Natural Gas up 3.67% on Improved Market Sentiment

natural gas futures are somewhat higher on Thursday as exports remain high and the reserve levels are lower than expected.

Quick overview

- Natural gas futures slightly increased to $3.27/MMBtu as the market corrected and export data improved.

- Low heating demand due to warm weather is keeping gas prices near January lows, despite a recovery in storage levels.

- Gas output has risen to 107.5 bcfd, but warm weather is expected to decrease withdrawals and increase supply injections.

- WTI crude oil prices are above $65, supported by positive U.S. employment data and a bullish outlook in the market.

While natural gas futures remain near January lows, they did climb slightly on Thursday to $3.27/MMBtu as the market continued to correct and export data appeared solid.

Several factors worked this week to help gas prices recover slightly, including the latest storage report that showed that reserve levels were close to normal once more. The price of futures also benefited from news that U.S exports to trade partners was decent and was helping to offset lower heating demand throughout the United States as warm weather sets in.

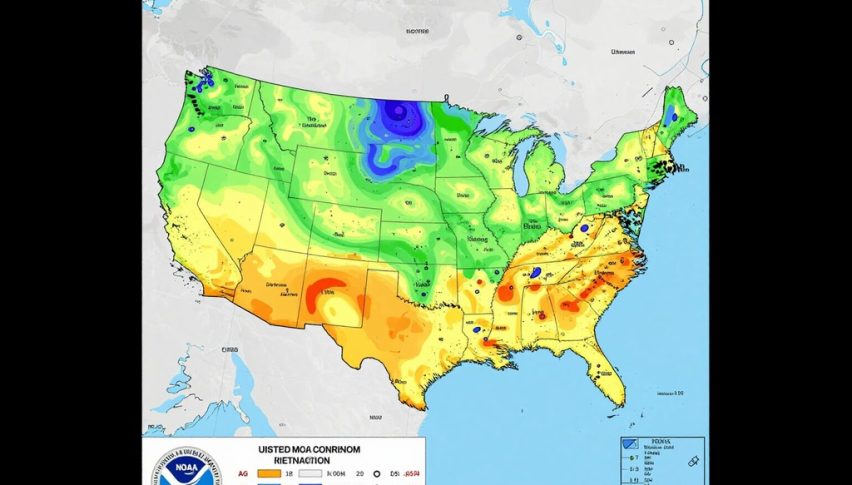

That warm weather is expected to spread through much of the country in the coming weeks, starting in the South and the Central United States. The northern and western areas of the county are still experiencing plenty of snow but not at the levels seen in late January and early February during an intense cold front. As heating demand decreases, the price of futures has been dropping since early February.

Where Gas Futures Are Headed

Forecasts are calling for warm weather for the next few weeks, and even though parts of the United States are not feeling that yet, the LNG futures are already dropping. On Thursday, the price of gas futures climbed slightly, but part of that was due to continued market correction after sharp declines between last week and early this week.

Gas output increased to 107.5 bcfd for the lower 48 states of the U.S. Even though gas withdrawals have been higher than normal in recent weeks and reserve levels are flattening out, that should start to change swiftly. As warm weather sets in, gas withdrawals will decrease and supply injections could increase. With new production facilities opening in Texas, Canada, and other parts of the world, the summer of 2026 could be similar to 2025’s with excess storage and little demand.

WTI crude oil is now above $65, which is surprising considering a supply increase of 8.4 million barrels. The $66 level will be crucial for WTI crude, demeaning if it can move higher in the short term.

Brent was trading close to $69 at the time of writing, and the market appears bullish on that side. The latest U.S. employment data for January was very positive and helped lift the market this week. President Donald Trump called the jobs report greater than expected, and the White House is very optimistic about the state of the U.S. economy.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM