Nvidia Doubles Down on CoreWeave with $2 Billion Investment for AI Factory Expansion

In a strategic move, Nvidia has put another $2 billion into CoreWeave, a cloud infrastructure startup that focuses on AI. This nearly double

Quick overview

- Nvidia has invested an additional $2 billion in CoreWeave, increasing its stake from 6.6% to 11.5%.

- The partnership aims to build AI factories with a target capacity of 5 gigawatts by 2030, enough to power approximately 3.75 million homes.

- CoreWeave will exclusively use Nvidia technology for its data centers, enhancing its dependence on the chip maker.

- Despite the promising collaboration, challenges such as regulatory hurdles and community opposition remain significant obstacles.

In a strategic move, Nvidia has put another $2 billion into CoreWeave, a cloud infrastructure startup that focuses on AI. This nearly doubles the chip maker’s investment in the data center operator from 6.6% to 11.5%.

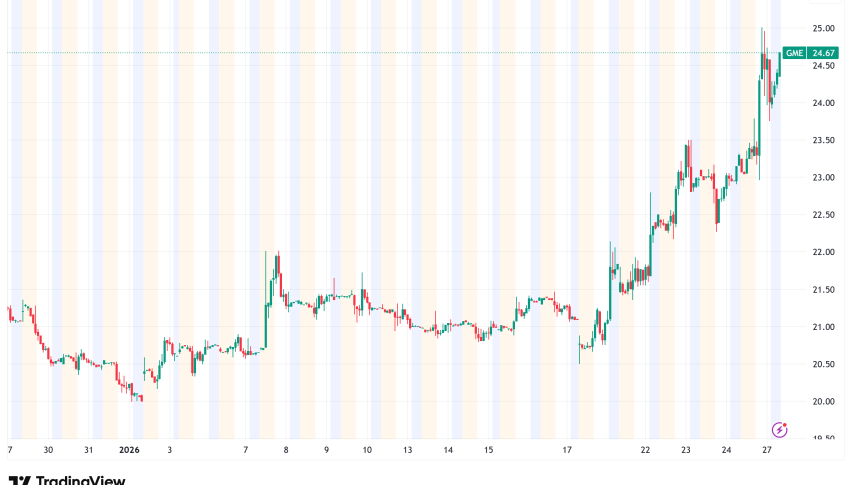

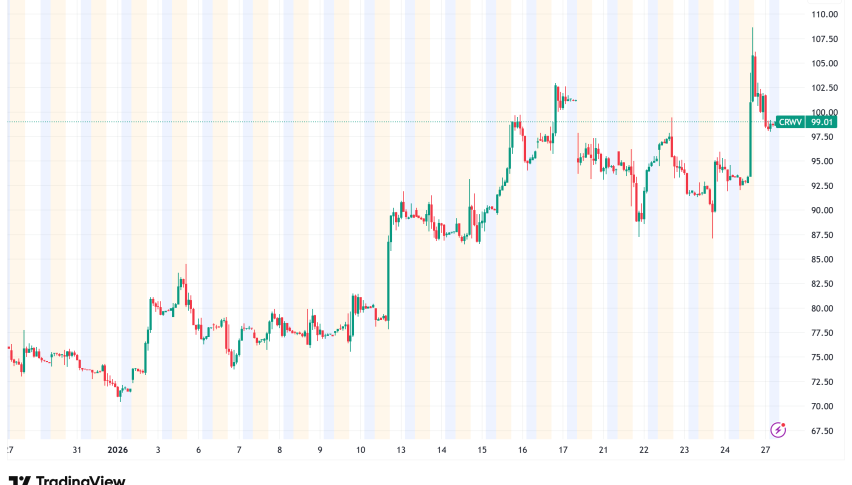

The investment, which was made public on Monday, puts the value of CoreWeave shares at $87.20 per, which is about 6% less than the closing price on Friday. CoreWeave’s stock went up 5.7% to close at $98.31 after the news. Earlier in the trading session, shares had gone up as much as 17%. Shares of Nvidia fell 0.6% to $186.47.

The transaction is a big step forward in the relationship between the two businesses, who said they will work together to construct AI factories using Nvidia’s computing platform technologies. Their goal is to have 5 gigawatts of capacity by 2030, which is enough energy to power about 3.75 million homes.

According to Nvidia CEO Jensen Huang, “AI is entering its next frontier and driving the largest infrastructure buildout in human history.”

Nvidia-CoreWeave Strategic Partnership with Benefits and Risks

The expanded partnership makes CoreWeave’s place in Nvidia’s ecosystem even stronger. Recent filings with the SEC show that CoreWeave’s customers need the company to use Nvidia GPUs. Now, CoreWeave has promised to create huge data centers using only Nvidia technology.

This dependence is both a chance and a danger. CoreWeave benefits from being connected to the biggest AI chip producer, but it is becoming more and more dependent on one vendor for its IT infrastructure.

Nvidia is giving more than just money. The chip giant will use its financial firepower to help CoreWeave get land, power, and other important resources for the AI factories. This might be a big help because CoreWeave’s debt load is growing quickly. By September 2025, it had reached $14 billion, up from $8 billion at the end of 2024.

CoreWeave will also get early access to Nvidia’s next-generation technologies, such as Rubin GPUs, standalone Vera CPUs, and new BlueField-4 DPUs that can improve inference in new ways.

Addressing Circularity Concerns

Some people are worried that the deal is circular because Nvidia provides infrastructure and CoreWeave provides AI factories that Nvidia might use. Huang called these worries “ridiculous” in a Bloomberg interview and said that Nvidia’s $2 billion is only a small part of what CoreWeave will need in the future.

CoreWeave CEO Michael Intrator remarked, “This expanded collaboration shows how strong the demand is across our customer base and in the larger market as AI systems move into large-scale production.”

CoreWeave (CRWV) Challenges Ahead

There are still a lot of problems to solve, even when things look good. The goal of 5 gigawatts by 2030 is very ambitious, especially in the US, where data center projects encounter community opposition, regulatory hurdles, and ongoing problems with power availability.

CoreWeave’s platform helps companies grow their AI operations by making machine learning workloads run more smoothly. The company’s market cap is currently $46 billion, and its stock has traded between $33.52 and $187.00 in the last 52 weeks. Investor sentiment regarding the company’s future has been erratic.

We’ll have to wait and see if Nvidia’s support and money can help both companies get past the problems with their infrastructure. Huang said that not all problems can be solved by throwing money at them, but both businesses are betting big on addressing the growing need for faster computing services because the AI boom shows no signs of slowing down.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM