Zcash Surges Past $526 as Institutional Accumulation Fuels Privacy Coin Renaissance

Zcash (ZEC) is trading for more than $526 right now, which is almost 4% more than it was 24 hours ago. This steady rise comes after a huge

Quick overview

- Zcash (ZEC) is currently trading above $526, reflecting a nearly 4% increase in the last 24 hours after a significant 1,200% rise over 90 days.

- The cryptocurrency has shown strong support above the $500 level, indicating bullish sentiment despite recent market dips.

- Institutional adoption is accelerating, with significant investments from companies like Reliance Global Group and Cypherpunk Technologies, enhancing Zcash's long-term value proposition.

- Short-term price targets for ZEC range from $625 to $750, while medium to long-term projections could see prices reaching between $800 and $2,000.

Zcash ZEC/USD is trading for more than $526 right now, which is almost 4% more than it was 24 hours ago. This steady rise comes after a huge spike that saw the privacy-focused cryptocurrency rise more than 1,200% in 90 days, momentarily going above $700 before settling into its current level.

The asset’s capacity to stay above the $500 psychological level shows that there is considerable support behind it. This is especially true since ZEC recently showed extraordinary strength by increasing more than 20% amid a market dip when most altcoins were poor. The 30% drop from the local high in November looks like a healthy consolidation rather than a change in the main trend.

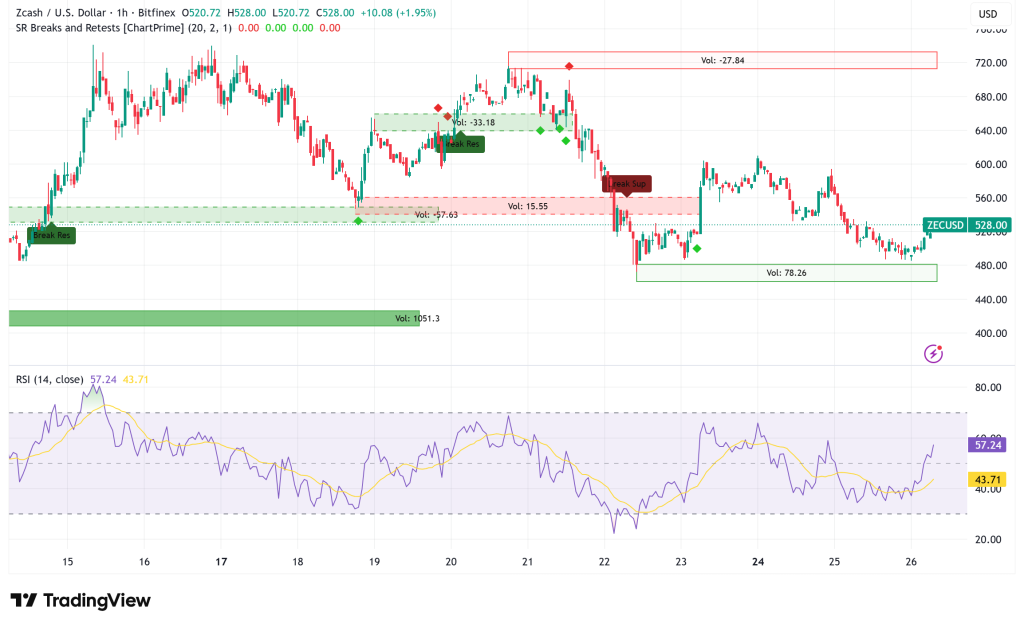

ZEC/USD Technical Analysis Points to Multi-Level Support Structure

From a technical point of view, Zcash’s chart shows a number of important support areas that have formed in the last several price movements. The $500 to $526 range is currently the immediate support level, and there is always substantial buying demand at these prices. This area is a significant battleground between bulls and bears, and the fact that ZEC is able to stay above it strengthens short-term optimistic optimism.

Volume analysis shows that a lot of institutions are involved, with Zcash futures activity nearing $10 billion on November 7 and derivatives platforms indicating growing open interest. This amount of activity usually means that bigger players are making important moves, which commonly comes before long-term price changes instead than short-term spikes.

The relative strength shown during market-wide drops implies that smart investors are buying up shares because they see present levels as good entry points. The asset’s performance above $526 while the broader markets are sluggish shows that ZEC is breaking away from prevailing market sentiment, which is something that happens to assets that are being fundamentally revalued.

Zcash’s Fundamental Catalysts Reinforce Bullish Case

There are more than just speculation behind Zcash’s recent price swings. The halving in November 2024 cut the daily output from about 3,600 coins to 1,800 coins. This caused an initial shock in supply that still affects price discovery. This halving cuts new selling pressure in half, bringing the total quantity of coins to 21 million, which is the same as Bitcoin’s monetary policy.

The number of people using shielded addresses has skyrocketed, going from 1.7 million ZEC to almost 4.5 million coins in the last year. More over 27% of the circulating supply is currently in shielded pools, which shows that people are using it for real instead of just trading it for fun. This shows that people are actually using the protocol and suggests that they are using Zcash’s main privacy features.

The NU6.1 governance upgrade, which went live on November 24, 2025, added a funding model that gives coinholders authority over the money. It gives 20% of block rewards to development and community donations. This open governance system answers past concerns about centralized finance and gives a clear plan for the next halving cycle in 2028.

Institutional Adoption Accelerates Treasury Diversification

Accelerating institutional adoption may be the most important thing that is keeping prices where they are now. Reliance Global Group made news when it sold all of its Bitcoin, Ethereum, Cardano, and XRP holdings and put all of its money into Zcash. This was a huge vote of confidence in ZEC’s long-term value proposition.

Cypherpunk Technologies, which is sponsored by the Winklevoss twins, bought 203,775 ZEC for about $50 million. This is part of a plan to get up to 5% of the total supply. Grayscale’s Zcash Trust now manages about $200 million in assets, which lowers the amount of Zcash that is available for trading and creates structural demand.

These institutional initiatives show that they think Zcash’s selective privacy model, which lets people make both open and private transactions, makes it more likely to succeed in a world that is becoming more regulated. The ability to give auditability when needed while keeping privacy when needed meets a key institutional necessity that purely opaque privacy coins can’t meet.

Zcash Price Prediction: Near-Term Targets and Longer-Term Outlook

There are a number of possible pricing scenarios for Zcash in the next few weeks and months, based on the existing technical structure and fundamental changes.

- Short-term (1-3 months): If ZEC stays above $500, the next resistance levels look to be around $625 to $650, followed by a test of the previous high at $700 to $750. A clear breach above $750 could cause FOMO to rise again and aim for the psychological level of $1,000. On the other hand, if the $500 support level doesn’t hold, the price might drop even more, to the $425-$450 range, which is the 50% retracement level of the recent advance.

- Medium-term (3–6 months): If institutional accumulation keeps going and protected adoption keeps expanding, ZEC could potentially reprice toward its prior all-time highs, which would put it in the area of $800 to $1,200. The halving cuts down on supply, while treasury allocations enhance demand. This makes for good supply-demand dynamics.

- Long-term (6–12 months): If Zcash can prove itself as a privacy solution for businesses and only gains a small part of the privacy-conscious market, targets of $1,500 to $2,000 become possible. When inflation and changes in the market structure are taken into account, this would still leave ZEC well below its peak of around $5,000 in 2016–2017.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM