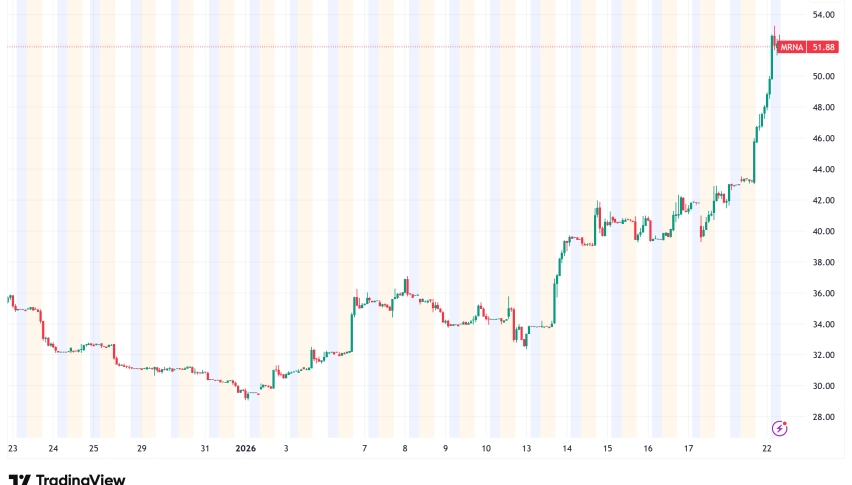

Moderna Stock Soars 16%, Hits 52-Week High as “mRNA 2.0” Cancer Vaccine Data Stuns Markets

On Wednesday, shares of Moderna Inc. rose more than 15%, reaching a 52-week high of $50. This was after the biotech company published

Quick overview

- Moderna's shares surged over 15% to a 52-week high of $50 following positive long-term results from a cancer vaccine study in collaboration with Merck.

- The study showed that Moderna's experimental treatment significantly reduced the risk of cancer recurrence in high-risk melanoma patients when combined with Merck's Keytruda.

- Moderna aims to diversify its portfolio beyond COVID-19 vaccines, exploring personalized mRNA therapies for various cancers.

- Despite the recent stock surge, analysts remain cautious, with a majority recommending 'Hold' and projecting a potential price drop in the coming year.

On Wednesday, shares of Moderna Inc. rose more than 15%, reaching a 52-week high of $50. This was after the biotech company published positive long-term findings from a clinical study testing an experimental cancer vaccine that it worked on with Merck & Co., a major pharmaceutical business.

The stock started the day at $49.81, up $6.81, and kept going up in after-hours trading to $52. The rise added around $3 billion to Moderna’s market valuation, which is currently about $19 billion.

Melanoma Study Results: A Milestone for Personalized Immunotherapy

The excitement comes from five years of follow-up data from a phase 2 study of intismeran autogene, Moderna’s tailored messenger RNA-based cancer treatment. When used alongside Merck’s popular immunotherapy medicine Keytruda, the treatment cut the chance of cancer coming back or death by 49% in high-risk melanoma patients who had surgery, compared to Keytruda alone.

Dr. Marjorie Green, a Merck executive, said in a press statement, “For many patients with stage III/IV melanoma, there is a significant risk of recurrence following surgery.” “Showing that intismeran autogene and Keytruda can lower the risk of recurrence for some melanoma patients over the long term is an important step forward.”

Moderna Stock Outlook: Moving Beyond the “Endemic” COVID Market

The good news is a big step forward for Moderna as it tries to expand its company beyond COVID-19 vaccinations, which have made up most of its income since the epidemic began. The company’s new method involves personalized therapy that is meant to provoke an immune response against tumors based on the specific genetic changes found in each patient’s tumor.

The possible uses go far beyond melanoma. Moderna and Merck are running several clinical trials to see if their tailored technology may cure different kinds of cancer, such as malignancies in the lungs, kidneys, and bladder. Dr. Kyle Holen, a Moderna executive, said that the business is still investing in oncology because of promising results like these that show mRNA’s promise in cancer care.

Moderna expects sales to expand by up to 10% in 2026, mostly because high-risk groups and elderly will need more COVID-19 boosters. The business has made deals with Canada, the UK, and Australia to help this source of income. Moderna also thinks that this year it will get clearance from the government for a flu vaccine on its own and a COVID-19/flu combination shot. However, both products won’t be available until the 2026 respiratory season.

Moderna (MRNA) Technical Analysis and 2026 Price Prediction

Wall Street analysts are still wary about Moderna’s future, even after Wednesday’s surge. The average price estimate for the next 12 months is $37.40, which means that the price could drop by 25% from where it is now. Of the 24 analysts who cover the stock, just four give it a “Buy” or “Strong Buy” rating. The rest say “Hold.”

Bank of America Securities recently boosted its price target from $24 to $27 but kept its “Underperform” rating, which means it might go down a lot. Earlier this month, UBS lowered the stock’s rating from “Buy” to “Neutral” and set a new price objective of $34.

After the news about the cancer vaccine, retail investors on sites like Stocktwits were “extremely bullish,” and the number of messages posted went up a lot. The stock has gone up about 39% in the last year, which is much better than many other biotech companies.

As Moderna moves from being a firm that focuses on COVID to one that makes a wider range of vaccines and treatments, the clinical results from Wednesday shows that its mRNA platform technology could change the way cancer is treated.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account