GameStop Surges 4.4% as Legendary Investor Michael Burry Returns to Meme Stock

Shares of GameStop rose by more than 4% on Monday when Michael Burry, the famous investor who foresaw the 2008 financial crisis, said he

Quick overview

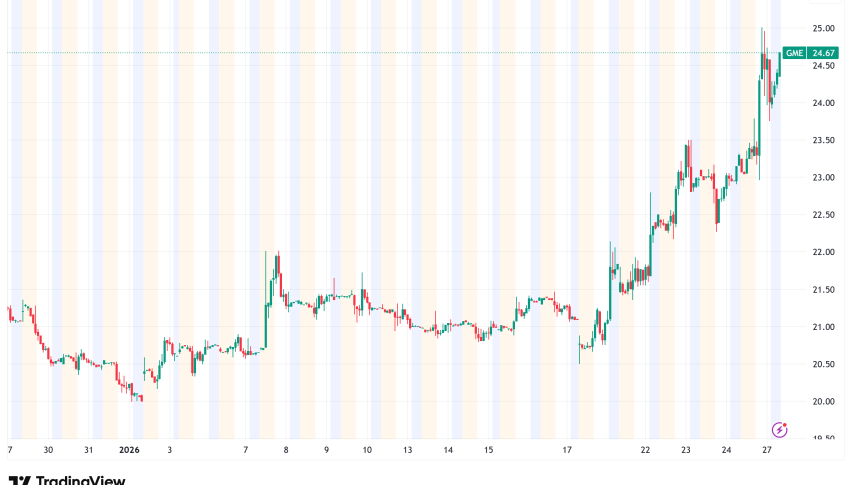

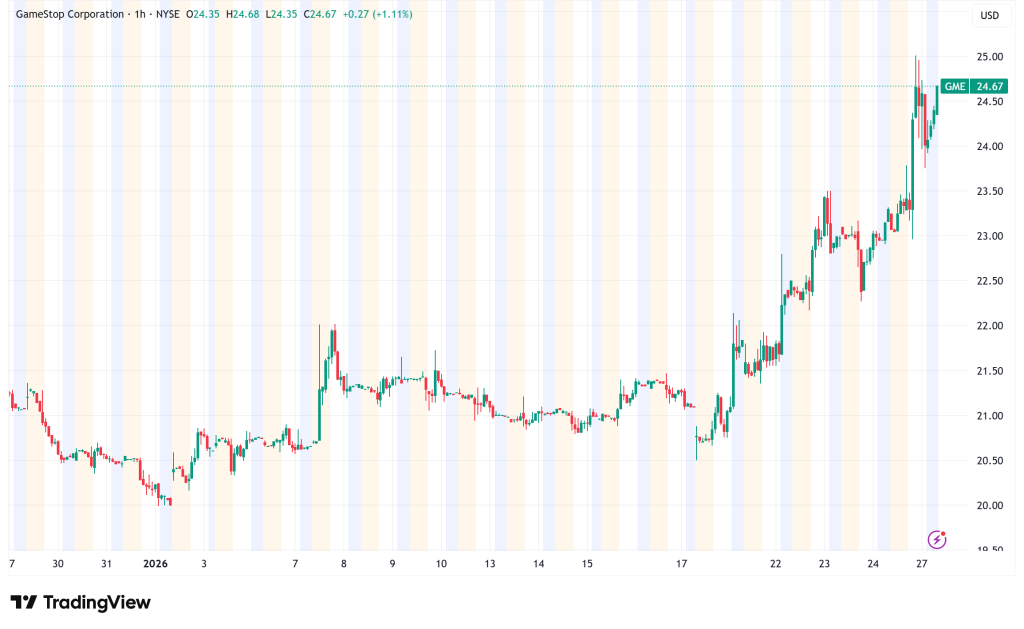

- GameStop shares rose over 4% after investor Michael Burry announced he had bought shares in the company.

- Burry's support comes as CEO Ryan Cohen implements significant changes, including closing over 500 stores and investing in cryptocurrencies.

- GameStop is currently trading significantly below its early 2021 highs, with analysts suggesting the shares are undervalued.

- Investors are closely monitoring the company's restructuring plan and its ability to maintain sales while transitioning to a more digital-focused strategy.

Shares of GameStop rose by more than 4% on Monday when Michael Burry, the famous investor who foresaw the 2008 financial crisis, said he had bought shares in the video game store. The news comes over five years after GameStop’s infamous stock peak in January 2021. This is a big return for one of the company’s first institutional backers.

Burry’s “Big Short” Vote of Confidence

“I own GME.” Reports say that Burry said in his Substack newsletter “Cassandra Unchained,” “I have been buying recently.” The financier, who made a smart bet against the housing market that led to the book and movie “The Big Short,” now has more than 200,000 Substack members and has made the newsletter his only job since leaving his hedge fund.

Burry’s support comes at a very important time for GameStop. CEO Ryan Cohen is leading the company through a major change. He has been closing stores, buying insider shares, and investing in cryptocurrencies to make the business more profitable. Cohen bought 1 million shares in GameStop in a recent regulatory filing. This increased his ownership stake and showed that he is confident in the company’s future.

Ryan Cohen Doubles Down

Burry said that Cohen knows how hard it is for GameStop’s legacy stores to stay in business. The investor thinks that Cohen “has a bad business and is making the most of it while taking advantage of the meme stock trend to get money and wait for a chance to buy a real growing cash cow business.” Some people compare this method to Warren Buffett’s Berkshire Hathaway model of building up cash reserves for strategic acquisitions, which is similar to how famous investors allocate capital.

Trimming the Fat: 500+ GameStop Stores Closing

At the same time, GameStop is making big changes to how it works. The company said it would close over 500 stores since more and more people are buying things online and downloading them digitally. The goal of this footprint reduction is to make the business smaller and more focused so that it can make more money in a changing retail environment.

GameStop has moved all of its Bitcoin holdings to Coinbase Prime as part of another strategic move. This suggests that the company is taking a more institutional approach to handling its digital assets. As part of its plan to expand beyond traditional retail and into new digital marketplaces, the corporation has begun buying cryptocurrencies.

What’s Next for GameStop (GME) After the $8 Billion Cash Pile and the Bitcoin Pivot?

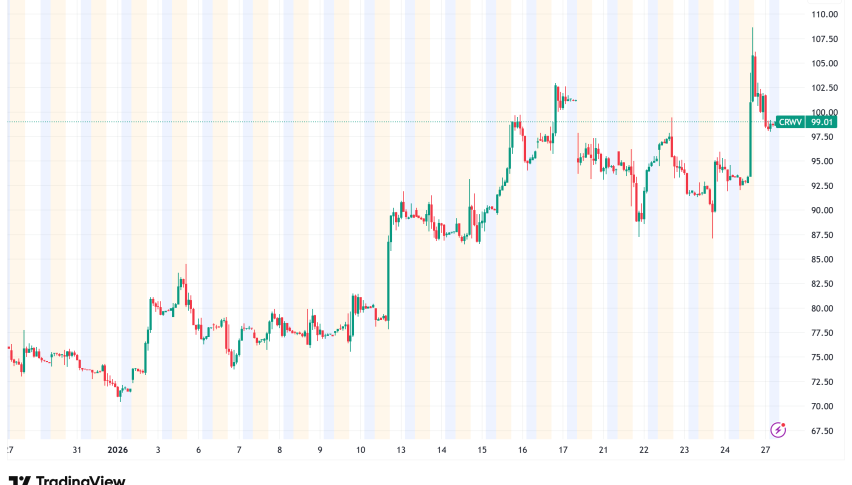

GameStop is still significantly below its early 2021 highs during the height of the meme stock frenzy, even though shares have gained around 20% in 2026 and about 13.8% in the previous month. The company is currently worth $24.01, but Simply Wall St says the shares are undervalued and that they are trading around 76% below their fair value.

Investors are now keeping an eye on a few important numbers: the company’s price-to-earnings ratio of 25.5 compared to the average for specialty retail of 19.9, the sales patterns from the remaining stores and e-commerce activities, and how Bitcoin holdings show up on the balance sheet.

The main risk is how well the plan is carried out. GameStop needs to keep sales steady while closing stores, manage its digital asset strategy well, and eventually use the money it has saved up to make the big purchase that both Cohen and Burry seem to be planning for.

Burry’s public support gives GameStop’s restructuring plan new credibility, and both retail and institutional investors are once again interested in seeing if Cohen can repeat the success he had turning Chewy into a huge online store.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM