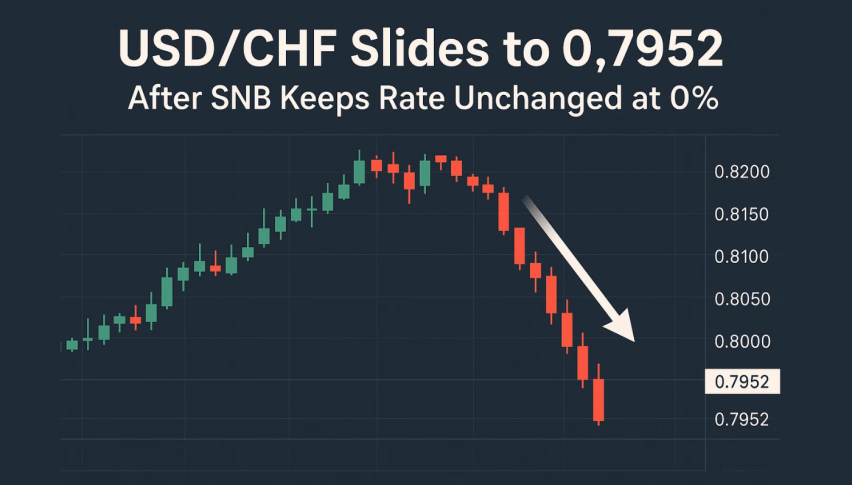

USD/CHF Slides to 0.7952 After SNB Keeps Rate Unchanged at 0%

USD/CHF continued to slide into the European session, with the Swiss Franc strengthening to around 0.7985 as investors gained...

Quick overview

- USD/CHF is declining as the Swiss Franc strengthens to around 0.7985, influenced by the Swiss National Bank's stable policy outlook.

- Despite a contraction in Switzerland's economy in Q3, positive signs like softer US tariffs are reducing the likelihood of negative interest rates.

- The US Dollar remains under pressure following a dovish tone from the Federal Reserve, which has led to expectations of further rate cuts.

- Technical analysis shows USD/CHF trading at 0.7952, with bearish trends indicating potential further declines towards key support levels.

USD/CHF continued to slide into the European session, with the Swiss Franc strengthening to around 0.7985 as investors gained a clearer picture of the Swiss National Bank’s policy direction. The SNB had left rates where they were – at 0% – saying that inflation is still looking pretty tame and will likely stay stable for a while.

Switzerland’s economy actually contracted in Q3, but the SNB is seeing some positive signs – softer US tariffs, recovering global demand. All of which has led people to think negative interest rates are less likely than before, helping to prop up the Franc.

Now everyone is waiting to hear from SNB Governor Martin Schlegel, and as long as policy looks stable, the Franc should retain its safe-haven appeal.

Fed’s Dovish Tone Pressures the US Dollar

The US Dollar is still under pressure after the Federal Reserve cut interest rates by 0.25% and then said it doesn’t think inflation is a big problem and doesn’t need to be hiked just yet. Fed Chair Jerome Powell played down the risk of persistent inflation and said that we don’t need to worry about rates going up anytime soon – that’s a dovish tone.

The US Dollar has been on the back foot ever since, and people are still expecting another cut next year – the Fed officials are keeping an eye on the labor market and think it needs some support. And with the Dollar not offering much interest, it’s struggling against the Franc’s safe-haven appeal.

Safe-Haven Demand Reinforces CHF Strength

There are a couple of reasons why the Franc is doing so well. Firstly, it has a safe-haven appeal, and investors turn to it when they’re feeling uncertain. The fact that US data releases are not really helping the Dollar’s cause isn’t helping the Dollar either. As long as the Fed is keeping its powder dry, we can expect more Franc strength.

USD/CHF Technical Analysis

USD/CHF is currently trading at around 0.7952 after breaking below a trendline that had held it up for a good month. We had a strong bearish candle that confirmed the break, and the structure is now decidedly bearish.

The price is now below 0.7999, which used to be a support but has since turned into resistance. The 20 Day EMA at 0.8021 remains a barrier to any recovery attempts. We’re seeing sellers putting a lot of effort into keeping a lid on things.

If selling pressure keeps up, our next key supports are at 0.7927 and 0.7879, and then there’s a deeper target at 0.7832. The candle patterns over the last few sessions have shown a pattern of lower highs and long lower wicks – that doesn’t look like a lot of buying interest to us.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM