Polymarket will not pay out Bets on a U.S. Invasion of Venezuela

Following suspicions of unusually profitable trades, proposals have emerged in the United States to criminalize insider trading.

Quick overview

- Polymarket has withheld payouts for bets on a U.S. invasion of Venezuela, citing a narrow definition of 'invasion' that caught investors off guard.

- Over $10.5 million was wagered on these contracts, revealing vulnerabilities in traders' understanding of risk and contract terms.

- The incident raises concerns about how prediction markets interpret ambiguous events and the importance of governance and dispute resolution.

- Regulatory discussions have emerged around insider trading in prediction markets, as traders increasingly focus on resolution mechanisms rather than the events themselves.

The leading prediction market has reignited debate over the fine print of these investments, highlighting how outcomes often hinge more on human judgment than on purely financial factors.

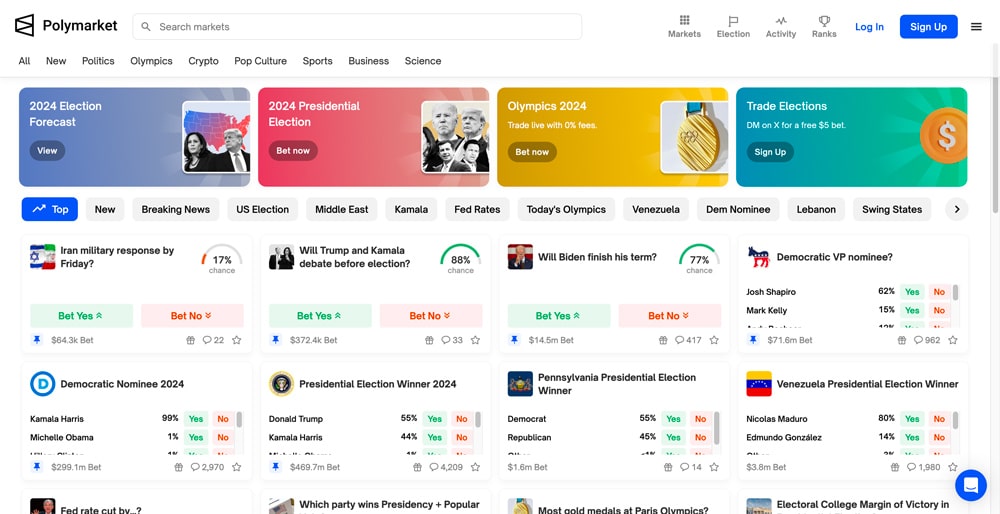

Polymarket, widely regarded as the world’s largest prediction market, decided to withhold payouts from users who bet that the United States would invade Venezuela this year, arguing that the capture of Nicolás Maduro did not meet its threshold for an “invasion.” Under the platform’s rules, an invasion requires a clear intent to establish territorial control.

The decision caught many investors involved in the so-called “Operation Caracas” off guard. A large number of participants ended up taking losses, unaware that they were exposed to an especially fragile “mental model” of risk. In total, more than $10.5 million had been wagered on these contracts before the ruling was issued.

Beyond the controversy surrounding the resolution itself, the episode raises broader questions about the potential implications for prediction markets. How might platforms interpret ambiguous events—such as coups, cyberattacks, or “limited interventions”—if core terms like “invasion” are defined so narrowly? And how can these markets protect themselves against traders operating with informational advantages?

Prediction markets’ Achilles’ heel

This episode exposed what many now see as the Achilles’ heel of prediction markets: it is not enough for an event to occur—the outcome must unfold exactly as the contract language specifies.

As a result, social oracles and governance mechanisms can matter more than volatility itself. As long as significant capital is at stake, issues such as dispute resolution, platform governance, and reputation will remain central to the debate.

The incident has also reignited discussion around regulation. Following suspicions of unusually profitable trades, proposals have emerged in the United States to criminalize insider trading in prediction markets. Against this backdrop, seasoned traders increasingly focus less on the event itself and more on the resolution mechanism: who decides, based on what evidence, and under which definitions.

Meanwhile, the crypto market has started the year with Bitcoin on the rise—a signal that as capital and activity increase, so too will friction when trust breaks down. In that sense, Bitcoin is once again being positioned as one of the most attractive cryptocurrencies to invest in at the moment.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM