Daily Crypto Signals: Bitcoin Bulls Reclaim $91K, Zcash Plunges Amid Governance Crisis

Bitcoin is testing critical support around $90,000 after rejecting at $93,000 for the third time, with rising open interest suggesting

Quick overview

- Bitcoin is testing critical support around $90,000 after facing resistance at $93,000 for the third time, with potential for a short squeeze or decline to $86,000-$87,000.

- Zcash has plummeted over 20% following the exit of its core development team, with forecasts suggesting further drops of 40-50% toward the $200-$300 range.

- The cryptocurrency market is experiencing mixed signals, with regulatory initiatives gaining traction while project-specific issues create instability.

- Wyoming has launched the Frontier Stable Token, marking a significant advancement in state-level cryptocurrency acceptance.

Bitcoin BTC/USD is testing critical support around $90,000 after rejecting at $93,000 for the third time, with rising open interest suggesting potential for either a short squeeze or further decline to $86,000-$87,000. Meanwhile, Zcash has crashed over 20% following the departure of its core development team from Electric Coin Company, with technical analysis pointing to possible further drops of 40-50% toward the $200-$300 range.

Crypto Market Developments

The cryptocurrency market started 2026 with mixed signals. On the one hand, initiatives to make rules clearer are gaining steam. On the other hand, project-specific problems are making things more unstable. The Stand With Crypto advocacy group, which is supported by Coinbase, said it now has 2.6 million members after adding 675,000 over the past year. This makes it one of the largest grassroots cryptocurrency policy groups in the US. The group’s main goal for 2026 is to push for the Responsible Financial Innovation Act, which would be a set of rules that would make it easier for the Securities and Exchange Commission and the Commodity Futures Trading Commission to work together.

Wyoming has opened its Frontier Stable Token (FRNT) to the public, making it the first fiat-backed stablecoin issued by a US state. This is a big step forward for state-level crypto acceptance. Governor Mark Gordon said that the fully-reserved stable token would be “a cheaper, faster, and more transparent way to do business” while also raising money for schools and lowering the tax burden on the people of the state. Kraken now has the token, and Solana is live with it. Stargate lets you bridge it to Arbitrum, Avalanche, Base, Ethereum ETH/USD, Optimism, and Polygon.

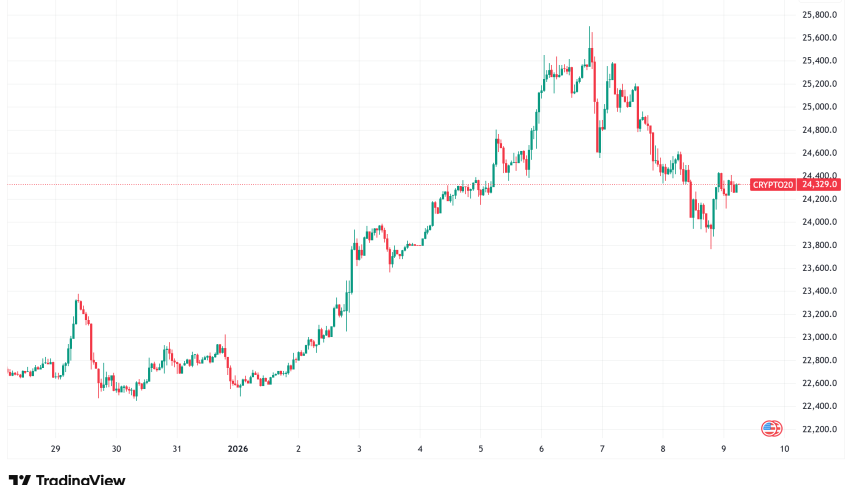

Bitcoin Faces Immediate Resistance at $93,000

Bitcoin’s early 2026 rise hit a wall near $93,000, which was the third time it has been turned down at this resistance level. This caused the price to drop down into weekly lows around $89,250. The top cryptocurrency rose 8% before forming a swing failure pattern at the key resistance level, which raised worries about a possible consolidation or bearish continuation. Even if it was turned down, the lower time-frame structure shows that bulls may still have a chance to take back control if crucial support levels stay strong.

The market is now paying attention to a key order block between $89,200 and $90,500. This is the first major place where bulls could try to make new long entries if the momentum turns favorable. Bitcoin is still trading above the monthly rolling volume-weighted average price (VWAP), which became bullish at the beginning of 2026. This gives the price some technical support. Open interest data shows that short positions have been growing as BTC fell from $92,000 to $90,000. The steep rise in open interest suggests that the market could be vulnerable to a short squeeze if the $90,000 level holds. CoinGlass’s aggregated order book data reveals high passive bids around $90,000, which is a pattern that has happened before short-term recoveries in the last two weeks. But traders are still cautious, and some analysts say that if Bitcoin doesn’t stay above $89,000, it might swiftly fall to objectives in the $86,000-$87,000 region.

Zcash Drops Amid Developer Exodus

Zcash (ZEC) fell sharply on Thursday, dropping more than 20% to about $381, its lowest price in three weeks. The key development team of Electric Coin firm (ECC) suddenly quit, which led to the sell-off. ECC said it will break away from Bootstrap, the charity that supports the privacy-focused cryptocurrency, and start a new firm. Josh Swihart, the former CEO, said that the team will keep working on privacy-focused projects under the new company. However, his reassurances did not calm the market, and investors left because they were unsure.

Bootstrap’s official answer says that the governance crisis is caused by larger systemic problems. Board members had talked about getting outside investors and several ways to privatize Zashi, the self-custodial crypto wallet made for private Zcash transactions. Bootstrap said that any way ahead had to follow US nonprofit law and stay true to Zcash’s long-term objective without putting the whole community at risk. However, ECC said the split was because to worries about what it called “malicious governance actions.” Technical analysis doesn’t seem good for ZEC’s short-term future, as several bearish patterns predict that prices could drop by 40–50% from where they are now.

According to analyst Osemka, ZEC’s price movement seems like a pullback like the one that happened in November, which led to a 58% drop. The cryptocurrency fell below an important support level made up of a rising trendline and its 20-day exponential moving average. This level had helped it recover 85% and kept it from going down during the 1,000%-plus rise in late 2025. Also, ZEC is breaking out of a bear flag pattern after a steep drop from the $550–$580 range. Measured move objectives indicate to the $275–$300 zone, which is very near to the 200-day EMA. Some experts think that prices might drop to between $200 and $250, which would challenge the lower trendline of the current declining channel pattern.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM