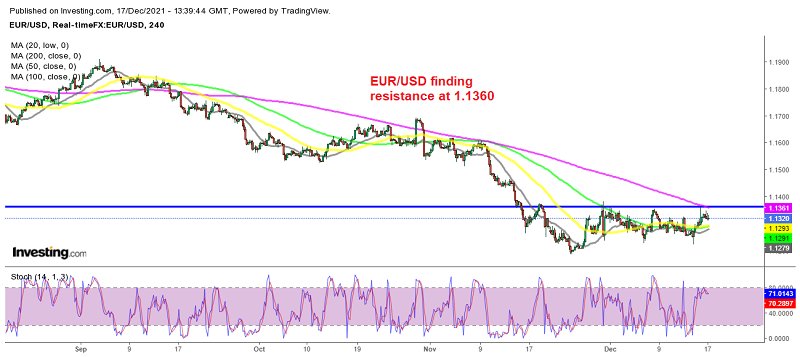

Is EUR/USD Consolidating Above 1.13 Before the Bearish Trend Resumes Again?

EUR/USD Hoovers Above 1.13 As Inflation Increases in Europe Too

Inflation has been increasing worldwide, as the prices of most goods and services keep growing at rates never seen before. The US is leading the way, with inflation heading toward 7%, after jumping to 6.8% in November, so the FED has been forced to run hawkish, and to start tightening their monetary policy. Today, we heard comments by FED members, suggesting just that.

That has led to the USD gaining considerable strength in recent months, but the European Central Bank ECB is also being forced to accept that inflation is higher, and they will probably act soon. Yesterday, during the ECB press conference, we heard the ECB president, Christine Lagarde, accept that inflation is getting too high, while today we are hearing further comments from other ECB members.

The EUR/USD seems undecided at the moment, so it has been consolidating above 1.13, but now the 200 SMA (purple) has caught up, and the bearish trend might resume again. But the FED is ahead in the tightening cycle now, so the USD still has the upper hand.

ECB’s Muller Says

- ECB is prepared to tighten faster if inflation stays north of 2%

As a reminder, the ECB has revised inflation projections higher

- 2021 2.6% (vs 2.4%)

- 2022 3.2% (vs 1.7%)

- 2023 1.8% (vs 1.5%)

- 2024 1.8%

Nothing new from Muller’s comments, but just remember that inflation will remain a hot topic. At the moment the projections are still seen to be transitory, as inflation will return to below 2% by 2023, hence Villeroy’s comments earlier about ‘peak inflation’.

ECB’s Villeroy

- Probably relatively close to the inflation peak

November 2021 Eurozone HICP

- HICP Final YoY 4.9% +4.9% prior

- Final HICP MoM +0.4% vs +0.8% prior

- HICP MoM excluding energy, food, alcohol and tobacco 0.0% vs +0.1% prior

- HICP YoY excluding energy, food, alcohol and tobacco vs 2.6% +2.6% prior

No surprises here for the final readings. The inflation headline is at 4.9% y/y. The ECB expects the core reading to creep up to 3.2% next year, before falling back down.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account