United States Outlook: Economists See Growth and Stable Inflation in 2026

Inflation is expected to end the year at 2.9%, slightly below the October forecast of 3%, and ease only marginally to 2.6% next year.

Quick overview

- Economists project U.S. economic growth of 2% and inflation at 2.9% for 2026.

- Job creation is expected to remain sluggish, with a forecast of 64,000 jobs added per month.

- Tariff impacts are seen as the biggest downside risk to the economic outlook.

- The Federal Reserve is anticipated to implement a quarter-point rate cut in December, with limited easing expected in the following year.

A new survey of economists and market analysts shows expectations for 2% economic growth and 2.9% inflation in the United States next year.

U.S. economic growth is projected to edge higher in 2026, though job creation is expected to remain sluggish and the Federal Reserve is likely to slow the pace of future rate cuts, according to economists surveyed by the National Association for Business Economics in its year-end outlook report.

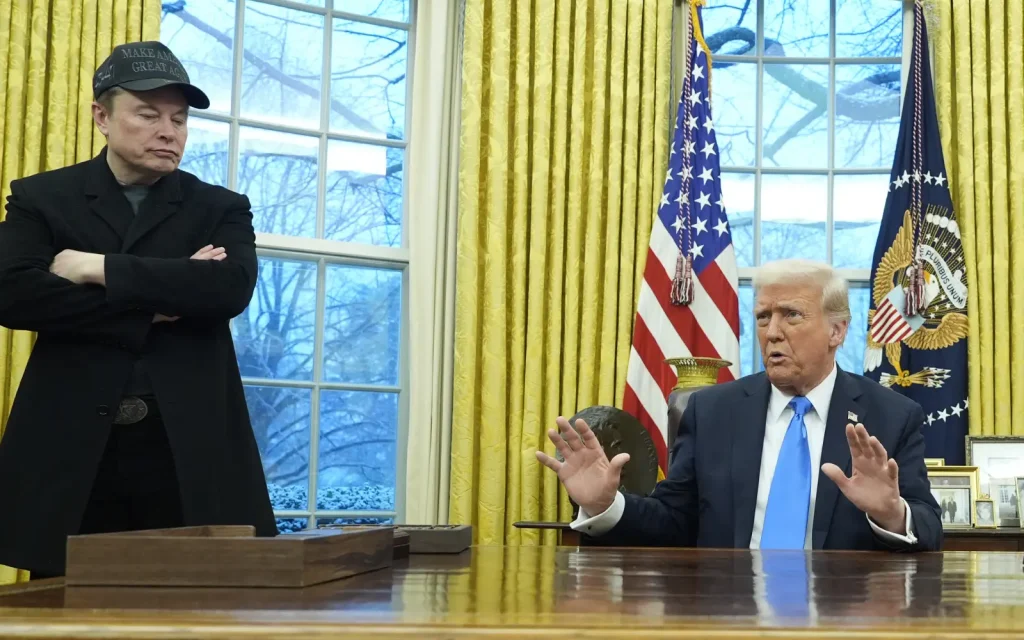

The survey — conducted between November 3 and 11 among 42 professionals — produced a median growth forecast of 2%, up from 1.8% in October and sharply higher than the 1.3% estimate in June. Stronger personal spending and business investment are expected to drive the improvement, offset by what the panel — in near-unanimous agreement — said would be a drag of at least a quarter-percentage point from the Trump administration’s new import taxes.

Respondents cited “tariff impacts” as the biggest downside risk to the U.S. outlook, both in likelihood and in potential economic damage.

Tighter immigration measures were also viewed as a factor that could weigh on growth, while a pickup in productivity was considered the most likely driver of stronger-than-expected economic performance.

Economic Variables in 2026

Inflation is expected to end the year at 2.9%, slightly below the October forecast of 3%, and ease only marginally to 2.6% next year. Tariffs are expected to account for between a quarter and nearly three-quarters of a percentage point of that inflation reading.

Job growth is projected to remain historically modest at around 64,000 jobs per month—faster than this year, but well below recent norms. The unemployment rate is expected to rise to 4.5% in early 2026 and hold there through year-end.

With inflation still elevated and unemployment rising only slightly, economists expect the Federal Reserve to approve a quarter-point rate cut in December, followed by only another half-point of easing next year, bringing policy closer to what is considered a neutral range.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM