XRP Price Prediction: Garlinghouse Eyes 90% “Clarity Act” Odds as XRPL Real-World Assets Explode to $1.4B

Right now, the XRP market is feeling the pressure from both growing institutional interest and upcoming regulations. Even though...

Quick overview

- The XRP market is experiencing pressure from increasing institutional interest and potential regulatory changes, with the token currently trading around $1.41.

- Ripple CEO Brad Garlinghouse predicts a 90% chance that the U.S. Digital Asset Market Clarity Act will pass by April 2026, which could significantly impact crypto regulation.

- The XRP Ledger has seen a 266% increase in tokenized Real-World Assets, now valued at $1.44 billion, making it a leading platform for institutional assets.

- Technical analysis indicates that XRP is in a bearish descending triangle, suggesting a potential short-term price drop unless key resistance levels are reclaimed.

Right now, the XRP market is feeling the pressure from both growing institutional interest and upcoming regulations. Even though the token is trading steadily around $1.41, big changes are happening behind the scenes.

There has been a 266% jump in tokenized Real-World Assets (RWAs), and Ripple’s CEO has made a bold prediction about new legislation. These developments could set the stage for a major market move, even though prices are steady for now.

The 90% Gamble: Garlinghouse Bets Big on April

Ripple CEO Brad Garlinghouse now estimates there is a 90% chance that the U.S. Digital Asset Market Clarity Act (H.R. 3633) will pass by the end of April 2026. This is much higher than the 78–83% odds predicted by most markets.

Why the “Clarity Act” is the Ultimate Catalyst:

- End of Enforcement: It would officially move crypto regulation from the courtroom to a formal legislative framework.

- Banking Greenlight: Federal guardrails are the missing link for Tier-1 U.S. banks to integrate XRP for cross-border liquidity.

- ETF Velocity: Passage could accelerate the approval of diversified XRP-based financial products beyond the current spot ETFs.

The RWA Revolution: XRPL Becomes a Global Hub

As traders watch price charts, the XRP Ledger (XRPL) has become the fourth largest blockchain in the world for tokenized Real-World Assets.

By the Numbers:

- $1.44 Billion: Current value of represented RWAs on the XRPL.

- 266% Growth: This is the monthly increase in the value of tokenized assets.

- 63% Dominance: The XRPL now hosts a majority of tokenized U.S. Treasuries, surpassing rivals like Ethereum and Polygon in this specific institutional niche.

Standard Chartered’s Shock Target Cut: $8.00 to $2.80

Standard Chartered surprised many by lowering its 2026 year-end XRP price target from $8.00 to $2.80. Geoffrey Kendrick, Head of Digital Assets, pointed to the February market selloff and changing macro risks as reasons for the 65% cut.

Even after the downgrade, the $2.80 target is still double the current price. The bank is still positive on XRP, expecting $4–$8 billion in spot XRP ETF inflows, which could reduce supply as exchange reserves reach multi-year lows.

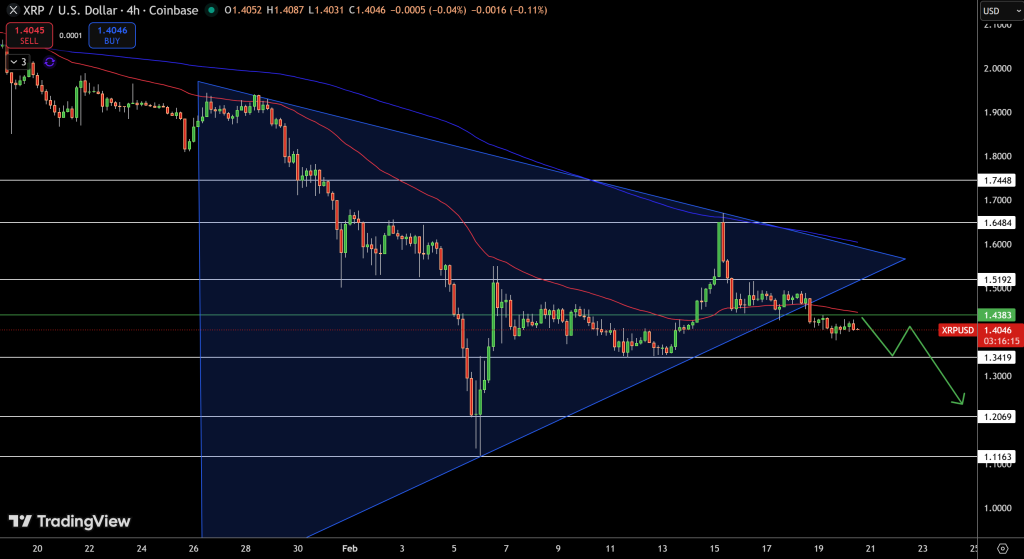

XRP/USD Technical Analysis: Navigating the Descending Triangle

Looking at the 4-hour XRP/USD chart, there is a warning sign that traders should notice. The pair is stuck in a Descending Triangle, which usually leads to a bearish outcome unless something significant changes.

The Technical Setup:

- Resistance: The 50-period EMA ($1.43) and the descending trendline from the $2.00 peak are acting as a heavy ceiling.

- Support: The horizontal base at $1.34 is a key level. If the price falls below this, it could quickly drop toward the $1.20 area.

- Historically, XRP has seen median declines of 8% in February. However, with more outflows from exchanges and large investors accumulating at a 15-month high, this trend may be changing due to institutional demand.

Key Support and Resistance Levels

| Level | Type | Significance |

| $1.52 | Resistance | A break above here invalidates the bearish triangle. |

| $1.43 | Pivot | Current battleground for the 50-EMA. |

| $1.34 | Support | Critical base; failure here opens the door to $1.20. |

Trade Idea: The “Breakdown” Hedge

Given the triangle structure, a cautious approach is warranted until the $1.52 resistance is reclaimed.

- Short Entry: Sell below $1.38

- Target (TP): $1.30 with Stop Loss (SL): Above $1.48

In summary, XRP is currently in a holding pattern. Technical analysis suggests a possible short-term drop, but upcoming regulatory clarity in April could mean that any big pullback is the last chance to buy before a larger rally.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM