Chainlink Drops 4.8%, Struggling below the $20 USD Resistance

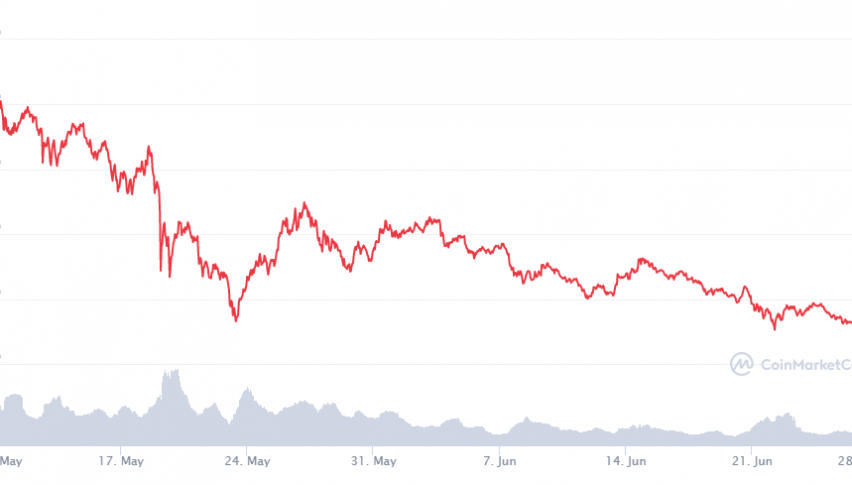

Chainlink (Link/USD) is at $17.22 right now, continuing a bearish trend from the last few days. It was almost a week ago that the cryptocurrency hit the $20 US mark.

That’s about as high as it’s gone since the middle of last month, where it reached an impressive $26.15 on June 15th. At the beginning of June, Chainlink was sitting above the $30 mark, but just barely. It has been trending mostly downward since then, buoyed by a few small spikes.

What Is Chainlink?

Chainlink works as a way to step beyond the limitations of the typical blockchain network. As popular as blockchains like Bitcoin are, there are certain limitations to the different factors they can take into consideration when determining the value of a cryptocurrency on that blockchain.

Chainlink considers more factors that would affect a financial market, and that can include credit cards, fiat currency, and more. It can be used on multiple blockchain networks to account for more economic and financial factors. Chainlink goes beyond the range of your typical blockchain because it is a decentralized oracle network.

Even though Chainlink is going through a rough spot right now, as is much of the cryptocurrency market, it offers an important technology. Chainlink adds value to blockchains and can grow in inherent value over time it is as it is used by more and more blockchains.

As a currency that stands on its own, the LINK token from the Chainlink network ranks #15 out of all cryptocurrencies. That means it is widely available and sold on hundreds of networks. It also has plenty of room to grow, not having reached even half of its total potential supply, with a current circulating supply of around 438 million. Over the last 24 hours, $560,433,247 in Chainlink transactions have been made.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM