Bitcoin Holds Above $89,000 as Exchange Inflows Signal Critical Resistance Test Ahead

Bitcoin is currently worth more over $89,000, and it has stayed rather stable over the previous 24 hours, even though there have been some

Quick overview

- Bitcoin is currently valued at over $89,000, showing stability despite unusual exchange activities.

- Recent sharp inflows to exchanges have created a supply overhang, making the $89,000 to $90,000 zone a critical resistance level.

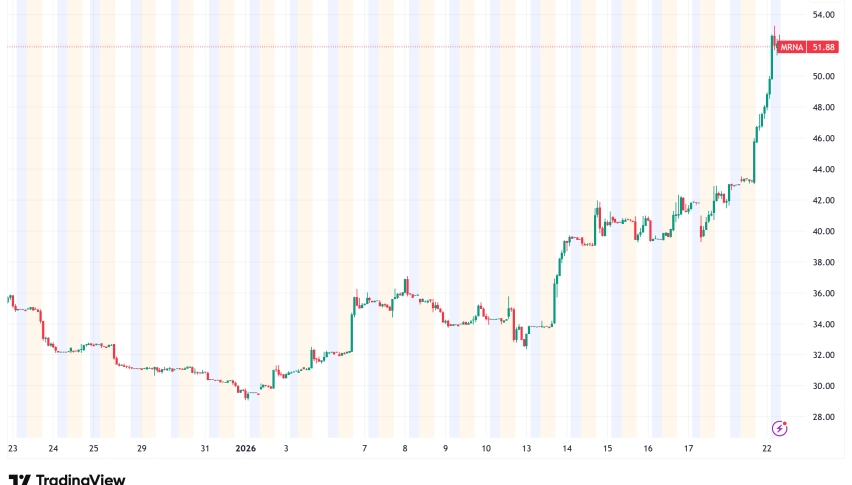

- Technical analysis suggests a potential rally above $100,000 in February 2026, but a negative outlook remains for the following months.

- A key support level at $73,000 is crucial for maintaining an overall uptrend, with risks of a drop to the mid-$50,000s if breached.

Bitcoin BTC/USD is currently worth more over $89,000, and it has stayed rather stable over the previous 24 hours, even though there have been some strange exchange activities that have caused problems. Technical indications and on-chain data give a mixed picture over the next few weeks, which is a very important time for the cryptocurrency.

Sharp Exchange Inflows Echo Previous Market Tops

In the last two days, crypto exchanges saw a huge increase of 16,653 BTC in deposits, similar to what happened during market peaks in July and August 2025. Bitcoin analyst Axel Adler Jr. said that this unusual activity happened on Tuesday and Wednesday. On Tuesday, 9,867 BTC went to exchanges, and on Wednesday, 6,786 BTC went to exchanges. These numbers are very different from the normal daily netflow range of negative 2,000 to positive 2,000 BTC in January.

Netflows have subsequently returned to normal levels of about 296 BTC, but the accumulated inflows have created a supply overhang that makes the present $89,000 to $90,000 zone a very important resistance level. This supply pressure happens at the same time that Bitcoin’s short-term holder Spent Output Profit Ratio is at 0.996 on its seven-day simple moving average, which is below the important 1.0 break-even point. The SOPR fell to 0.965 during the last decline near $87,500, which means that short-term holders were losing an average of 3.5%.

Spot Market Dynamics Show Signs of Stabilization

Even though there are worrying exchange inflows, Glassnode data shows that Bitcoin’s spot markets are becoming better. Both Binance and the aggregate exchange’s cumulative volume delta have turned back toward buy-dominant conditions. At the same time, selling pressure on Coinbase has leveled out. The combined exchange location CVD is at levels not seen since April 2025, which was a time when the range had just started to grow significantly.

According to crypto expert Darkfost, stablecoin data point to a possible bottoming process. After Bitcoin’s recent price collapse, the Stablecoin Supply Ratio dropped the most it has in this cycle. This suggests that Bitcoin’s market cap fell faster than the amount of stablecoin liquidity available. This is a pattern that has happened before price recoveries.

2022 Fractal Points to February Rally Before Mid-Term Weakness

CryptoBullet, a technical analyst, has found that Bitcoin’s current price structure is quite close to a fractal pattern from 2022. The cryptocurrency has dropped 28.7% from its peak in October 2025 and is now trading in a choppy consolidation that looks a lot like the beginning of the 2022 decline. But there is still one big difference: Bitcoin has not yet tested the 50-week and 200-day moving averages, which means that the current structure may not be finished.

If the pattern from 2022 holds, Bitcoin might make one last push higher in the next month, momentarily going back above $100,000 before hitting heavy resistance at the 50-week moving average. CryptoBullet says this rise might happen in February 2026 if support stays over $83,000. However, the bigger picture is still negative for the next few months. The fractal suggests that prices could drop below $71,500 after being rejected at the 50-week moving average.

BTC/USD Technical Analysis: $73,000 Separates Bulls from Extended Bear Market

Nik Patel, a veteran trader, says that Bitcoin’s swing low in April 2025, which was approximately $73,000, is the most important mark for 2026. Patel is still very sure that Bitcoin will reach new all-time highs in the first half of 2026. He says that the market has moved away from the usual four-year cycles and into a “higher for longer” regime that might last until 2027.

Patel’s thesis depends on Bitcoin closing above $73,000 on a greater time period. He stresses that the weekly structure has stayed positive since 2022, with higher highs and higher lows. As long as this level holds, the overall uptrend will stay in place. His worst scenario is clear: if Bitcoin closes below $73,000 a month, it will probably drop to the mid-$50,000s, where it will stay for months without making new highs in 2026.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account