TSMC Set to Achieve Historic Q4 Earnings, Signaling Robust Growth

TSMC could be setting a record with tis profits for the upcoming 4th quarter earnings statement.

Quick overview

- TSMC is expected to report record-breaking profits of around $15 billion for Q4 2025, marking a 27% increase from the previous year.

- The company's success is largely driven by high demand for semiconductors in the expanding AI market, particularly for data centers.

- Despite market fears surrounding AI, TSMC has maintained profitability and upward momentum, focusing on AI-related chips rather than smartphone components.

- With major clients like Apple and a share price near its record high, TSMC's upcoming earnings report could set a positive precedent for the AI industry.

Taiwan Semiconductor Manufacturing Company Limited (TSM) will report its 4th quarterly earnings on Thursday and may break some records in the process.

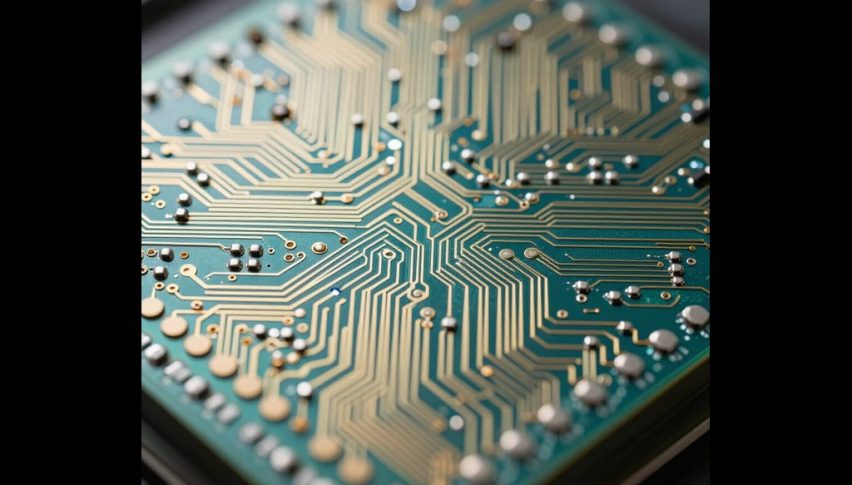

The semiconductor company TSMC is set for a record-breaking quarter for the end of its 2025 run, with some estimates placing their net profits at around $15 billion. That would mean the company’s profits increased by 27% in 2025.

The high demand for TSMC semiconductors is mostly coming from the rapidly expanding AI market, TSMC hit a record high on the stock market in December of 2025. Trading on the New York Stock Exchange, TSMC is down from its record high right now but not by much, and the company shows no signs of being hindered by continued AI market fears.

TSMC Keeps Momentum High

When other AI-related stocks went through long down periods in late 2025, TSMC continued its mostly upward momentum. Part of that can be attributed to its particular niche in the market, selling semiconductors designed by Nvidia to power AI data centers. They do not create AI programming that requires a massive investment to take the next leap forward but instead focus on a more profitable aspect of the market.

TSMC has sidestepped much of the controversy and fear surrounding AI markets because they have been maintaining profitability. Their N3 node is an excellent seller and is powering the current generation of AI technology. The company has been focusing more on making AI-related chips for data centers than on the smartphone chips it used to produce. This has proven to be a smart business move in a time when tech companies have faltered.

The company boasts major customers like Apple who use their chips in the iPhone 17, as well as for the A19 SoC- their latest RAM-based system. Now, they are set to declare profits that are unprecedented for the company and that will cement their place in the industry even further.

Even with inflation concerns on the rise with the latest Consumer Price Index report, TSMC is moving forward unimpeded onto what are likely bigger profits than the company has ever seen. As the wider stock market contracts after a minor early 2026 rally, TSMC is priced at $325 per share, still near its record high. Their Q4 earnings could prove to be decisive for the AI industry, setting a standard that may be hard to beat but will also help to allay some of those market fears that have persisted for months now. If TSMC performs well with the Q4 release, that will make things easier for other major AI players when it is their turn this year.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM