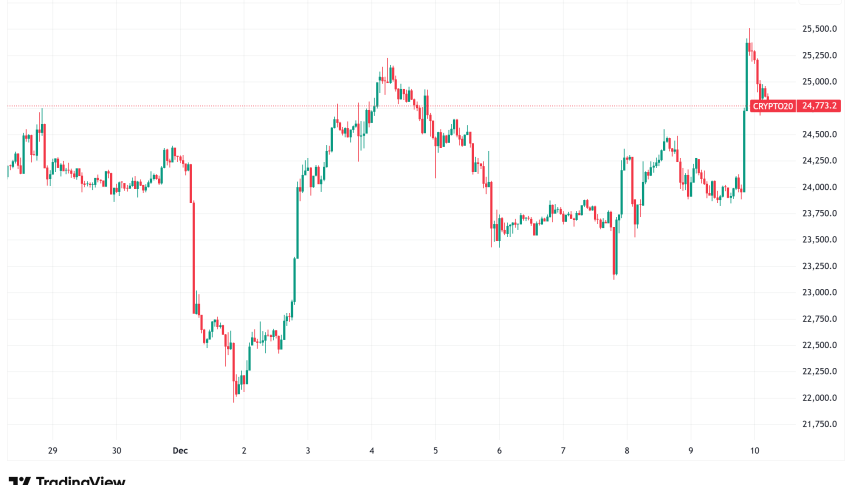

Daily Crypto Signals: Bitcoin Reclaims $94K, Ethereum Faces 62% Fee Decline Amid Layer-2 Growth

Bitcoin surged back above $94,000 as bulls regained short-term control despite muted liquidity signals, while regulatory developments

Quick overview

- Bitcoin surged back above $94,000 as bulls regained control, despite muted liquidity signals.

- Ethereum experienced a 62% drop in base layer fees while rallying to $3,400, with layer-2 expansion mitigating concerns about mainnet activity.

- Regulatory developments, including Senator Lummis's Responsible Financial Innovation Act and the CFTC's new pilot program, indicate growing institutional integration in the crypto market.

- Despite recent challenges, Ethereum maintains a significant 68% market share in the DeFi ecosystem, supported by strong layer-2 scalability incentives.

Bitcoin BTC/USD surged back above $94,000 as bulls regained short-term control despite muted liquidity signals, while regulatory developments including Senator Lummis’s anticipated market structure markup and the CFTC’s tokenized collateral pilot program signal growing institutional integration. Meanwhile, Ethereum ETH/USD experienced a sharp 62% drop in base layer fees even as ETH rallied to $3,400, with robust layer-2 expansion offsetting concerns about declining mainnet activity.

Crypto Market Developments

This week, there were big changes in the cryptocurrency sector in terms of rules, institutions, and technology. Wyoming Senator Cynthia Lummis said that the Responsible Financial Innovation Act should go on to markup hearings before Congress goes on holiday. After months of intense negotiations, bipartisan talks have reached a key point. The senator admitted that some in the crypto business were worried about the bill’s pace. She said that repeated changes during bipartisan talks had worn out staff members from both her office and Senator Kirsten Gillibrand’s office.

Matt Huang, co-founder of Paradigm, said that crypto is getting close to its “Netscape moment,” which is a turning event like the debut of the first mainstream web browser in 1994. Huang stressed that the industry is growing at an unprecedented rate in both institutional investment vehicles and grassroots cypherpunk apps. This judgment comes at a time when about 200 crypto-based exchange-traded products might start trading in the coming year, with 155 now waiting for regulatory permission.

The US Commodity Futures Trading Commission (CFTC) has unveiled a new pilot program that lets futures commission merchants accept Bitcoin, Ethereum, and Circle’s USDC stablecoin as margin collateral in derivatives markets. Caroline Pham, the acting head of the CFTC, said that the program provides explicit safety limits for customer assets and makes it easier to monitor and report on them. Companies who take part will have to send in weekly reports on all of their customers’ holdings and any problems that come up with using crypto as collateral. This is another big step toward bringing digital assets into regulated markets.

Bitcoin Reclaims $94,000 on Tuesday

Bitcoin (BTC) bulls were able to go back above the $94,000 mark after a few days of sideways consolidation. They broke past the important $93,500 resistance and set a new higher high, which brought back short-term bullish momentum. Before the Federal Reserve’s FOMC meeting, traders who had been waiting and seeing began to prepare for any changes in monetary policy. The increase made any earlier doubts about Bitcoin’s fair value gap between $87,500 and $90,000 meaningless. However, BTC is still trading close to the monthly volume-weighted average price on both four-hour and daily timeframes.

Even though the prices are going up, the underlying liquidity measurements show that the market is more cautious. Bitcoin’s bid-ask ratio has stayed rather low and irregular compared to November’s big drop from $100,000 to $80,000, when big bids quickly absorbed selling pressure. The recent bounce looks like it’s being driven by price rather than depth. This means that buyers are active, but they’re not yet committing in the large clusters that are common in strong uptrends. The Korea Premium Index has dropped substantially from its previous highs, trading near flat or slightly negative territory. The Coinbase Premium Index, on the other hand, has turned slightly positive, which is usually a sign of spot accumulation during early-stage trend reversals.

Ethereum Holds Above $3,300

Ethereum (ETH) rose to a three-week high of almost $3,400 after disappointing US labor market statistics that made some think monetary policy will be less tight. It gained 11.2% for the week. But the network’s base layer activity has dropped a lot. Network fees have dropped 62% in the last 30 days, which is a much bigger drop than the 22% drops seen on other blockchains like Tron and Solana during the same time period. The Fusaka upgrade that went live on December 3rd made modifications to make rollups work better. This may have led to lower mainnet fees all month.

Over the course of seven days, the volume of decentralized exchanges on Ethereum dropped from $23.6 billion to $13.4 billion. At the same time, the revenue from decentralized applications plummeted to a five-month low of $12.3 million. The total value locked on Ethereum’s foundation layer fell from $100 billion two months ago to $76 billion now. Leading DApps like Pendle, Athena, Morpho, and Spark saw their TVL drop sharply. Even if these contractions are happening, Ethereum still has a huge 68% market share in the DeFi ecosystem. Layer-2 networks are also growing quickly—Base transactions went up 108% and Polygon transactions went up 81%, showing that Ethereum’s scaling infrastructure is still going strong.

Ethereum bulls say that the network’s strong incentives for layer-2 scalability make it a better long-term model than competitor blockchains, which need greater computing power and centralized coordination. The annualized financing rate for ETH perpetual futures stayed close to 9%, which means that long and short traders were evenly balanced. The new SEC Chair, Paul Atkins, says that tokenization of US markets could happen in “a couple of years” and praises blockchain’s benefits for making things more predictable and open. This means that Ethereum is likely to see a lot of growth in institutional DeFi adoption, even though there are some problems with the base layer right now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account