ECB to Remain Broadly Accommodative in H1 of 2021, Even if Inflation Jumps

Inflation jumped by 0.8% in Germany during January

•

Last updated: Wednesday, February 10, 2021

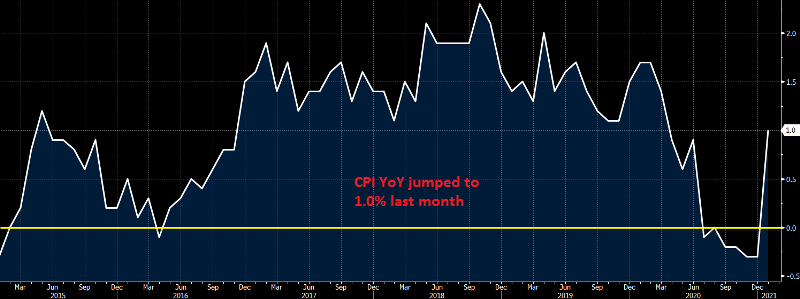

Inflation has been weak in the Eurozone for a long time, and it turned negative in September last year, and has been declining since then. But, inflation turned positive in Germany in December, growing by 0.5%, while today’s report showed a 0.8% increase for January. The European Central Bank commented on the monetary policy later on, but they won’t think about tightening until at least Q2 of this year.

Germany January Final CPI Report

- January final CPI +1.0% vs +1.0% y/y prelim

- CPI +0.8% vs +0.8% m/m prelim

- HICP +1.6% vs +1.6% y/y prelim

- HICP +1.4% vs +1.4% m/m prelim

There has been no change to the initial estimates, as German inflation bounced back last month. However, as mentioned before, this is largely due to special factors with the VAT cut expiring and the introduction of a new CO2 tax this year. We expect the ECB to continue brushing aside any jumps in inflation during H1 of 2021.

Comments by ECB policymaker, Pablo Hernandez de Cos

- ECB prepared to adjust all instruments as needed, in order to reach inflation target

- Euro area economic recovery is fragile, faces downside risks

- This is due to uncertainty surrounding evolution of the pandemic

- Ample monetary stimulus continues to be essential

This isn’t anything out of the ordinary, but at least there’s no specific mention of the euro exchange rate in the latest bunch of remarks here, so that’s something.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

Related Articles

Sidebar rates

HFM

Related Posts

Pu Prime

XM

Best Forex Brokers

Join 350 000+ traders receiving Free Trading Signals