Texas Buys $5M of IBIT as State Sets $10M Bitcoin Allocation Strategy

Texas has made an enormous leap forward in state-level digital asset adoption by spending $5 million on BlackRock's spot Bitcoin ETF...

Quick overview

- Texas has invested $5 million in BlackRock's spot Bitcoin ETF, IBIT, and plans to allocate another $5 million to directly purchase Bitcoin.

- The state aims to establish a Bitcoin reserve fund, following a bill signed by Governor Greg Abbott that allows Bitcoin as a long-term financial investment.

- Texas is taking a structured approach to cryptocurrency investments, with eligibility for the fund based on a market cap of over $500 billion.

- Other states and institutions are also entering the Bitcoin market, indicating a broader trend towards public sector adoption of digital assets.

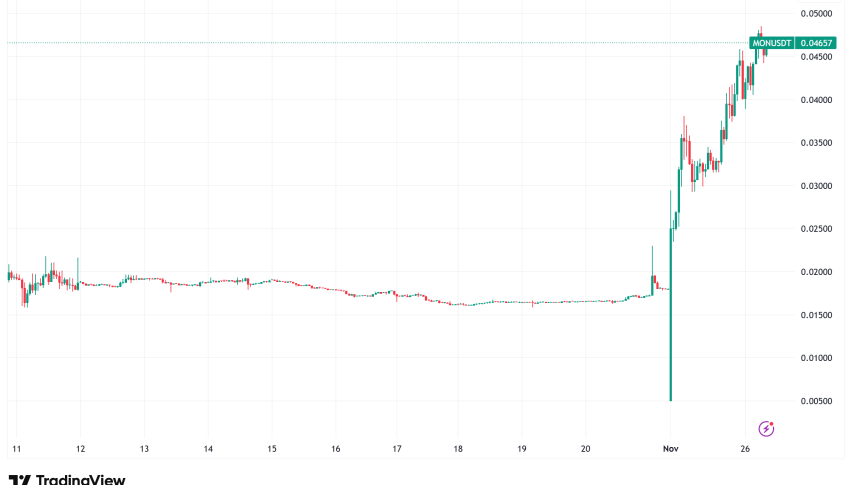

Texas has made an enormous leap forward in state-level digital asset adoption by spending $5 million on BlackRock’s spot Bitcoin ETF, IBIT. But that’s not all, they’ve also set aside a further $5 million to buy and hold their own Bitcoin directly. The deal went down on November 20th, and Texas Blockchain Council President Lee Bratcher made sure everyone knew about it, stating that the ultimate aim is for the state to take full control of Bitcoin once the necessary paperwork is in order.

Bratcher made it clear that the entire $10 million had been ring-fenced from general revenue, even though only half had been spent so far. By using IBIT, the state can gain regulated exposure to Bitcoin while it sorts out how to hold physical Bitcoin.

Pierre Rochard, CEO of The Bitcoin Bond Company, reckons this move is a game-changer for the state’s attitude towards Bitcoin and how quickly institutions are coming on board.

Strategic Reserve Plans Shape Texas’ Crypto Policy

This purchase is a follow-up to a larger push in the Texas state assembly to create a state-managed Bitcoin reserve fund. Back in June, Governor Greg Abbott signed a bill that will let the state keep Bitcoin as part of its long-term financial investments. The catch is that only cryptocurrencies with a market cap over $500 billion qualify – and given Bitcoin has a comfortable lead in that regard, it’s no real issue.

NEW: 🇺🇸🟠 Texas scoops up $10M in $Bitcoin at the dip, becoming the first U.S. state to make an official $BTC buy via BlackRock’s IBIT ETF. pic.twitter.com/Y4CuWsSOVW

— Bitcoin.com News (@BitcoinNews) November 25, 2025

Even though IBIT does not meet the eligibility rules, we can see the $5 million from the state buying into it as a good step in the direction they want to take. All because the state is taking a thoughtful, structured approach to introducing Bitcoin into its portfolio.

Key features of the plan include:

- That $10 million has been set aside to start dipping their toes in crypto investments

- They plan to hold onto some of that Bitcoin themselves once they’ve figured out how to do it properly.

- Eligibility for the fund will be based on market cap – over $500 billion.

- They might at some point consider adding Ether into the mix too if its market cap stays above $500 billion for two years or so

The state’s ambitions in the crypto space are pretty serious, and who knows, they may start looking into other cryptocurrencies too. Texas Senator Charles Schwertner, one of the authors of the bill for the cash reserve, even said that Ethereum might be a candidate for the fund in the not-too-distant future if it can maintain its market cap for 24 months.

Texas Joins Growing List of Public Sector Bitcoin Buyers

Texas is definitely not the only state getting into the whole Bitcoin market, sadly. Wisconsin’s investment board splashed out nearly $100 million on IBIT shares at the start of the year, and other institutions are getting in on the action too – Harvard University and Abu Dhabi-based investment funds are all now buying into BlackRock’s spot ETF, according to Bloomberg analyst Eric Balchunas.

Despite the growth in adoption, BlackRock’s IBIT has taken a 10% hit this year – trading near $49.56 at the moment. After-hours trading did manage a tiny 0.22% bump upwards, though, an uptick from yesterday’s price.

Texas’s decision to buy into the Bitcoin market is part of a bigger shift towards mainstream public finance with digital assets – it really puts them right at the forefront of getting more public institutions involved in Bitcoin.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account