Gold Price Breaks $5,595, Pulls Back to $5,505 as Bulls Defend Fibonacci Support

Gold (XAU/USD) eased slightly after a strong nine-day rally that took prices to new record highs near $5,595. In early European...

Quick overview

- Gold (XAU/USD) has slightly declined after reaching record highs near $5,595, currently trading around $5,505 due to strong safe-haven demand.

- The US dollar remains under pressure from concerns about monetary policy and global economic growth, which supports gold's appeal as a hedge.

- Market expectations of steady interest rates from the Federal Reserve are limiting dollar rebounds and maintaining gold's attractiveness.

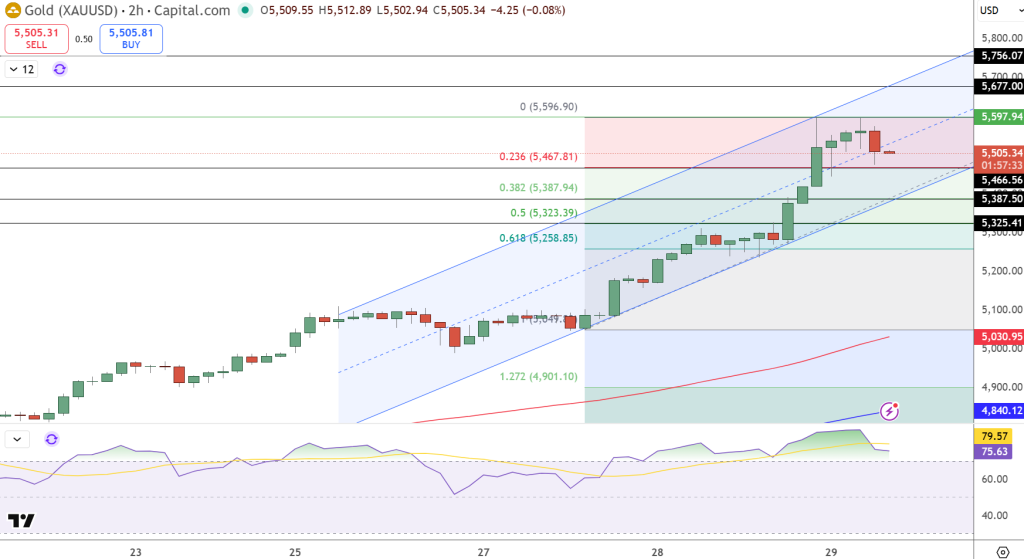

- Technical analysis shows gold is testing key Fibonacci support levels, with bullish targets set between $5,680 and $5,750.

Gold (XAU/USD) eased slightly after a strong nine-day rally that took prices to new record highs near $5,595. In early European trading, gold slipped to about $5,505, but the decline has been gradual. Safe-haven demand remains strong as concerns about monetary policy, global growth, and geopolitical risks continue to pressure the US dollar.

Gold has shown strong resilience. Even though global stock markets stayed positive and Fed Chair Jerome Powell said inflation is still above target, gold did not see much selling. Since markets already expected the Fed to keep rates steady, gold is reacting more to general economic uncertainty than to interest rate talk. Silver also moved higher, trading near $119 after rising almost 2%, which supports the overall strength in precious metals.

Dollar Pressure and Global Risk Support Bullion

Gold’s strength has been amplified by persistent dollar weakness. The greenback remains under pressure as investors question the longer-term independence of US monetary policy and brace for softer economic momentum. At the same time, renewed tariff concerns in Europe and escalating global tensions have added another layer of uncertainty.

These factors are important because gold tends to do well when people lose confidence in stable policies and clear growth. About a third of global gold demand comes from investment and reserves, so even small changes in risk perception can cause big price moves. Right now, those flows are still supporting gold.

Fed Outlook Keeps the Floor Under Gold

The Federal Reserve’s choice to keep rates unchanged was expected, and markets barely reacted to Powell’s tough comments. Most investors now think rates will stay steady this quarter, with the first real cuts likely not coming until 2026. This view limits any dollar rebound and keeps gold appealing as a hedge that doesn’t pay interest.

Attention now turns to US jobless claims, due Thursday. Any upside surprise could reinforce slowdown fears and renew pressure on the dollar, while a softer reading would likely extend gold’s consolidation rather than reverse the trend.

Gold (XAU/USD) Technical Outlook: Fibonacci Support in Focus

Looking at the charts, gold’s setup still looks positive. On the 2-hour chart, the price is staying inside a rising channel, and the recent pullback is testing the 23.6% Fibonacci retracement near $5,468. The small-bodied candles with lower wicks show that buyers are still interested when prices dip.

Key levels traders are watching include:

- Immediate support: $5,468 (23.6% Fib), then $5,388 (38.2% Fib)

- Trend support: Rising channel midline

- Upside trigger: A sustained move above $5,550

- Bullish targets: $5,680 to $5,750

The RSI has dropped from overbought levels but is still above 60, which shows that momentum is cooling but the trend is not finished.

Trade idea: Consider buying on pullbacks near $5,470, with a target of $5,680 and a stop below $5,390.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM