Bitcoin Plunges to $82,000 as Microsoft Sell-Off and Gold Flash Crash Wipe Out 2026 Gains

Bitcoin is facing additional selling pressure on Thursday, trading around $82,000 after sliding 7% in the past 24 hours to reach its lowest

Quick overview

- Bitcoin is currently trading around $82,000 after a 7% drop, erasing all gains from early 2026 due to aggressive futures deleveraging.

- The recent sell-off has resulted in over $570 million in liquidations, primarily driven by overleveraged futures positions rather than spot market weakness.

- Bitcoin is testing critical support at $83,800, with analysts eyeing the November 2025 bottom near $80,600 as the next potential downside target.

- The upcoming monthly candle closure will be crucial for Bitcoin's near-term outlook, with a finish above $87,500 potentially boosting bullish sentiment.

Bitcoin BTC/USD is facing additional selling pressure on Thursday, trading around $82,000 after sliding 7% in the past 24 hours to reach its lowest levels in over two months. All of the cryptocurrency’s gains since the beginning of 2026 have been erased by the steep collapse, which analysts attribute to aggressive futures deleveraging more than underlying weakness in spot markets.

BTC Futures-Driven Sell-Off Triggers Mass Liquidations

With weekly closures limited between $94,000 and $84,000, the most recent decline puts Bitcoin within a 10-week consolidation zone that has dominated price behavior since mid-November 2025. BTC fell around 4.4% from $88,000 to $83,400 during Thursday’s New York trading session, wiping out about $570 million in leveraged long positions and contributing to a total of more than $500 million in crypto liquidations in only four hours.

The strength of the selling push is demonstrated by data from CryptoQuant, which shows that in just two hours, the volume of Bitcoin taker sales on all exchanges increased to around $4.1 billion. This concentrated rise reflects forced liquidations from overleveraged futures positions rather than gradual distribution in spot markets, showing that derivatives traders—not long-term holders—are driving the current price movement.

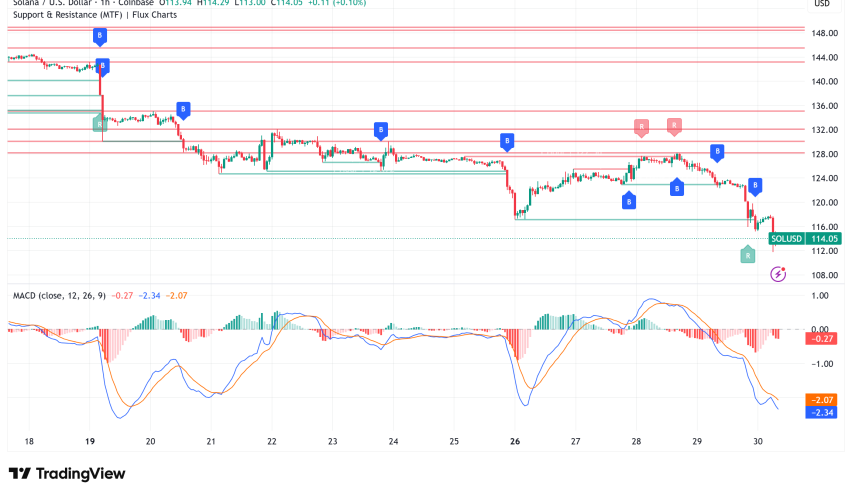

BTC/USD Technical Analysis: Support Levels Under Pressure

From a technical perspective, Bitcoin is presently testing critical support at $83,800, having briefly touched $83,156 on Bitstamp. The failure to sustain a meaningful rebound from this zone has switched analyst focus onto the November 2025 bottom near $80,600 as the next potential downside target.

The 2026 yearly open, along with adjacent moving averages, has failed to give meaningful support. With returns down 26% since July 2025, Bitcoin’s quarterly performance indicates a change in market structure, according to market analyst CryptoZeno. This indicates a definite move from the mid-2025 expansion phase into a corrective regime.

Historical derivatives data reinforces this interpretation. Multiple instances of 8% to 10% declines in futures open interest have coincided with local Bitcoin price lows, including the late-February to March 2025 dip near the mid-$80,000 range, the early-April 2025 cycle low around $78,000 to $80,000, and the mid-November 2025 bottom near $85,000 to $88,000. These patterns show severe leverage unwinding often marks downward exhaustion rather than the commencement of persistent bear trends.

Macro Headwinds: Gold Flash Crash and Tech Stock Weakness

Bitcoin’s collapse coincided with extreme volatility across traditional markets. Gold, which achieved an all-time high of $5,600 earlier Thursday, fell by $400 in just 30 minutes—erasing more value than Bitcoin’s whole market capitalization. Similar volatility was seen in silver, and prior to the steep decline, the total value of the precious metals market had reached $43.4 trillion.

The precious metals flash drop has generated fears about global financial stability and what some experts call a “debasement trade,” when investors seek safety in scarce assets despite fixed-income yields remaining over 3.5%. Technology equities also added to risk-off sentiment, with Microsoft shares tumbling 11% following poor cloud sales and concerns over AI industry overvaluation.

Bitcoin Price Prediction: Path to Recovery or Further Downside?

Looking ahead, the monthly candle closure will be key for deciding Bitcoin’s near-term future. The 2026 yearly open, $87,500, is the most significant level on the chart, according to Keith Alan of Material Indicators. A monthly finish above this mark would boost bullish sentiment, while a closure below might speed the slide toward what traders are calling “Bearadise.”

Interestingly, Bitfinex Bitcoin margin longs reached a two-year high of 83,933 BTC despite the price fall. Analysts warn that since traders take advantage of the difference between margin costs and futures premiums, this might be an indication of arbitrage activity rather than true bullish positioning.

In the immediate term, $80,000 to $80,600 is the next significant support zone. A recovery rally back toward $87,500–$88,000 could be facilitated by a successful defense of present levels around $82,000–$83,000, especially if macro volatility decreases and leverage continues to drain the system.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM