdown.

- Traders are cautious ahead of the US Nonfarm Payrolls report, with significant support for gold expected around $4,018.

- If gold prices fall below $4,000, they may drop further towards $3,931 and potentially $3,886.

Gold attracts new sellers and continues to drop from the weekly high hit the previous day after rising to the $4,110 region during the Asian session on Thursday.

Less dovish Federal Reserve (Fed) expectations push the US dollar (USD) to its highest level since late May despite concerns about the slowing economic momentum following the longest-ever US government shutdown.

The non-yielding yellow metal is therefore believed to be under considerable downward pressure. Additionally, the generally positive sentiment surrounding the equity markets is thought to weaken the demand for safe-haven gold.

However, traders seem apprehensive and decide to wait until later in the North American session for the release of the US Nonfarm Payrolls (NFP) report for September. However, given the fundamental backdrop, one should be cautious before positioning for an extension of this week’s bounce from levels below the $4,000 psychological mark.

From a technical perspective, any further price decline is likely to encounter significant support near the 200-period Exponential Moving Average (EMA), currently situated around $4,018. Following that, the weekly swing low, just below the psychological $4,000 level, serves as the next support point.

If this level is tested, the price of gold may accelerate its drop toward the $3,931 support.

The downward trend could continue until reaching the $3,886 area, which corresponds to the swing low from late October.

On the other hand, the peak of the Asian session around $4,110 may act as an immediate resistance level. If there is some follow-through buying beyond the overnight swing high near $4,120, the price of gold could advance to the next significant resistance range of $4,152–$4,155. Bullish traders would see this as a fresh buying opportunity. A subsequent increase could allow for a move towards regaining the round number of $4,200.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account