Trump Administration Takes 10% Stake in USA Rare Earth (USAR) in Landmark $1.6B Deal

The Trump administration has made a historic $1.6 billion investment in USA Rare Earth (NASDAQ: USAR), buying a 10% stake in the Oklahoma

Quick overview

- The Trump administration has invested $1.6 billion to acquire a 10% stake in USA Rare Earth, aiming to enhance the U.S. supply chain for critical minerals.

- The investment includes 16.1 million shares and the option to purchase additional shares at a discounted price, reflecting strong investor confidence.

- USA Rare Earth is developing the Round Top project in Texas, which is expected to produce significant quantities of heavy rare earth elements essential for high-tech applications.

- Despite the potential benefits, challenges such as technical difficulties and environmental regulations may impact the project's execution and profitability.

The Trump administration has made a historic $1.6 billion investment in USA Rare Earth (NASDAQ: USAR), buying a 10% stake in the Oklahoma-based rare earth mining company. This is part of a larger effort to strengthen America’s supply chain for critical minerals and make it less reliant on foreign sources.

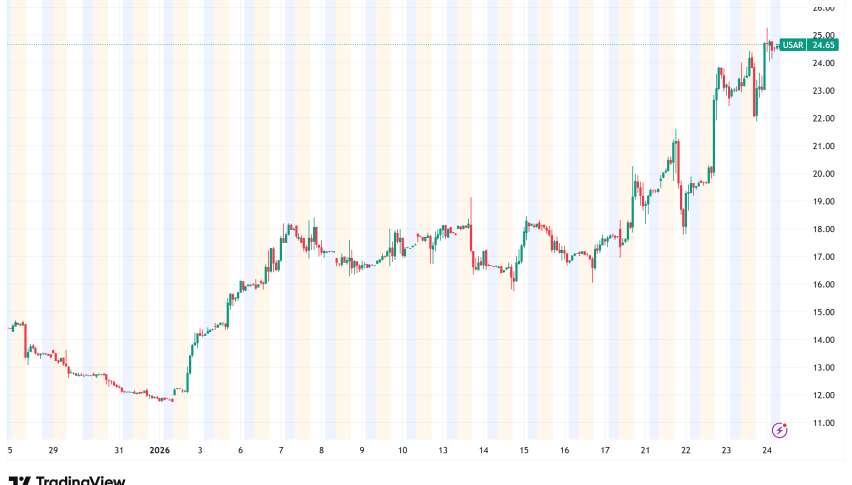

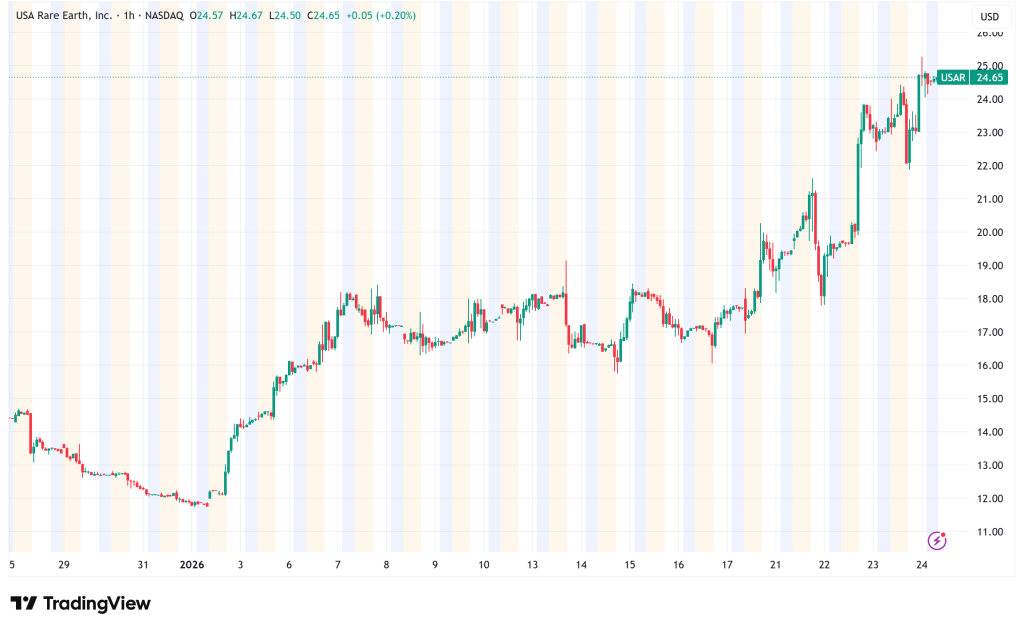

The U.S. government will get 16.1 million shares and the right to buy another 17.6 million shares for $17.17 each, according to a deal that was initially disclosed over the weekend. This is around a 25% discount from USAR’s closing price of $22.71 on Friday. Since then, the stock has risen more than 40% to $24.77, showing that investors have a lot of faith in the government-backed project.

The investment package includes $1.3 billion in financial financing from a facility set up by the CHIPS and Science Act and direct equity involvement. This two-part arrangement gives USA Rare Earth a lot of money to help its ambitious mine-to-magnet supply chain while also giving Washington a significant stake in a sector that is very important to the country’s security.

Building America’s Rare Earth Infrastructure

The Round Top project near Sierra Blanca, Texas, is being developed by USA Rare Earth. This deposit has a lot of “heavy” rare earth elements like dysprosium and neodymium. These materials are important parts of permanent magnets that are utilized in a wide range of high-tech applications, including as electric cars, wind turbines, defense systems, and advanced electronics.

A technical analysis from 2019 said that the open-pit mine could generate 2,213 tonnes of rare earth elements every year for 20 years, with more than 1,900 tonnes being heavy REEs. Production is set to start in late 2028, but the business reached a major goal last January when it made its first batch of dysprosium oxide with 99.1% purity.

The company’s vertically integrated approach goes beyond just mining. This year, a magnet factory in Stillwater, Oklahoma, that can make 5,000 tonnes of magnets a year will start doing business. A processing and separation lab in Wheat Ridge, Colorado, also completes the domestic supply chain.

USA Rare Earth is also growing outside of the US. By the end of 2026, it expects to open a factory in Lacq, France that will make 3,750 metric tons of metals and alloys per year. Fluor Corp. and WSP Global have been chosen by the firm to be engineering partners for the final feasibility study for Round Top.

Strategic Implications of USAR’s Investment

The investment is the Trump administration’s most recent attempt to protect important mineral supply chains. Previous deals included putting money into Canada’s Lithium Americas and Trilogy Metals, both of which are working on projects in the U.S., as well as a historic partnership with MP Materials, the only rare earth producer in the U.S.

China’s strong position in rare earth manufacturing provides it a lot of power over global supply chains, which is why this is so important. The US has relied on imports of these minerals for decades, which has made national defense and clean energy technology less safe.

Wall Street analysts have given the news a thumbs up. The average 12-month price objective for USAR is $22.75, but estimates range from $15.00 to $28.00. People think that the government’s support will lower the perceived risk and maybe even lead to federal contracts for military, infrastructure, and clean energy.

There are still problems, though. Mining and processing rare earths are technically difficult, expensive, and have to follow rigorous environmental rules. Execution risks, possible project delays, and trouble getting permits might all have an impact on schedules and profits for investors.

Last October, Barbara Humpton, the CEO of USA Rare Earth, said that the company had been in “close communication” with the White House about the sale. This alliance might be a turning point in restoring America’s industrial capacity in vital minerals if it goes well. This sector is becoming more and more important for both national security and economic competitiveness.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account