US Dollar Holds Steady Amid Thin Liquidity in Holiday Trading

The US dollar is trading steady and holding on to recent gains against its major rivals amid thin liquidity in markets ahead of the year-end

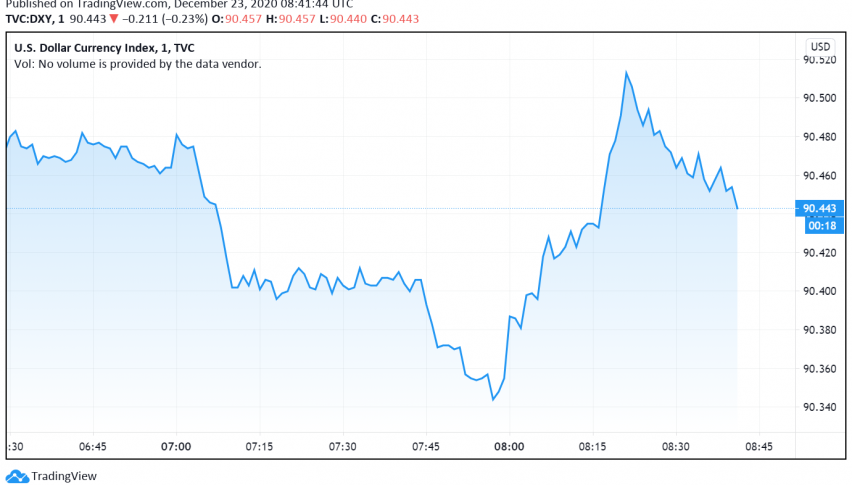

Early on Wednesday, the US dollar is trading steady and holding on to recent gains against its major rivals amid thin liquidity in markets ahead of the year-end holidays, supported by worries of the latest strain of coronavirus. At the time of writing, the US dollar index DXY is trading around 90.44.

So far this week, the US dollar index has gained by 0.7% as it safe haven appeal strengthens amid rising fears about the prospect of tighter lockdowns and restrictions across the UK and other parts of the world following the discovery of the new, more contagious strain of coronavirus. Several countries have banned flights from the UK, heightening fears that the pandemic could hurt the global economy even more severely despite the development and rollout of vaccines that are already underway.

The safe haven status of the US dollar received an additional boost by ongoing Brexit uncertainties, with time running out for Britain-EU discussions. Both sides have not yet been able to come to an agreement on the issue of fishing, but the EU is willing to extend talks beyond the December 31 deadline – a proposal UK PM Boris Johnson has repeatedly refused.

In addition, the greenback also enjoyed some support from uncertainty about the coronavirus relief bill after President Donald Trump threatened to not sign it until some changes were made. The possibility of further delay in releasing additional stimulus has kept a lid on the dollar’s weakness for now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM