Nine-Year Dormant ETH Whale Moves $250M to Gemini in Massive Transfer

An Ethereum whale that had been inactive for years moved 85,000 ETH, worth almost $250 million, to the Gemini exchange this week.

Quick overview

- An Ethereum whale moved 85,000 ETH, valued at nearly $250 million, to the Gemini exchange, marking a significant dormant wallet activation.

- The wallet, which initially purchased 135,000 ETH for $12.17 million in 2017, has seen its value grow to $393 million, resulting in a 32-fold profit.

- This large transfer has raised concerns about its potential impact on market liquidity and ETH price fluctuations.

- Despite recent whale activity, Ethereum's price remains volatile, with analysts warning of possible declines amid broader market risks.

An Ethereum whale that had been inactive for years moved 85,000 ETH, worth almost $250 million, to the Gemini exchange this week. This is one of the biggest dormant wallet activations in recent crypto history. According to blockchain analyst EmberCN, the wallet (0xb5a…168d6) first bought 135,000 ETH at $90 each in 2017, spending $12.17 million.

After almost ten years, the value of these holdings has grown to $393 million, giving the investor a 32-fold profit. This large transfer has sparked new talks about how dormant whales might affect market liquidity and ETH price swings.

Breakdown of Large ETH Transfers

On-chain data from Arkham shows the whale moved ETH in several steps:

- 50,000 ETH was moved on Monday

- 25,000 ETH was transferred earlier in the week

- 60,283 ETH moved later, valued at $175.23 millionhe wallet now holds about $70 in altcoins, indicating a near-total liquidation of its Ethereum assets. EmberCN noted this massive move mirrors a similar Bitcoin event last week, where a wallet held for 12+ years moved 909 BTC ($84M) to a new address.

Traders and analysts watch these large transfers closely because they can show profit-taking, reallocation, or market timing by long-term holders.

休眠 9 年时间的 ETH 巨鲸地址,今天凌晨完成清仓:把剩余的 8.5 万枚 ETH ($2.48 亿) 也全部转进了 Gemini 交易所。

9 年时间,一买一卖,盈利 $3.81 亿 (32 倍)。◎9 年前 (2017 年),通过 Bitfinex 以 $90 的价格提出并囤积 13.5 万枚 ETH,当时价值 $1217 万。

◎9… https://t.co/tGv60P9Qf5 pic.twitter.com/zwgZ4RZhEm— 余烬 (@EmberCN) January 27, 2026

ETH Price Outlook and On-Chain Activity

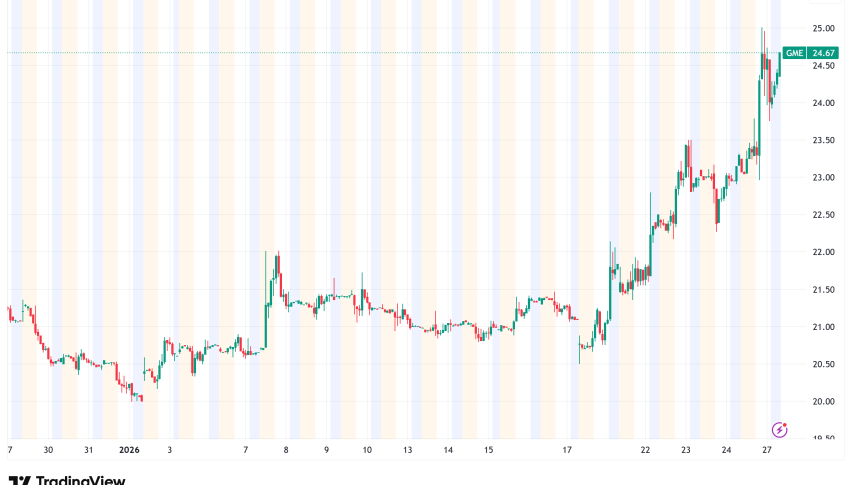

Ethereum had a tough week, dropping more than 7% to below $2,800 before bouncing back to $2,934 at the time of writing. Analysts say ETF-related selling is a main reason for the limited upward movement.

Key on-chain metrics show the network remains strong:

- The number of daily active addresses has increased to 1.3 million.

- Staking activity is still high. Tom Lee’s BitMine has staked 2,218,771 ETH ($6.52 billion), including 209,504 ETH ($610 million) today.

However, Bloomberg Intelligence strategist Mike McGlone warned that ETH could move toward the lower end of its $2,000 to $4,000 trading range. He pointed to risks from wider stock market volatility that could affect crypto markets.

This recent whale activity, along with strong staking and more user participation, highlights Ethereum’s complex dynamics as both a long-term investment and a liquid market asset.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM